Going Beyond "Intent to View": TV Dailies Fall 2010 Research Briefing & Wrap Up

TV Dailies is Ipsos OTX MediaCT's industry leading weekly tracking study of marketing effectiveness for new and returning television programs. Analyzing this year's new fall broadcast programs, the study confirmed that while the awareness and buzz for new programs is critical, the urgency to and intended method of tune-in, can be the difference between the success and failure of new programs.

UNAIDED AWARENESS

Step one to creating a successful program is to generate awareness in the marketplace. The strength of awareness, however, becomes even more important when making early determinations of success or failure. TV Dailies captures awareness on both an unaided and aided basis. While most programs never achieve a significant level of unaided mentions, those that are top of mind, especially early on in tracking, are those which tend to premiere the strongest. This season was no exception as shows like NBC's The Event and CBS' Hawaii Five-0 reached over 10% unaided awareness in the weeks leading up to premiere. On the contrary, NBC's Outlaw and ABC's My Generation received some of the lowest levels of top of mind awareness.

TV Dailies has also concluded that buzz is highly correlated to unaided awareness. Buzz can be generated very early on in the process though such methods as TV websites, social networking sites and talk / news / entertainment programs.

Figure 1: Unaided Awareness of New Fall Broadcast Shows among Adults 18-49 (week prior to premiere)

INTEREST INTENSITY

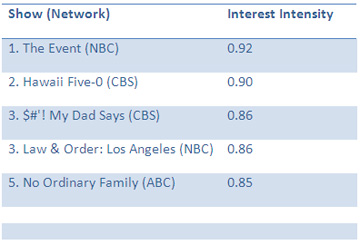

In a marketplace with so many choices of what to watch and how to watch it, television networks should be more concerned than ever about creating urgency. TV Dailies not only measures "intent to view" but also looks at the "interest intensity" and "how the respondent intends to view" the program the first time. The shows that receive the highest "intensity scores" (on a scale of 0 - 1) leading up to premiere are the ones that also tend to generate the highest initial viewership. For example, NBC's The Event and Law and Order: LA, CBS' Hawaii Five-0 and $#'! My Dad Says and ABC's No Ordinary Family all had solid intensity leading up to premiere and subsequently were among the most viewed new shows in their first week. Marketers still need to maximize awareness, but effectively converting that to positive and strong intent to view drives initial performance. Unlike more traditional metrics, Intensity is calculated using a scale and is not impacted by awareness. In fact, many shows with high awareness receive low intensity scores.

Figure 2: Top Five Interest Intensity Scores of New Fall Broadcast Shows (among shows with Top Box Intent to View of 4% or greater; week prior to premiere)

Although the survey does not measure intensity for returning shows, the desire to view returning shows this season is evident. That strength can have a great impact on the success of new shows. What is clear from the first few weeks of this season is that viewers are not only flocking to the familiar, but the definition of "water cooler" television has rapidly evolved to the point where one no longer has to wait to get to the cooler. Shows like Dancing with the Stars, The Office and Glee are must see because people want to be part of the communication that is happening almost simultaneously with the airing of the show. Shows which follow these buzz worthy shows, such as NBC's new Outsourced and FOX's Raising Hope have the opportunity to attract an audience that otherwise may not have been measurably interested in the show.

HOW INTENT TO VIEW

While networks rely heavily on the next day results, time shifted and digital viewing is a growing reality. By measuring intended viewing method, TV Dailies goes deeper into the mindset of the consumer to better predict behavior. With 16 of the 21 shows premiering over a five day period, this season proved it is more important than ever to create and market shows that will break out of the clutter. But in reality, consumers know they have choices. The decision to watch a program has now become a decision on how (and when) to watch it.

Beyond just "scheduled time period" TV Dailies also measures the percentage of intended viewing going to DVRs and other time shifting devices. Programs like The Event, Blue Bloods and No Ordinary Family had indications that a high percentage of viewing would be via DVR. For network executives, this information can help set expectations for performance.

Figure 3: Top Five Percent of Intent to View to "DVR" (among shows with Top Box Intent to View of 4% or greater; week prior to premiere)

WHAT HAPPENS AFTER PREMIERE?

History has proven that many shows take time to build an audience and often what starts as a very niche and limited audience can grow into something far more popular over time. ABC's Modern Family is one of the most watched programs on television this season, after being moderately received in its premiere season. CBS' Big Bang Theory has exploded in its fourth season after being moved to Thursdays. Many broadcast networks, however, dependent on ad dollars as a main revenue source, do not have the luxury of nurturing shows. As a result, four new fall broadcast shows were cancelled within the first month of the season for poor initial performance.

THE TV DAILIES ADVANTAGE

By combining insights from these various data points and working with Ipsos' experienced TV Insights group, researchers, marketers and executives can use TV Dailies to pinpoint early on which shows are primed for initial success and which may struggle. Cutting data by a variety of standards demographic and psychographic attributes as well as through the use of customized tack on questions can also determine who to target in order to maximize marketing effectiveness.

ABOUT TV DAILIES

TV Dailies is Ipsos OTX MediaCT's industry leading tracking study of marketing effectiveness for new and returning television programs. Every week of the year TV Dailies polls more than 3,000 respondents nationally. By September 2010, the database included key information on more than 2,300 individual shows. More than 30 of America's top broadcast and cable networks are already gaining valuable insights from TV Dailies. TV Dailies continues to track programming several weeks after premiere to provide clients with data on overall appeal, future intent to view, as well as likelihood to recommend the show to others. This insight helps inform decisions for future scheduling, marketing and renewal decisions.

![[WEBINAR] The Super Bowl’s Best Ads of 2025](/sites/default/files/styles/list_item_image/public/ct/event/2025-01/linkedin_1.png?itok=LXfnrrAL)