More say they can save money as mixed bag of economic opinions continues

The Ipsos Consumer Tracker asks Americans questions about culture, the economy and the forces that shape our lives. Here's one thing we learned this week.

Why we asked: The economy, man. ¯\_(ツ)_/¯ Unemployment is down. Interest rates are steady but high. Inflation and gas prices are down but back up but down again? I mean… How are consumers supposed to feel?

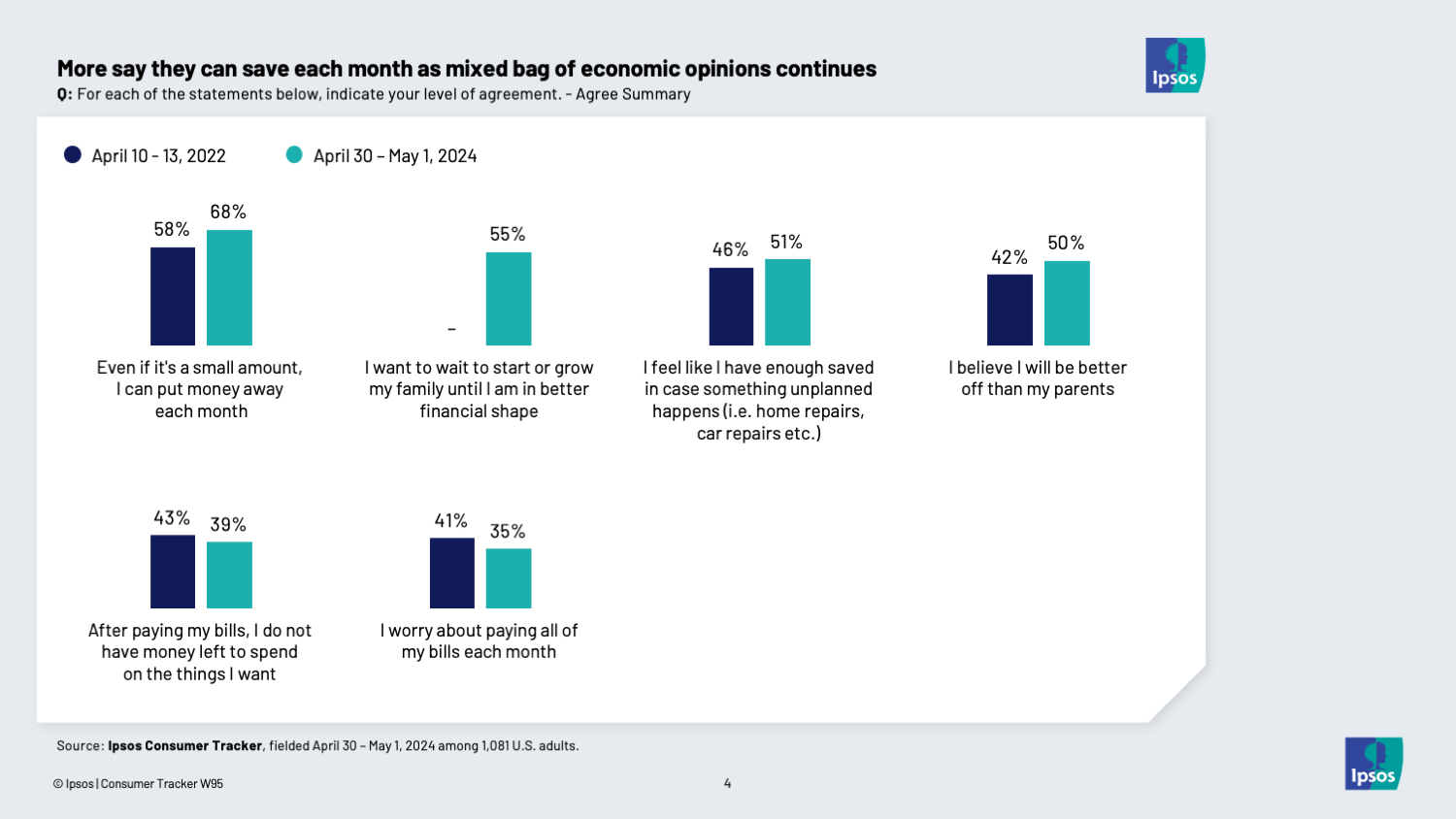

What we found: Just looking at this wave’s results, we see about four in ten essentially saying that they have no disposable income. Though we also see nearly seven in ten saying they are saving at least a little each month. About half have enough money saved for an unexpected expense, while 35% are worried about paying their bills each month. 55% say that economic concerns are impacting their family planning as they delay having kids, or more kids. Only half think they will be better off than their parents.

But if we look back over previous waves, we see fewer saying they have nothing left over after paying their bills than when we asked in August 2022, though on par with March of that year. Optimism about being better off than your parents is higher than in any previous wave and generally trending upward. And worry about paying bills is lower than in previous waves and trending downward. All in all, while these numbers are maybe improving, it’s still arguably not great that such a sizable part of the population can’t splurge on a nice-to-have after paying their need-to-have bills. Or that only half of Americans think they will reach the same rung on the economic ladder that their parents did.

[See more in Ipsos Top Topics: Economy and Consumer Spending]

More shift to multiple incomes as one in ten work overtime without getting paid for it

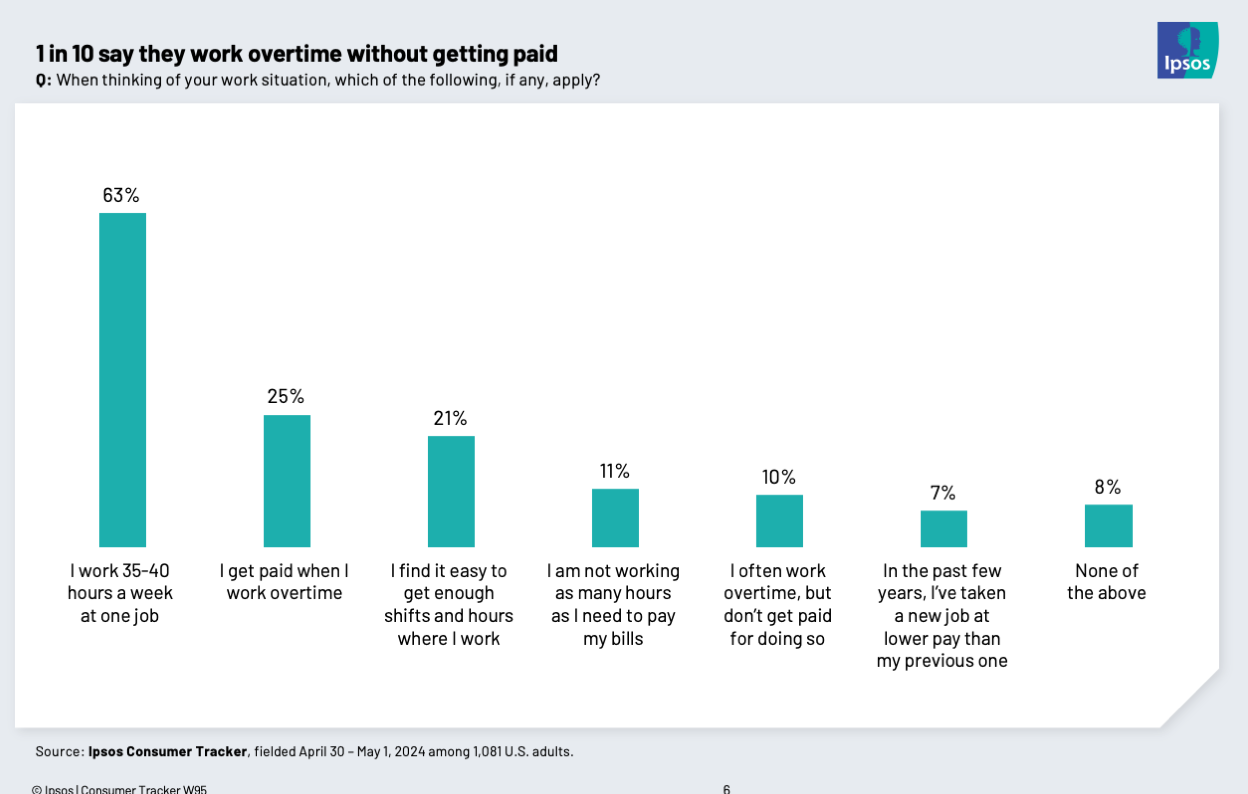

Why we asked: We wanted to dig a little more into some details of our economic situations, like how many jobs we hold. Meanwhile, the Biden-Harris administration recently expanded overtime pay requirements to cover more workers.

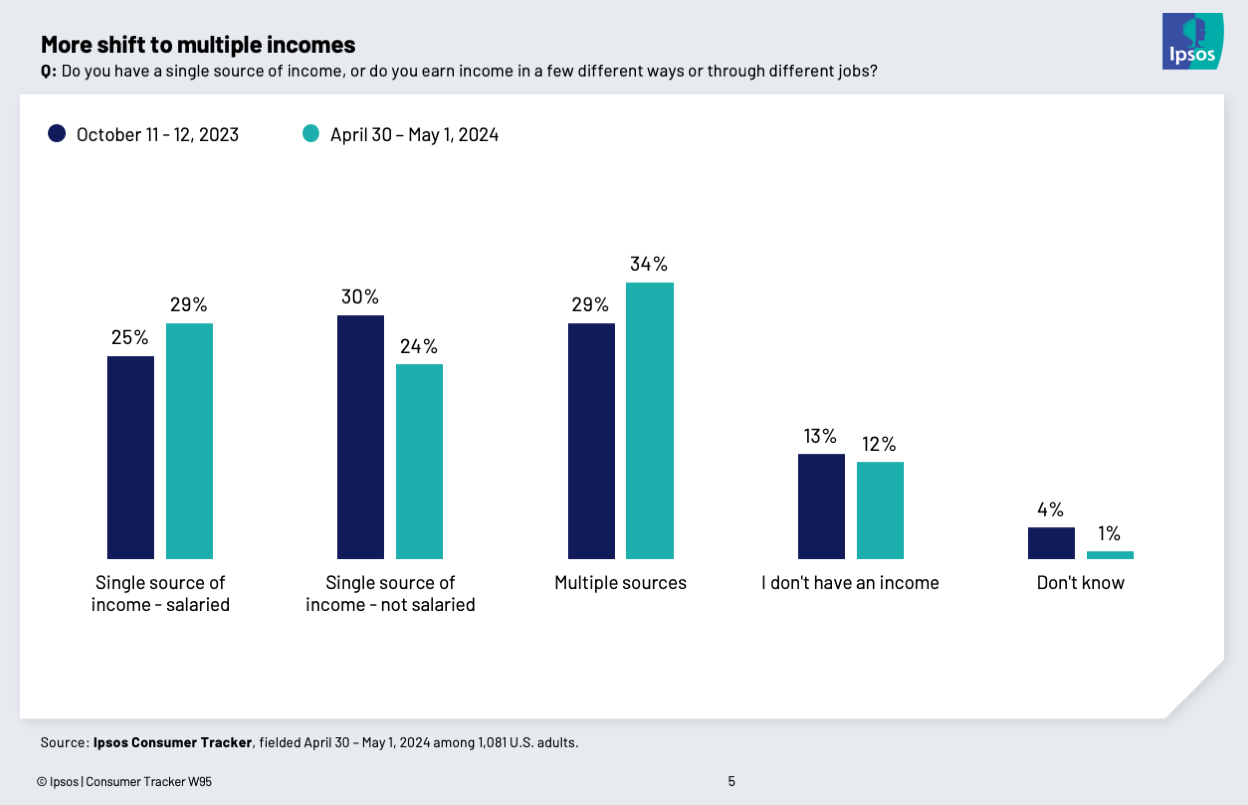

What we found: Nearly three in ten say they have a single source of income, up slightly from when we last asked in August, 2022. But there is a drop in those who say they are non-salaried and an increase in those who say they have multiple sources of income. The majority of workers say they work 35-40 hours at one job. One in four get paid overtime. One in ten don’t. One in five say they find it easy to get enough shifts and hours where they work. But one in ten say they aren’t working as many hours as they need, to pay their bills. About 7% say they have taken a lower-paying job in the past few years than they had previously.

More insights from this wave of the Ipsos Consumer Tracker:

Eight in 10 Americans value their credit card rewards

A new benchmark in our perception of COVID’s waning threat

The Ipsos Care-o-Meter: What does America know about vs. what does America care about?