Improving Consumer Duty Outcomes Through Customer Experience

The FCA’s assessment of firms’ Consumer Duty performance through the twin lenses of Cultural Change and Consumer Testing places a clear emphasis on measuring customer sentiment. But are existing customer experience (CX) and voice of customer (VoC) programmes fit for the purpose?

Not necessarily. This is because the evidence the FCA is looking for is not that customers are satisfied with individual transactions, or engaged with a brand, but that the outcome of their experience with that brand is a positive one for the customer. Brands must understand customer outcomes across the four pillars outlined in the Duty:

- Products and services which are fit for purpose

- Consumers are receiving fair price and value

- Firms support consumer understanding to enable them to make informed decisions

- Firms are providing support which meets the consumer’s needs.

Being outcomes formed over time, these are not all concepts which lend themselves easily to a literal question and answer approach, but Ipsos has developed a holistic framework designed to measure the over-arching sentiments that lie at the heart of strong customer relationships.

Are you measuring the right metrics to understand Consumer Duty outcomes?

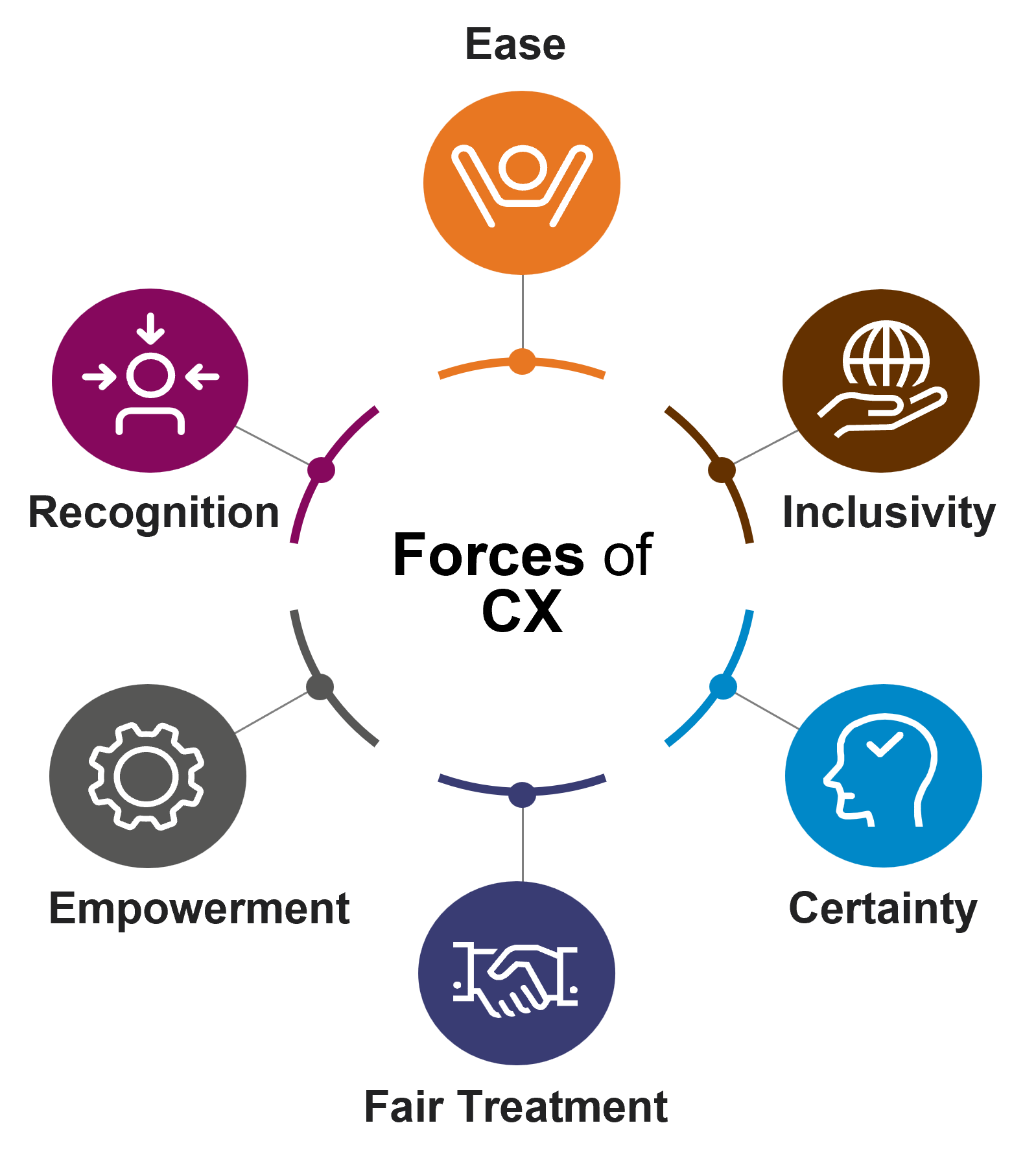

In collaboration with Ipsos’ Global Behavioural Science team, we developed a human centric framework for customer experience that measures the extent to which firms are delivering to customer’s fundamental functional, emotional, and relational needs.

In collaboration with Ipsos’ Global Behavioural Science team, we developed a human centric framework for customer experience that measures the extent to which firms are delivering to customer’s fundamental functional, emotional, and relational needs.

Because the CX Forces framework was developed to understand customer outcomes, it aligns closely with the dimensions detailed by the FCA in the Duty.

CX Forces provides firms with clear outcome metrics resulting from their relationship and interactions with customers and can be deployed in two ways:

- As a standardised set of six simple questions added to existing or new customer experience programmes, enabling firms to gain quantitative outcome measures

- As an analytical framework to analyse existing and new customer verbatims, including historic survey data, call centre transcripts, and chat conversations.

We have worked closely with the FCA to fine tune the wording of the questions to enable measurement of consumer duty outcomes via our Financial Research Survey. Whilst this will provide industry, category and brand level metrics for larger brands, the imperative within the Duty is not merely to measure outcomes but to work to continuously improve these.

Improving outcomes by embedding CX Forces into ongoing programmes

The clients we’ve worked with to embed CX Forces as a quantitative measure of customer sentiment have been able to bring to life the concerns of their customers and in doing so address them and drive the cultural change necessary to provide a better customer experience long-term.

The advantage of embedding CX Forces into ongoing CX or VoC programmes is that the forces measurement can be linked directly to customer data to enable firms to act directly to address potential Duty failings. Analysis of customer verbatims can bring Duty issues to life for a brand and act as a trigger for closed loop interventions with individual customers:

I have no idea what I can claim for…my premium just goes up and up…no one contacts me to highlight any benefits.

Insurance customer, aged 55-64

These verbatims also play a key role in helping to drive cultural change by demonstrating the emotional impact of poor customer outcomes:

Answer the phone! The average wait to get through is around an hour - it's extremely inconvenient and very annoying - in fact it’s an insult given that I am paying nearly £6,000 for this service every year.

Health Insurance customer, aged 64-75

Taking as an example of an issue long contact centre response times, whilst operational staff may have wearied of being told that delays are an issue seeing the impact of this on customers is having a transformative impact on service design and investment, helping to improve outcomes at the aggregate level.

By baking consumer duty trigger points into VoC programmes and establishing systematic approaches to ‘closing the loop’ we are seeing brands reach out to individual customers to address issues at a one-to-one level, ensuring improved outcomes for both customer and brand.

What are you waiting for?

The current focus for many clients is getting measurement in place and fixing obvious problems – improving the clarity of communications, making services easier for customers to access, giving greater certainty – but as the Consumer Duty era develops brands will need to implement new solutions to meet customer expectations in the harder to reach areas such as giving customers greater empowerment and treating them in more personally relevant ways.

About our CX capabilities

Whilst Ipsos is well known in the UK for the kind of research expertise and consumer understanding which enabled us to develop CX Forces, our CX experts offer the full breadth of capabilities needed not only to ask and measure the right questions, but to drive real improvement in consumer outcomes.

Our professional services team works closely with brands to fully understand customer journeys and to ensure that pain and gain points are identified to design better outcomes for customers. Our client and platform services teams work directly with clients to design, implement and manage ongoing VoC and CX programmes on industry standard SAAS platforms including Medallia and Qualtrics.

Table of contents

- Introduction to Consumer Duty: A clear way forward

- Creating and Embedding Cultural Change

- Building Stronger Stakeholder Relationships Through Consumer-Centric Culture

- Innovating with Financial Service Customers in Mind

- Improving Consumer Duty Outcomes Through Customer Experience

- Using Mystery Shopping to proactively measure staff engagement with Consumer Duty

| Previous | Next |