Using Mystery Shopping to proactively measure staff engagement with Consumer Duty

With the introduction of Consumer Duty requirements in the UK, it is more important than ever for firms to have a read on the actions and behaviours of their frontline employees across face-to-face, digital, and telephone channels. Organisations are investing in training and processes to align with the requirements of the Duty, and want to understand the impact of this, both in terms of their ability to report compliance activity and in terms of ROI for this investment. Critically, businesses must ensure they monitor and act on feedback and improve employee performance through training and feedback mechanisms in order to remain compliant, and consider these activities in the context of the broader customer experience.

Many firms, as they get to grips with Consumer Duty regulation, will be relying on customer feedback to assess how frontline staff are interacting with customers. However, this feedback (often in the form of complaints) can only provide evidence on events that have already happened and can be costly both financially and in terms of reputation and erosion of trust. As such, firms should also use more proactive methods to mitigate the risks associated with non-compliance, and to continuously improve the service given by frontline staff to drive improved outcomes for consumers and align with their expectations.

One such method is mystery shopping. Ipsos’ mystery shopping service provides independent evidence which is gathered to test the efficacy of an organisation’s training and communications, including adherence to compliance regulations. Measuring via mystery shopping enables clients to assess performance and identify gaps in process, staff comprehension and delivery, and ultimately customer understanding - ideally before an issue or complaint is reported. Mystery shopping, therefore, is a uniquely proactive measurement tool that organisations in the banking sector and beyond can deploy to understand the actions and behaviours of their employees, and importantly how the information they convey is received and understood by customers and prospects across all channels and touchpoints.

Thinking about Consumer Duty in the context of Customer Experience (CX) as a whole, proactive and effective measurement of staff behaviour can help organisations to continuously build strong connections with customers if the assessment is effective, actionable and leads to improvements.

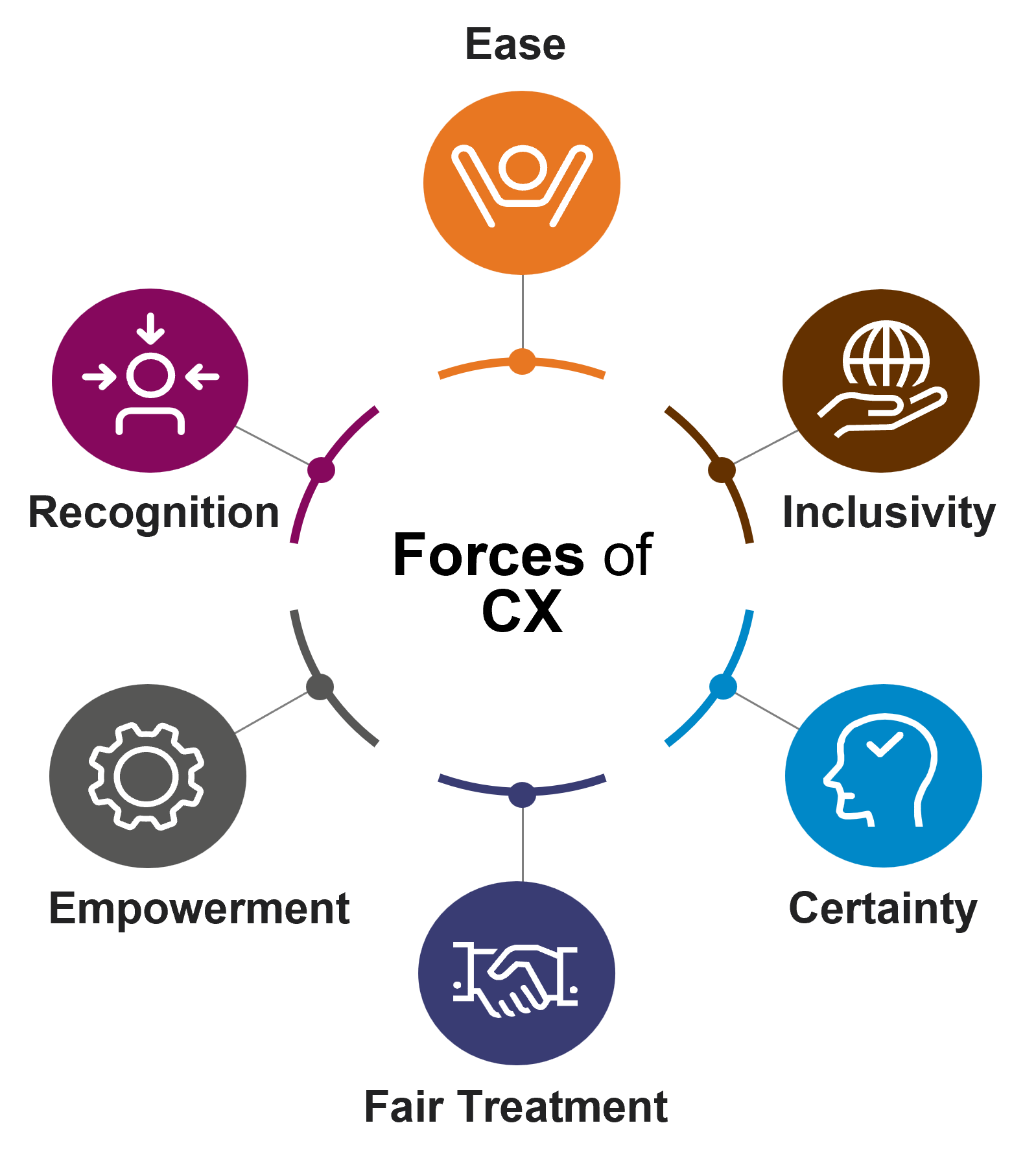

Strong customer connections, as demonstrated by Ipsos’ Forces of Customer Experience, drives improved sales and retention. Ipsos R&D has identified that strong relationships with customers are driven by meeting functional needs first, then going beyond that to meet the emotional needs of the customer across 6 areas; Ease, Inclusivity, Certainty, Fair Treatment, Empowerment, and Recognition. And, improved perceptions of social responsibility, which adherence to the Duty contributes to, is shown to result in an increase in three of these areas: Inclusivity, Fair Treatment, and Certainty. This ultimately saves organisations money and retains customers. A lack of perceived Fair Treatment has the potential to be a barrier to strong emotional connection with customers, meaning there is a lot to lose for organisations who do not put in the effort to measure adherence to the Duty in a proactive manner.

To ensure effective use of this tool, it is important to understand the steps to leveraging mystery shopping research in order to assess the staff behaviours which underpin compliance with Consumer Duty across key delivery channels. An effective mystery shopping programme should deliver actionable recommendations, therefore allowing firms to continuously improve delivery of Consumer Duty whilst also supporting the evidence required of firms by the FCA.

Building upon the framework in our Driving Compliance at the Front Line paper, this article dives specifically into how mystery shopping can be an essential tool for firms to adhere to the requirements of the FCA, with regards to Consumer Duty, and demonstrate they are doing so.

The Duty sets a higher expectation for the standard of care that firms give customers.

Firms are required to comply with the Duty’s cross-cutting rules by acting in good faith towards customers, avoiding causing foreseeable harm to customers and enabling and supporting customers to pursue their financial objectives. This requires firms to be proactive in delivering positive customer outcomes (rather than waiting for the FCA to intervene), however firms need the right culture and governance to enable this.

How do we do this?

Mystery shopping is a research tool which deploys trained individuals to interact with an organisation in a select channel, executing a particular task and then reporting back on their experience. Used best as a complement to Customer Experience research, which asks real customers about the experiences they had reflectively, Ipsos’ mystery shopping service offers a proactive measurement, asking individuals to look for, and observe, specific actions and behaviours. This provides an essential coaching tool for businesses.

Furthermore, mystery shopping can target specific scenarios and situations to provide clear, timely, and precise feedback on the interactions with frontline employees, including those which are lower incidence in regular interactions. For example, a mystery shopper can present that they themselves have a vulnerable circumstance, such as financial difficulty, and mention this as part of the interaction - providing insight to an organisation on how this vulnerability was addressed and providing the tools an organisation needs to coach and train frontline staff to ensure consistent outcomes for all customers. This is an important element of mystery shopping as it is one of the desired outcomes of the Duty. Similarly, deploying mystery shoppers of a particular age group can help gather essential feedback on the experiences of dealing with frontline staff for these individuals, by channel, and provide insights on where an organisation may need to deploy training resource, or review a process, to better serve this particular group.

Unlike Customer Experience, which focuses on how the customer feels, an audit gives the opportunity to assess frontline staff behaviour, and to adapt to behaviours they aren’t performing day to day. A strong suite of Customer Experience research will include both Voice of the Customer (VOC) measuring customers (subjective) and mystery shopping (objective) combined with additional KPIs relevant to the channel and sector. By including mystery shopping in a CX research programme, feeding back on the presence of certain elements (or lack of) in the process and whether specific pieces of information are provided and how they are understood, an organisation is afforded a thorough view of what is impacting customers, and what barriers may be in the way of staff improving this delivery. To do this effectively the programme design and implementation is critical and should be orientated around three phases.

Phase 1: Understand

Before a firm can take action and develop further training for frontline employees, it is important to have a read on what is happening now. At Ipsos, we deploy mystery shoppers who are able to report back on how staff are performing relative to the training and standards they have been provided. We then provide the data, both on a qualitative instance-based level for coaching, as well as summarised relative to the organisational structure, to look for trends and opportunities. Customer understanding is an essential element of what is being measured in this case; mystery shoppers report back in-the-moment on how things were specifically presented and understood, giving organisations insight into where real customers may (or may not!) leave the interaction with clarity and transparency on what happened, and the impact of any decisions they may take based on this information.

Ipsos have developed a set of diagnostic questions to indicate performance on the four Duty outcomes as defined by the FCA. Building on these, design of the mystery shopping task and questionnaire are essential to ensure that the measurement and resulting reporting align with the desired outcomes of the Duty and importantly, how the organisation has implemented these in their training. This is not a “one size fits all” situation but rather one where a tailored measurement is required.

Phase 2: Improve

Once we have helped an organisation to understand where the firm’s performance currently sits, Ipsos provide a tailored service from our portfolio of products and expertise based on the identified needs. This will support an organisation in taking corrective action where products or services fall short of the Duty outcomes, or to future proof new products and services. This includes anything from CX measurement or Employee Engagement through to Corporate Reputation or strategy research to define future needs, and many elements between.

This may include analysis relative to other metrics for a business to dig deeper into not just what is happening but why it is happening, and what they can do about it to improve compliance with the four outcomes. For example, analysing mystery shopping results, relative to the frequency of staff training, staff tenure, or footfall, helps an organisation to better understand where efforts may be needed to bring staff actions to the desired level and drive the required outcomes of the Duty.

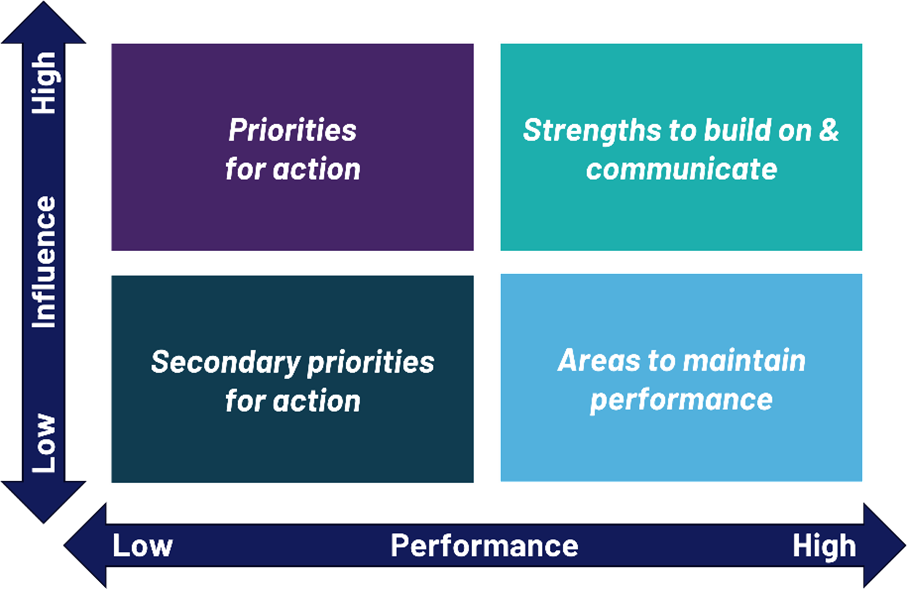

The first step of this analysis is to understand the relative influence of the specific actions on overall performance; leveraging mystery shopping data along with contextual data, we conduct analysis against a defined desired outcome – in this case compliance with Consumer Duty. This approach allows us to pinpoint the extent to which improving performance on a specific question will drive positive, or reduce negative, outcomes, and support the organisation in understanding what tools or training frontline staff may need to deliver this.

Secondly, by looking at an organisation’s performance on each factor, in relation to its overall influence on outcomes, we can help to develop an evidence-based framework to prioritise improvement planning.

Using Mystery Shopping results, and where available combining them with your other KPIs for the channel, we help you develop an evidence-based way to prioritise improvement planning, training, and staff development actions in your customer-facing channels, to drive improved Consumer Duty outcomes.

Phase 3: Monitor

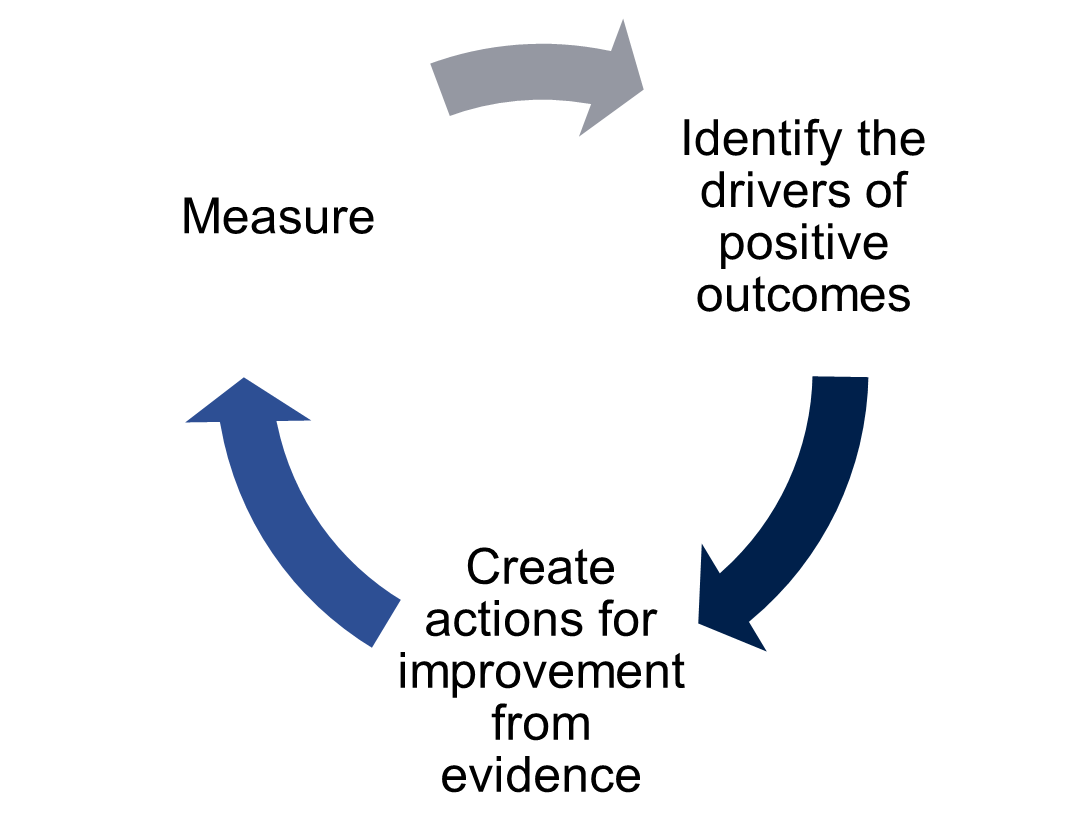

The last step is to then repeat the exercise after an organisation has implemented any actions based on the evidence supplied.

Once improvements and re-training have been deployed, we recommend monitoring the results through another round of mystery shopping tasks. With these results, we’ll bring together the reporting on cultural and consumer focused activities so a firm can holistically understand and assess progress on delivering against the Duty.

We’ll also highlight where there have been improvements, and where there is still work to do, meaning that we are supporting organisation in creating a culture of continuous improvement to drive improved Consumer Duty compliance.

The important thing is to not stop; to continually have a form of measurement and analysis of the data in order to continually improve the positive outcomes for customers. Additionally, in combination with our Financial Research Survey (FRS), analysis can be undertaken to understand performance relative to competitors, where to focus efforts, and how external stakeholders can view an organisation’s Duty implementation on an ongoing basis.

To drive continuous improvement, a regular and ongoing measurement is recommended. This supports in celebrating success, and in adjusting strategy to achieve the improvements organisations want to see.

Case Study

Working with a large telecommunications organisation in Canada, Ipsos mystery shopping helped their compliance team identify a process issue impacting consumer understanding of important pricing information across telephone, live chat, and face-to-face interactions. Deploying mystery shoppers in both a Control group of general population customers, as well as a Test group of shoppers, either presenting a vulnerability or inquiring on behalf of a friend or relative with one, we gathered data across three channels making the same inquiry about a new phone, TV, or internet service.

The findings identified that across both the Test and Control groups, shoppers were not clearly understanding an element of the pricing and cooling off period, which could result in consumer frustration and even complaints. This observation was most prevalent in the Contact Centre interactions, including phone and live chat. Working with the client, we aligned some mystery shops with their call records, and listened to the way the information was outlined. As a result, we were able to identify that the confusion was due to the order of the prompts for the Contact Centre employees. Changes were made to the prompt order, new training was deployed, and subsequent waves of mystery shopping reported an improvement in this key comprehension element across the Test and Control groups alike.

While Consumer Duty was not specifically at play here, as it is not applicable in Canada, the client question and approach apply perfectly for organisations wishing to improve customer outcomes in alignment with the Duty.

In conclusion, there is no better tool to proactively measure the impact training can have in delivering improved outcomes for customers relative to the requirements of Consumer Duty than mystery shopping, while also driving improved trust and driving stronger relationships with customers. When deployed as part of a comprehensive research toolkit, including Customer Experience measurements and Employee Engagement research, it can serve to improve an organisation’s success in this area, ultimately driving better experiences for customers.

To learn more about mystery shopping with Ipsos, or any other element of a strong suite of customer research, reach out today.

Table of contents

- Introduction to Consumer Duty: A clear way forward

- Creating and Embedding Cultural Change

- Building Stronger Stakeholder Relationships Through Consumer-Centric Culture

- Innovating with Financial Service Customers in Mind

- Improving Consumer Duty Outcomes Through Customer Experience

- Using Mystery Shopping to proactively measure staff engagement with Consumer Duty

| Previous |