4 charts that explain the zero-sum human economy

The Ipsos Consumer Tracker asks Americans questions about culture, the economy and the forces that shape our lives. Here's one thing we learned this week.

Why we asked: As the Wall Street Journal points out, we’re hitting five years of persistent inflation. And while it’s not ’70s-gas-lines level of inflation it’s still not something most of us have really faced before. The “middle class is buckling,” is the conclusion the Journal draws. We’ve been dutifully measuring this in the Tracker for … all five of those years. Here we round up some telling, trended metrics that together tell quite a story.

What we found: I am not an economist, but I do know a thing or two about consumers, or to use a technical bit of market research jargon, “people.”

Economists and businesses alike watch consumer confidence indices like the LSEG/Ipsos Primary Consumer Sentiment Index for a lot of valid reasons. One of those reasons is that people can actually drive the economy in positive and negative ways. Fear of inflation can lead to increased spending by some (but not others), reports the Wall Street Journal. But Econofact also notes an “important source of ongoing high inflation is an expectation of high inflation among households and businesses.” But…

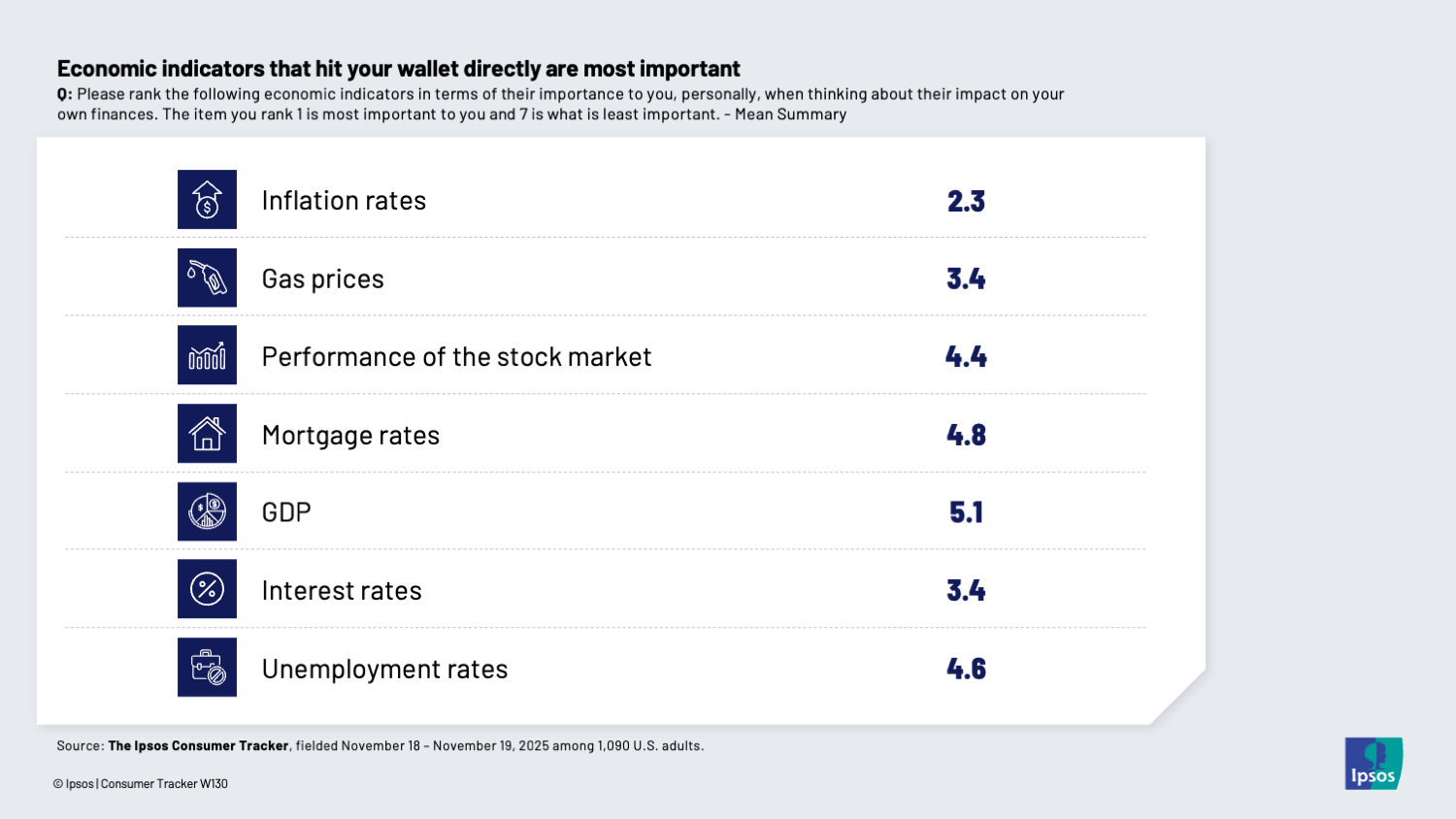

- People care about different things than economists do

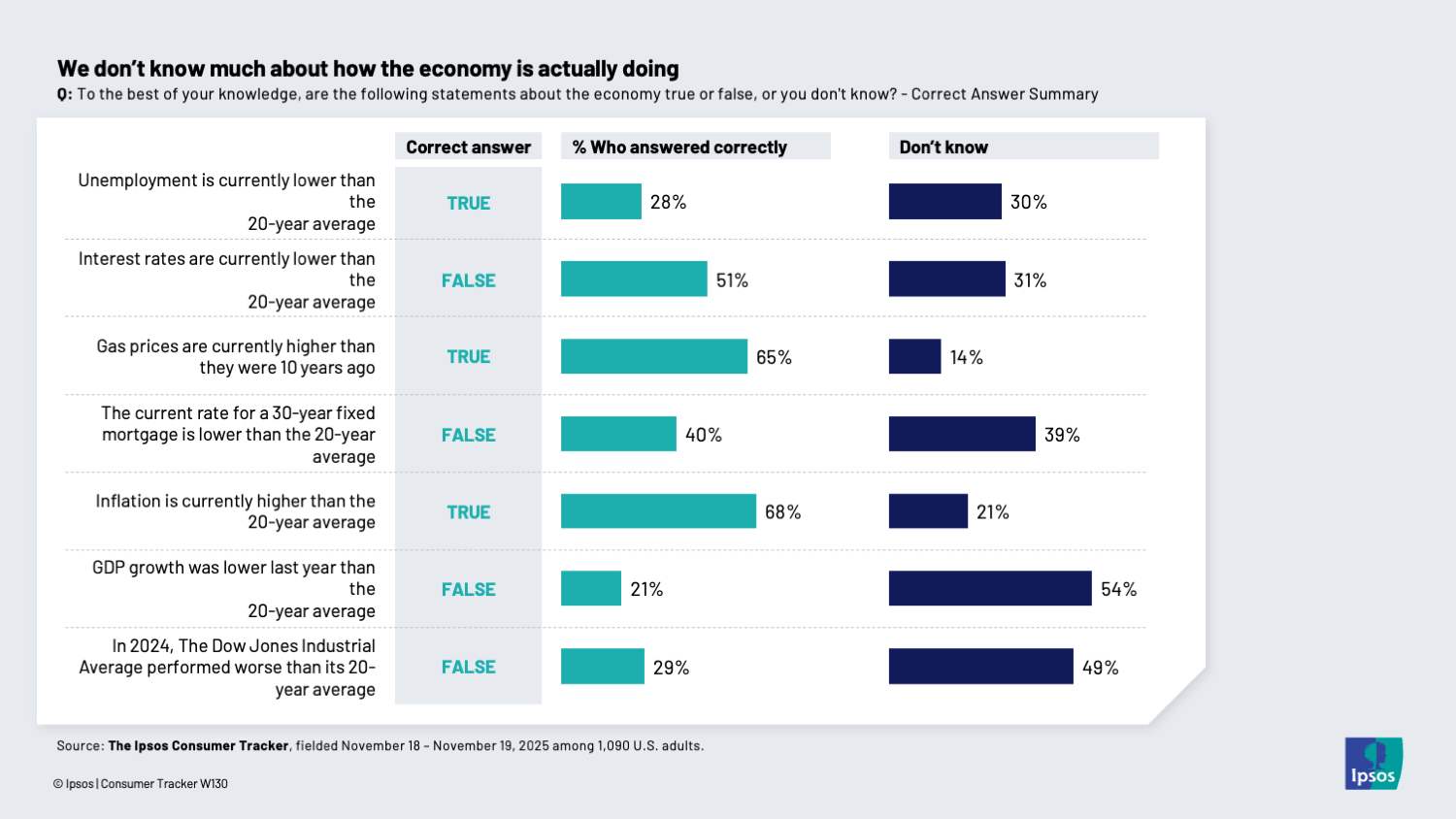

- People don’t know much about the economy

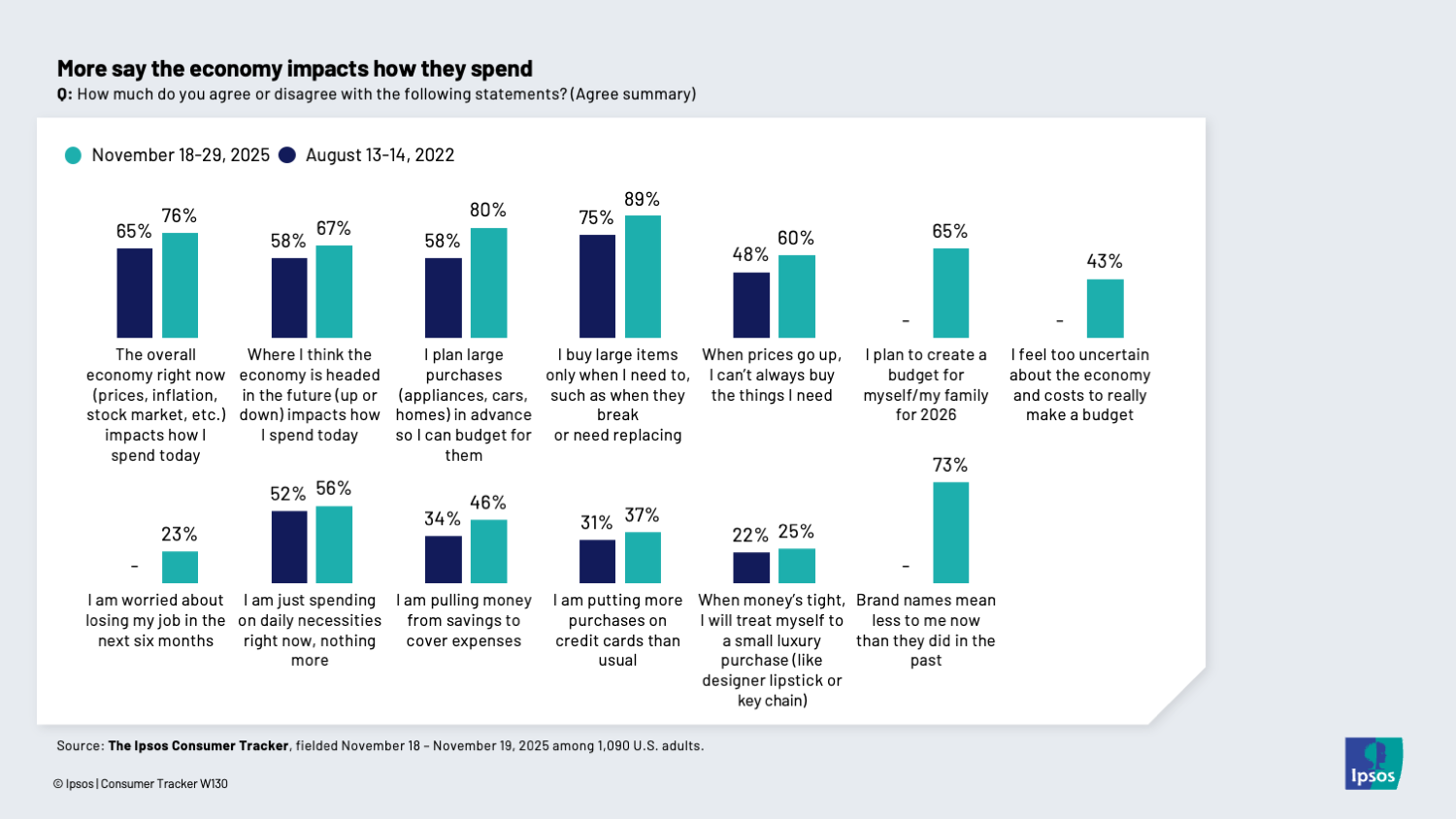

- Most people are stretched economically

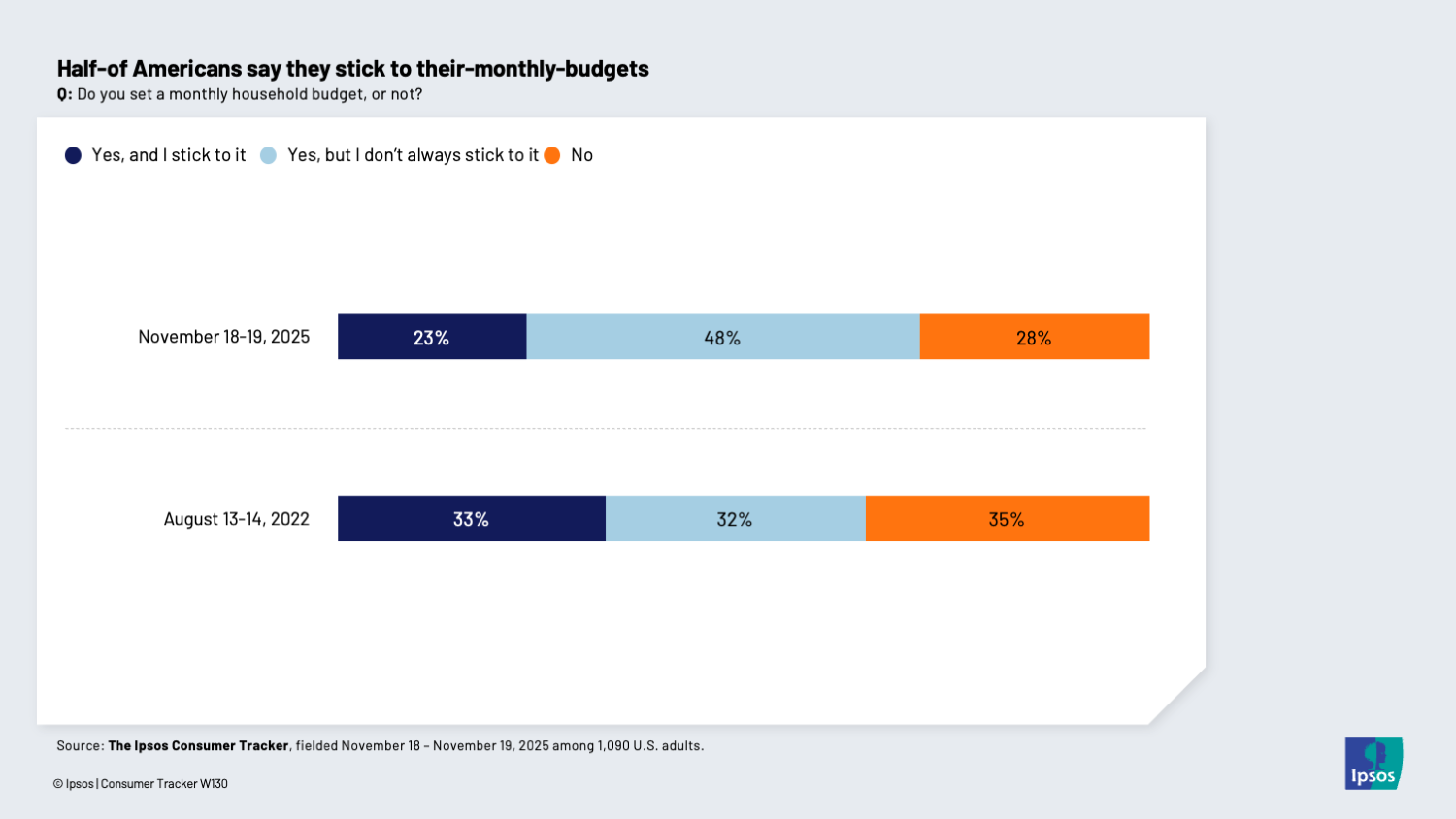

- Economic insecurity is having a larger impact on how people budget (or don’t)

Most importantly, I know this about people: People don’t need facts to have vibes.

And the vibes today ain’t great.

How do I know? Let’s do the numbers. First, the LSEG IPCS has confidence down month-over-month and quite a bit off last year at this time. Digging at the question from a few different angles in the Tracker we see that:

People care more about things that obviously impact their personal finances day-to-day like gas prices and interest rates, and less about things that economists watch a lot, like GDP and employment rates.

When asked a series of true/false facts about how the economy is faring in relative terms, people tend to either be wrong or just not know. We generously gave folks an “opt-out” in a and it says a lot that so many people just admitted they had no idea.

But… again, confidence is down. So that makes the 11-point rise in people saying that the economy impacts how they spend today (76%, up from 65% in 2022) and a similar rise in people who say they are impacted by where they think the economy is headed (67% up from 58%) … troubling.

We also see big increases in people who only buy large items when they need to, like when they break or need replacing (89% up from 75%) and that they plan those purchases in advance (80% up from 58%).

Two in three say they want to make a budget for 2026, but four in ten also say they’re feeling really uncertain about the economy and it’s hard to make a budget.

In a separate question, 71% of people say they make a budget, and almost half now say they stick to it (up from just 32% in 2022).

Part of that is that when prices go up, it doesn’t break the budget. It just means they (60%) “can’t buy the things they need.” That’s “need,” not “want.” That’s why a third more people (46% up from 34%) say they are pulling from savings to cover expenses.

Which leads us back to the all-important stat from a recent Consumer Tracker, that half of Americans spend their entire paycheck on their monthly bills.

If you’re wondering what this means for your brand, note the final line the earlier chart, that for three in four Americans, your brand name means less to them that it did in the past.

So as we’re looking at 2026, The zero-sum human economy is one big thing we’re thinking about. What will the mix of these attitudes, vibes, facts or lack thereof, mean for spending and the actual economy?

More insights from this wave of the Ipsos Consumer Tracker:

Shipping and returns are still the bugaboos of online shopping

Gift cards and food are growing as popular holiday gifts

The Ipsos Care-o-Meter: What does America know about vs. what does America care about?