Indonesia’s aquaculture industry: Key sectors for future growth

Indonesia is an archipelago consisting of 17,000 islands, with a coastline of about 81,000 km. Coupled with a warm tropical climate all year around, the potential for aquaculture is vast. Even as the country only utilizes 7.38% of its total potential area for aquaculture, it already ranks among the most productive countries in aquaculture production. Indonesia’s output in 2014 trailed only behind China and was slightly ahead of India. This is all the more remarkable considering that more than 80% of Indonesia’s fishery enterprises in 2014 were still traditional household enterprises and fishermen, utilizing minimal technology. Thus, with the right transfer of knowledge and technology of best aquaculture practices, Indonesia is very well positioned to consolidate its standing as one of the top aquaculture nations in the world. This represents corresponding growth opportunities for corporations who can help facilitate the modernisation of Indonesia’s fisheries.

The main growth driver for Indonesia’s fisheries is the fact that key commodities such as fish and shrimp continue to enjoy strong demand domestically and abroad respectively. The main domestic factor is the fact that the archipelago nation of more than 250 million people is a major consumer of fish. Fish consumption per capita was estimated at 33.76 kg / year in 2014.

Fish consumption in Indonesia is similar to fish consumption in Thailand and Vietnam in 2014 which are 29.04 kg / year and 35.24 kg / year respectively. Fish consumption volume has been steadily increasing from 2011 to 2014 at 5.35% per annum. Even so, it is expected that the growth trend will slow down to 1.06% from 2015 – 2020 as domestic demand per capita reaches saturation.

Similarly, worldwide demand for fish and fishery products has also steadily increased over the years. It is estimated that by 2020 world demand for seafood will reach 183 million tons from 158 million tons in 2011. The increase can be attributed to the growing population’s basic need for protein. Additionally, growing affluence has shifted consumer behavior towards consumption of healthier source of protein such as seafood. Hence, strong demand from both domestic and foreign markets will continue to fuel the growth of the nation’s fishery industry. Ipsos expects that Indonesia’s fishery sector will experience strong growth over 2015 – 2020 period, increasing production output from 10.5 millions tons in 2015 to 11.5 million tons in 2020. Hence, both upstream and downstream supporting industries will stand to benefit from the industry’s growth. In the next sections we will highlight the prospects for growth in the fishery industry.

Capture fisheries

Even though capture fisheries have traditionally been the main contributor of fish and seafood, capture fisheries’ recent growth has been considerably slower compared to aquaculture. Aquaculture has experienced strong growth of 13.7% CAGR over 2011 – 2014 period while capture fisheries grew at 2.8% over the same period. In fact, it is estimated that aquaculture growth will continue to outpace capture fisheries into 2020. From 2015 to 2020, aquaculture is estimated to grow at 3.7% CAGR while capture fisheries’ growth will essentially stagnate at 0.4% over a similar period. With global demand for seafood not slowing down, production from aquaculture is hence expected to take on a significantly greater role compared to capture fisheries in the future.

Aquaculture

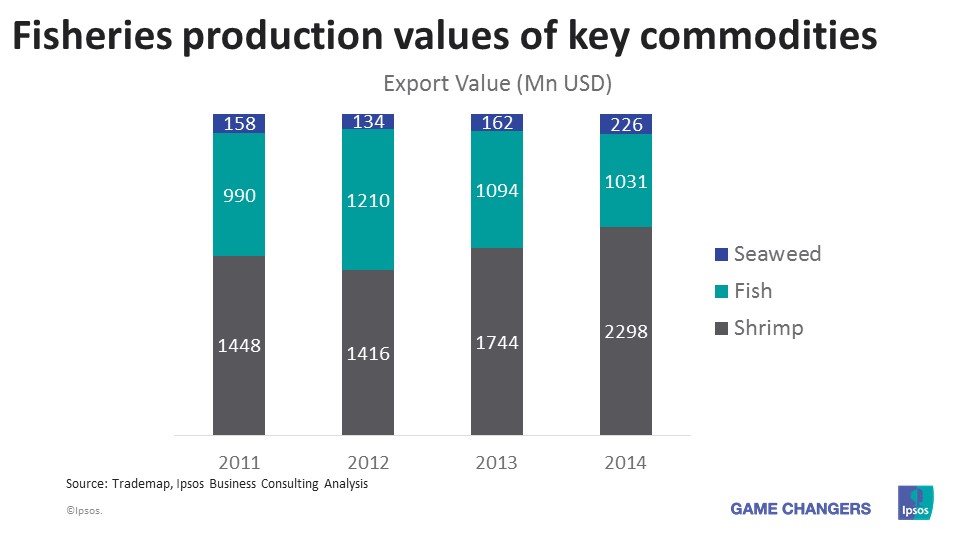

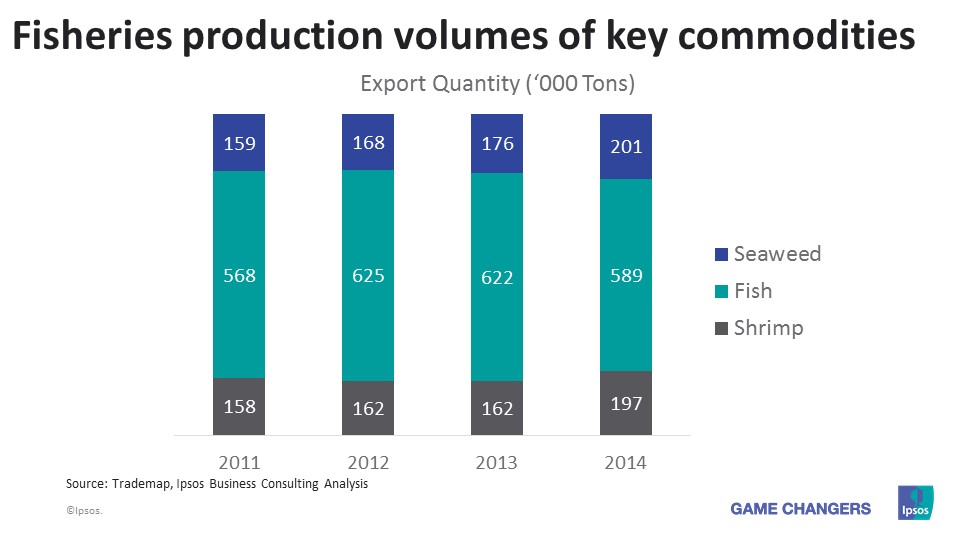

With regards to aquaculture one of the main species of interest in Indonesia is shrimp of which vannamei is the dominantly farmed species. Shrimp generates the highest revenue on a per kg basis among key commodities that are produced in significant quantities. Introduction of vannamei has revitalized the industry and bolstered shrimp’s position as Indonesia’s main fishery export commodity by value. It is estimated that as of 2011 shrimp contributes contributes around USD 1.5 billions in exports compared to around 1 billion and 0.2 billion for fish and seaweed exports respectively. Additionally, shrimp export value has also exhibited the most rapid growth overall, growing at 16.6% CAGR in 2011 – 2014 period while fish and seaweed has grown at 1.4% and 12.8% CAGR in similar time period. With its combination of highest export value and fastest growth rate among main aquaculture commodities, shrimp aquaculture could prove to be attractive to companies looking to bolster growth.

Shrimp

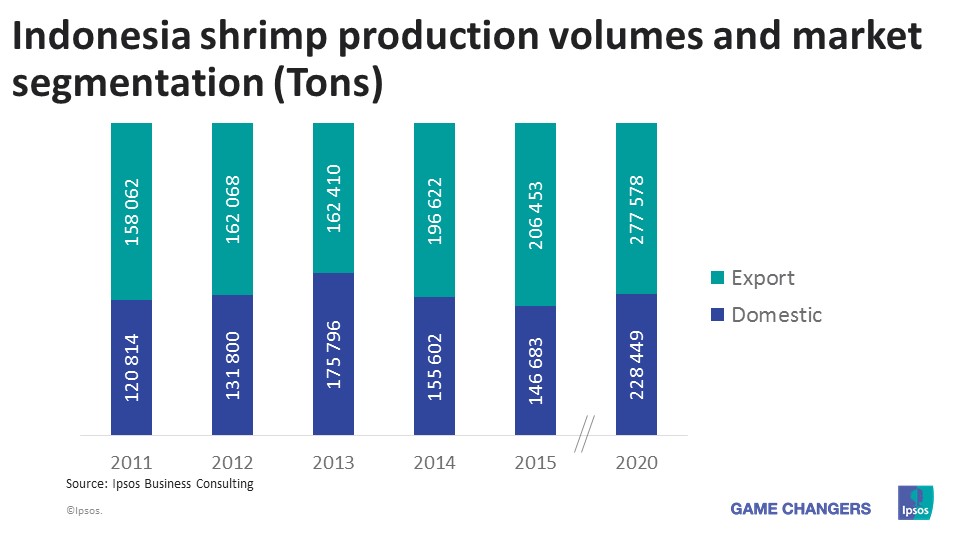

Indonesia’s shrimp industry has continued to see higher demand from the export market compared to the domestic market. From 2011 – 2015, export market grew at CAGR of 6.9% compared to 5.0% for the domestic market. Domestic demand for shrimp is relatively lower compared to fish as shrimp is still considered an expensive source of protein for most households. This means that Indonesia is estimated to consume only around 40% of its shrimp production volume. Majority of shrimp production was allocated for exports to major markets such as USA, Japan and EU. Due to relatively weaker domestic market, the shrimp industry is highly sensitive to global shrimp production volumes. Even with rising competition from countries such as India and the recovery of Early Mortality Syndrome (EMS) afflicted countries such as Thailand, Ipsos estimates that export market for Indonesia’s shrimp will continue to exhibit healthy growth of 6% per annum for the 2016 – 2020 period.

Due to relatively weaker domestic market, the shrimp industry is highly sensitive to global shrimp production volumes. Even with rising competition from countries such as India and the recovery of Early Mortality Syndrome (EMS) afflicted countries such as Thailand, Ipsos estimates that export market for Indonesia’s shrimp will continue to exhibit healthy growth of 6% per annum for the 2016 – 2020 period.

Global shrimp production volume has significantly increased since the outbreak of EMS in Thailand back in early 2012 with a resulting increase in supply pressuring ex farm shrimp prices. In fact, ex farm price for vannamei size 50 has already decreased from IDR 80.000/kg in 2014 to IDR 65.000/kg in 2015, or a reduction of 18% within a one year period. Even so, profit margins for intensive vannamei shrimp farming are still estimated to be significantly higher than other species, ranging between 30 – 60% margins for successful harvests as compared to 15% for catfish farming. Such healthy potential margins should be a sign of encouragement to companies looking to market new products and services to the industry. Additionally, the expansion of the shrimp aquaculture industry should help to bolster the growth of supporting industries as well.

Conclusions

Thanks to wide coastline and warm tropical climate, Indonesia has become one of the top 4 nations in fishery production. With growth of capture fisheries stagnating, further growth has to increasingly depend on the nation’s aquaculture fisheries, which comprises mainly of shrimp, fish and seaweed. Companies looking for stronger growth opportunities could be better served catering to the rapidly growing shrimp aquaculture industry, whose 2014 shrimp export value of USD 2.3 Bn already exceeds that of fish and seaweed industry combined. With entrenched players controlling large majority market share in shrimp feed industry, new entrants would be wise to look at developing shrimp health industry which is relatively much more fragmented and faster growing. Even so, an increasingly competitive marketplace and commoditisation of key aspects of the supply chain means that only companies that are able to deliver high quality products with excellent after sales service will be able to win and retain the market.