Here's what mixed signals in personal debt look like

The Ipsos Consumer Tracker asks Americans questions about culture, the economy and the forces that shape our lives. Here's one thing we learned this week.

The Ipsos Consumer Tracker asks Americans questions about culture, the economy and the forces that shape our lives. Here's one thing we learned this week.

Why we asked: The Federal Reserve Bank of New York reported that household debt reached a record $17 trillion in Q2 and credit card debt topped $1 trillion for the first time.

What we found: The Fed reported that “compared to other debt categories this quarter, credit card balances saw the most pronounced worsening in performance, following a period of extraordinarily low delinquency rates during the pandemic.” Car loans rose. Student loans dropped slightly. So first we asked if people are carrying personal debt other than mortgages. That was split 50/50 between those who reported debt and those who did not.

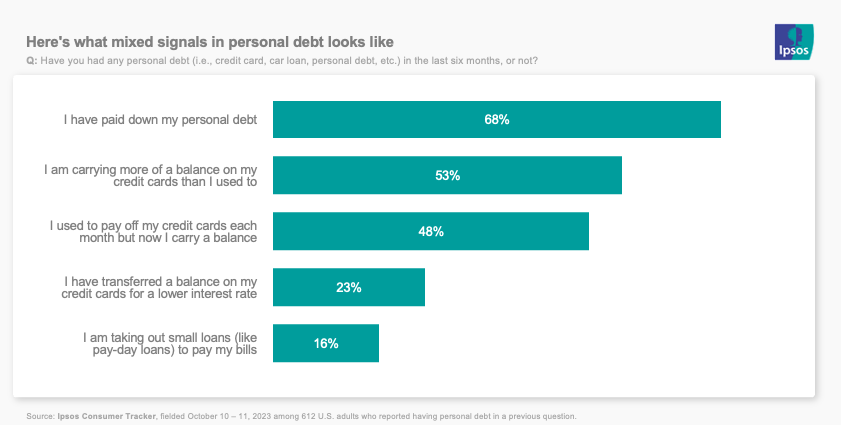

Of those who said they had debt, about half say they are carrying a balance on credit cards when they used to pay off their balances. Half also say they are carrying more of a balance. And 68% say they have paid down their debt. More affluent households ($125k+) were much more likely (82%) to say they were paying down debt than a (still high) 61% of those making under $50,000. So we’re carrying more debt, and letting it hang out on our credit cards, but we’re also paying it down. A not-insignificant number (16%) are taking out loans to pay bills. Interestingly there is no difference based on income for this behavior.

About one in four (23%) say they are transferring balances on credit cards for lower-interest rates. Upper-income households were about 10 points more likely than lower-income households to say this, likely reflecting that they are more often targeted for offers like that from credit card companies.

More insights from this wave of the Ipsos Consumer Tracker:

We think entertainment is costing more, and higher ticket prices are impacting our behavior

Americans still think gas prices are rising (but they’re not)

Our holiday shopping attitudes are quite consistent

The Ipsos Care-o-Meter: What does America know about vs. what does America care about?