Americans have more confidence in the economy than a year ago

The Ipsos Consumer Tracker asks Americans questions about culture, the economy and the forces that shape our lives. Here's one thing we learned this week.

Why we asked about confidence in the economy: The U.S. economy is generally more confident at the moment than most global consumers, according to the Ipsos Global Consumer Confidence survey. But we wanted to drill down into that a bit in the U.S.

Why we asked about confidence in the economy: The U.S. economy is generally more confident at the moment than most global consumers, according to the Ipsos Global Consumer Confidence survey. But we wanted to drill down into that a bit in the U.S.

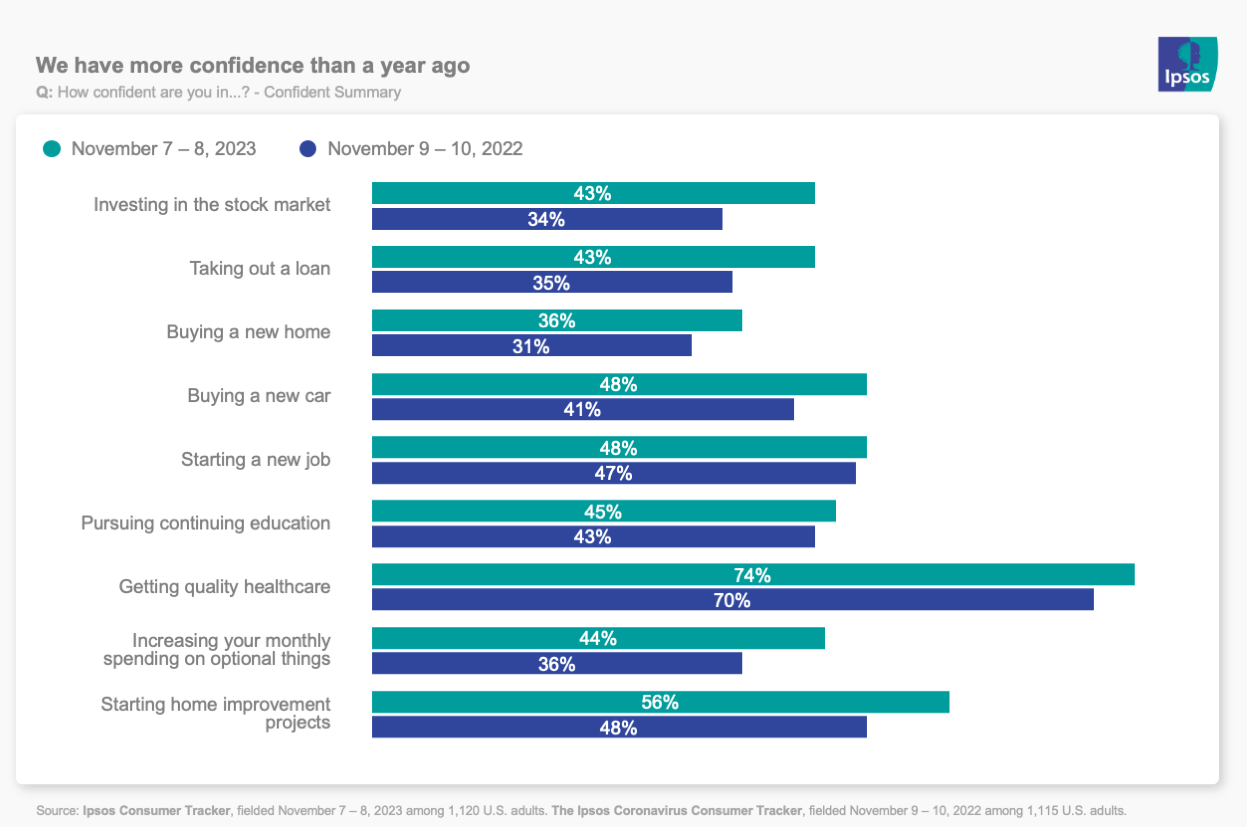

What we found: Compared to last year at this time, we are more confident in a wide range of economic activities. That includes investing in the stock market (43% say they are confident now vs. 34% a year ago); taking out a loan (43%/35%); buying a new home (36%/31%) or doing a home improvement project (56%/48%) and increasing discretionary spending (44%/36%).

Consumer confidence indices are all over the place at the moment, as the economy itself sends off mixed signals. We’ve seen that in our Consumer Tracker data for sure. Confidence aside for a moment, the government reported spending up in September even controlling for inflation, which is still very much a thing. Inflation might be lowering, but it’s still high and so are prices.

That gets us into the recent datapoint that consumer credit card debt in the U.S. hit a record $1 trillion recently. AP reports, “Economists caution that such vigorous spending isn’t likely to continue in the coming months.” The Wall Street Journal just ran a piece headlined “Right now is a bad time to spend money.”

So… what would help keep confidence rising?

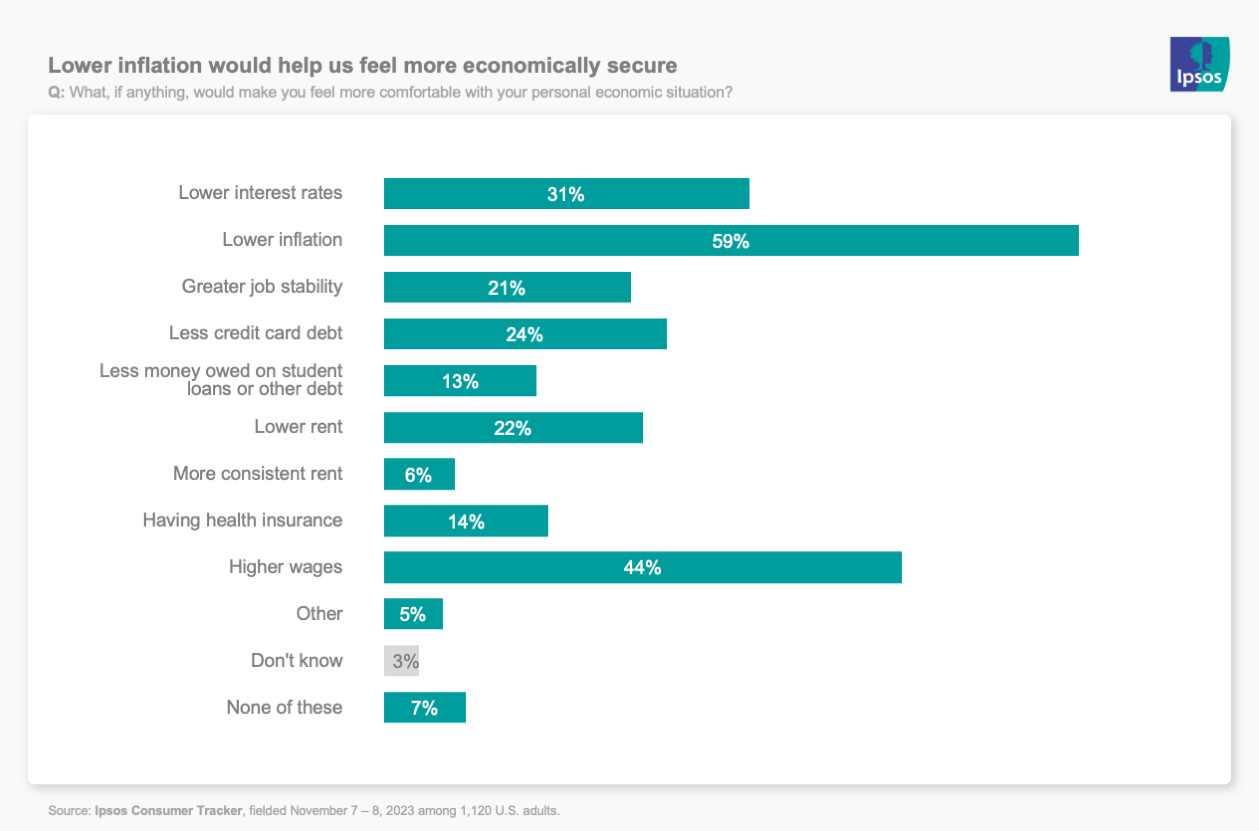

Why we asked: Last year at this point, we asked not only about confidence, but about what would help people feel more economically secure. Seemed a good moment of inflection to check in on that.

Why we asked: Last year at this point, we asked not only about confidence, but about what would help people feel more economically secure. Seemed a good moment of inflection to check in on that.

What we found: Despite all that has happened in the economy on a macro level, on a micro/personal level our concerns are pretty consistent. Lower inflation remains the top choice with 59% saying so, mostly unchanged since last year. Higher wages would make us feel more confident. That has risen slightly since last year at this time. Now 44% say that vs. 39% last year. Lower rent is a bit less of a concern (22% vs 29%) perhaps reflecting a steady decline over the past year, which just started to reverse.

More insights from this wave of the Ipsos Consumer Tracker:

There’s strong bipartisan support for Biden’s executive order on AI

Americans expect a COVID surge in winter

Americans care about a court case that could upend the real estate industry