The economics of your wallet are most important to Americans

The Ipsos Consumer Tracker asks Americans questions about culture, the economy and the forces that shape our lives. Here's one thing we learned this week.

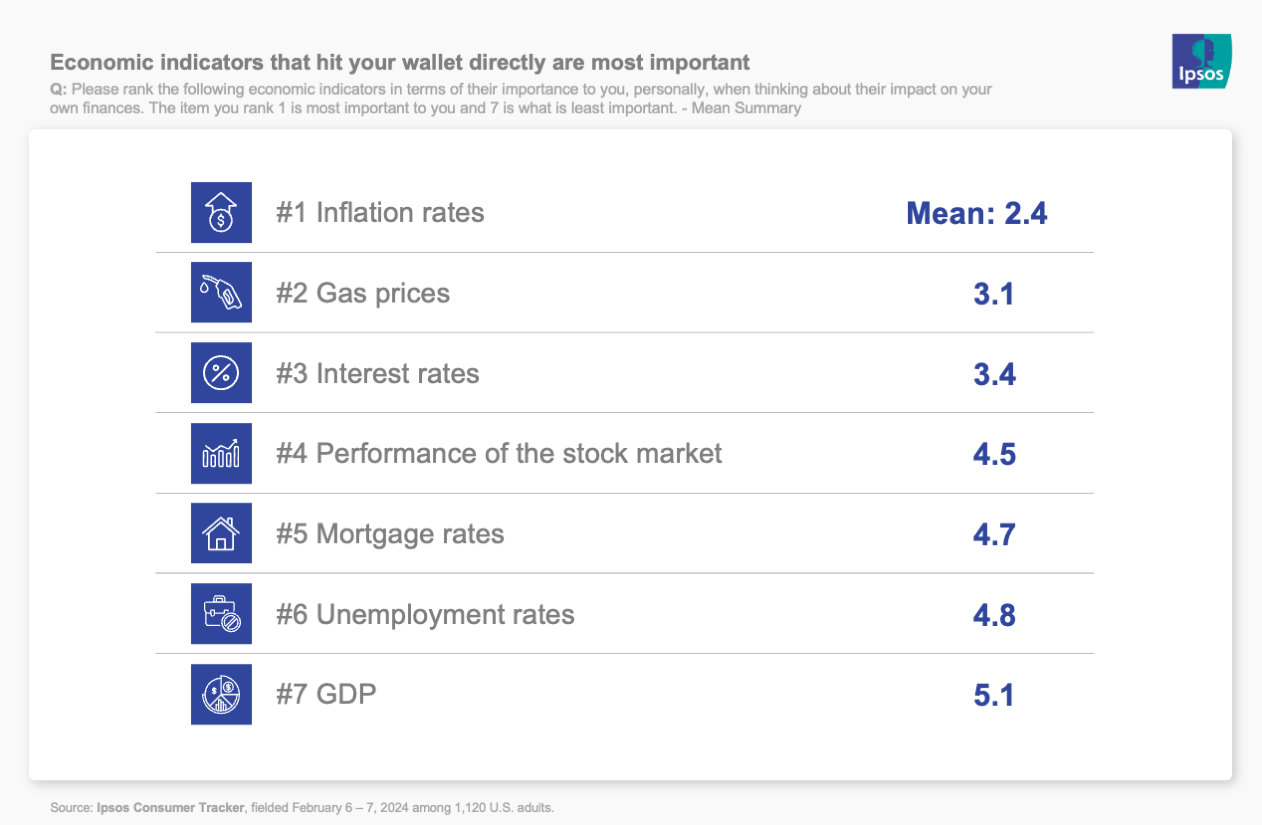

Economic indicators that hit your wallet directly are most important

Why we asked: As we talked about in the last wave of the tracker, the economy continues sending mixed signals, as strong macroeconomic indicators clash with the economic reality that, for individuals, things still cost more than they used to. We wanted to dig into that a little more in this wave.

What we found: As we start this election year, the economy seems to have achieved the “soft landing” that experts had dreamed was possible but worried wouldn’t happen. Lots of indicators are solid. Unemployment remains low. Inflation has been falling for a year. Gas prices are falling again. The market had a solid 2023. Even Fox’s Larry Kudlow said the economy is “not as bad.” But are those the parts of the economy that matter to people?

So we asked Americans to rank the parts of the economy that mattered most to them, and found that the answer is yes and no. Some of the positive news that hits their wallets directly matters, like inflation rates and gas prices. But unemployment, and GDP, much less so. The economy continues to be the No. 1 issue for voters. And while consumer confidence has ticked up, according to Ipsos data, people also still think prices are going up. Headlines are cropping up that prices for some goods might have peaked.

We think the economy is worse than it is

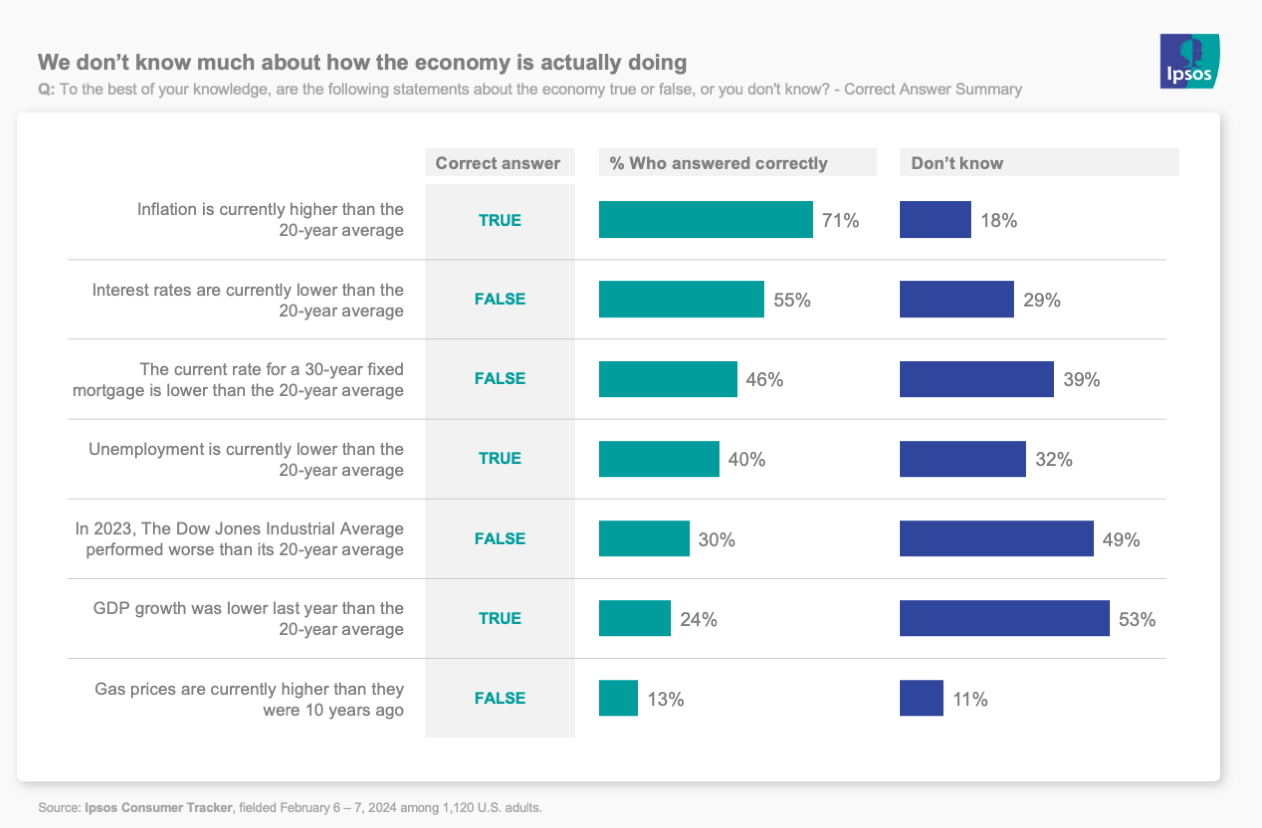

Why we asked: But… we don’t actually know a lot about the economy. In the spirit of Ipsos’ long-running Perils of Perception series, we asked a series of quiz questions about how the economy is doing today.

What we found: America… well, we mostly failed the test. Which is fine. We’re not all news junkie economists. But the way we failed is important. We think things are worse than they are. Where the data tells a negative story, we were more likely to be correct. Inflation is higher than the 20-year average, as are interest rates and mortgage rates. A majority or near-majority/plurality got those answers correct. Where the data is more positive, we aren’t getting those questions correct.

So for unemployment rates, stock market returns, and crucially, gas price data, we either don’t know, or mostly got wrong. In the last wave, we saw signs that people are catching on about gas prices improving, but a majority still think they are going up (they are not) and most think they are higher than they were 10 years ago (they are actually down almost $0.30).

GDP growth, which we established in the previous question is way less important to people, is currently lower than the 20-year average. Only 24% got that correct, but a majority didn’t even guess.

So to sum, many of the parts of the economy that are most important to us aren’t doing great compared to historical norms and we perceive that. And the parts that are doing well are less important to us, but we also don’t know that they’re doing well. That equates to a lot of peril in our perceptions.

More insights from this wave of the Ipsos Consumer Tracker:

One in five Americans planned to bet on the Super Bowl in 2024

Americans care a lot about the FBI director's warning about Chinese hackers