A majority of Americans value their credit card rewards

The Ipsos Consumer Tracker asks Americans questions about culture, the economy and the forces that shape our lives. Here's one thing we learned this week.

Why we asked: The U.S. Senate is considering legislation aimed at reducing the fees merchants pay to credit card companies. The idea is that merchants would then pass those savings along to shoppers. This was tried before with debit cards and research by the Federal Reserve Bank of Richmond showed that – shockingly – the merchants pocketed those savings and either kept prices constant or raised them. Those fees are used to bolster financial services company’s bottom lines and also to subsidize points, cashback and other rewards given to credit card holders.

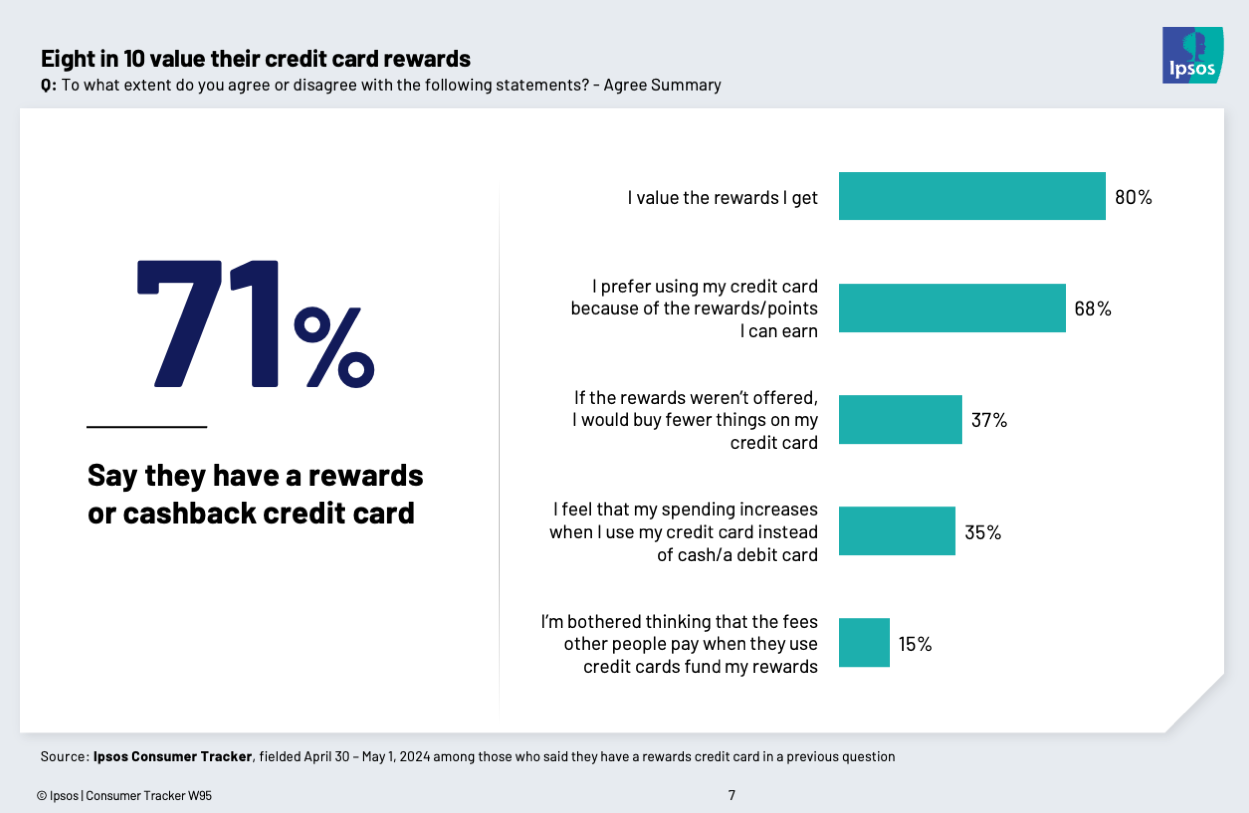

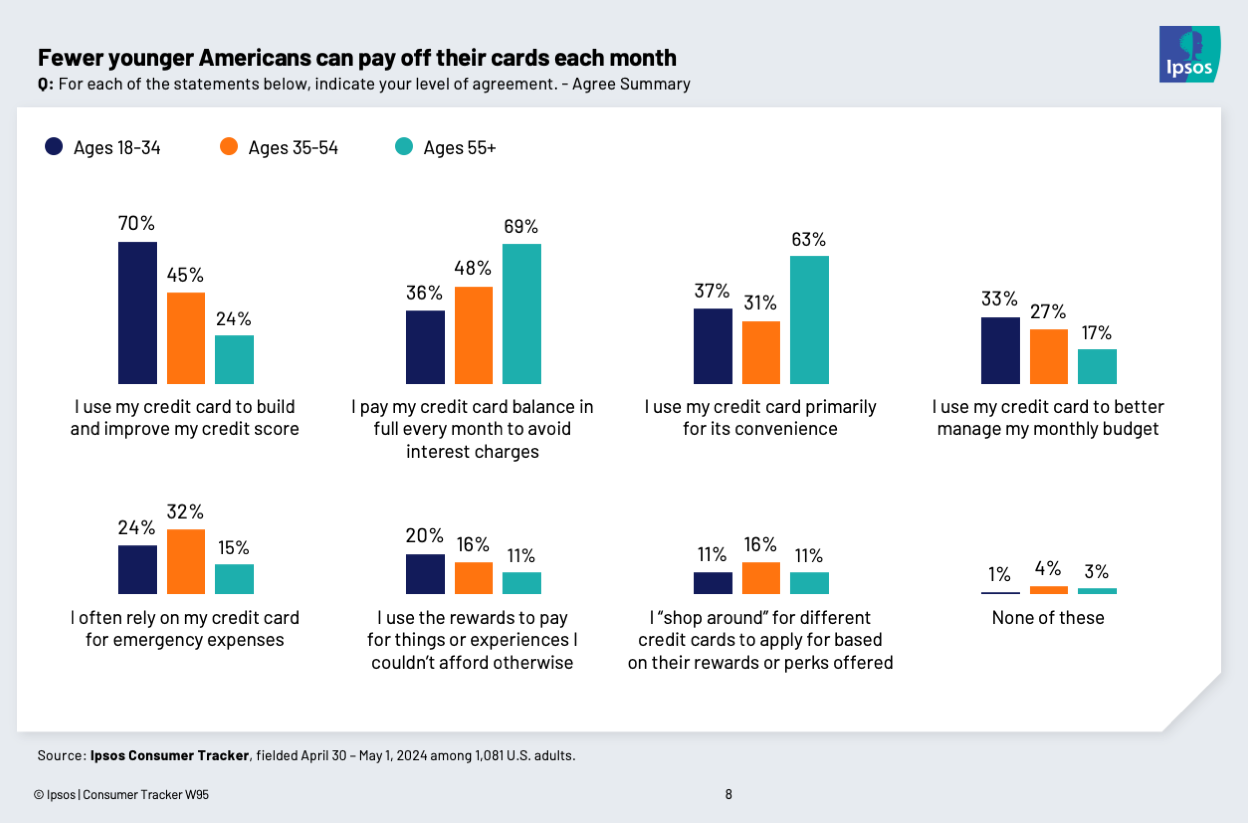

What we found: Those rewards are… incredibly popular. Seven in ten (71%) people say they have a rewards, points or cashback credit card of some sort. When we asked how people use them, half said they pay those off each month to avoid interest rates. But that hides a troubling age split. 69% of older Americans do this, but only 36% of younger Americans do. About half (45%) use their cards for the convenience of it. Nearly half (and 70% of younger Americans) use their cards to build and improve their credit scores. 13% “shop around” for credit cards to find the best rewards and perks. Equal numbers rely on credit for emergencies (23%) and to manage their budgets (25%). About one in five younger Americans (18-34) say they use their rewards to pay for things that they couldn’t afford otherwise.

When it comes to their attitudes about their cards, 80% value their rewards. And since there’s a political angle here as well as an economic one, we should note that there is no party split on any of this. These rewards are popular in an unusually bipartisan way. These rewards impact our spending habits in pretty profound ways. Nearly 70% prefer to pay with their cards in order to get those rewards or points. 35% think they spend MORE because of their credit cards. 37% say they would decrease their credit card spending if the rewards weren’t available.

More insights from this wave of the Ipsos Consumer Tracker:

More say they can save money as mixed bag of economic opinions continues

A new benchmark in our perception of COVID’s waning threat

The Ipsos Care-o-Meter: What does America know about vs. what does America care about?