Open Banking Series III│ Acceptability of Four Client Groups for Open Banking in Chinese Market

In 2017, Ipsos carried out the market survey for global open banking service, including 15 countries such as China, the U.S., U.K. and France, with a survey for responses of clients in different regional markets. In general, the client group in Chinese market can be divided into four categories, namely, the active adopters, cautious evaluators, conservatives and financially inactive persons, and the four categories show different attitudes toward the open banking.

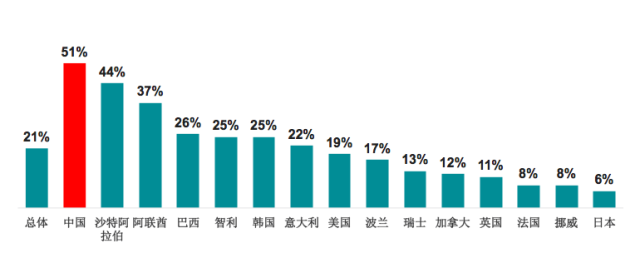

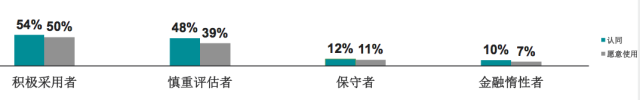

Active adopters are more receptive to open banking, and they think that such services are meaningful and they are willing to register for use, with the acceptability of over 50%. Almost 80% of clients are willing to share the personal financial data to the third-party institutions. Globally, this client group in China is the most open to the use of API in financial services, and the acceptability surpasses some developed countries including the U.S., U.K., South Korea and Japan.

Among the rest three client groups, the cautious evaluators’ acceptability for open banking ranks the second. 48% of them identify with the value of such services, and 39% of them express the willingness to register for use. More cautious evaluators think that they will feel relieved after understanding the purposes of the services.

Meanwhile, however, the client group most expects technical supports from the third-party service providers, and over 50% of them express the willingness. That is, the acceptability of this client group for open banking services is higher as long as the service provider shows the specific usage scenario, guarantees the security and privacy, and helps the clients to overcome the existing barriers.

In contrast, conservatives and financially inactive persons are less interested in open banking, and their degree of recognition of the service and the willingness of participation are far lower than the first two client groups. Only 12% of conservatives identify with the value of such services, and only 11% are willing to participate in the services. The proportion of financially inactive persons as for the two aspects is less than 10%, and the level of interest is lower. But the two client groups are different; conservatives are concerned about the open banking as they prefer the conservative methods of financial management, and the financially inactive persons are weak in the financial management ability and do not focus on the development of financial technology.

Different types of clients have different degrees of openness for new technologies and different needs for financial service due to the difference in age and region. As an emerging financial service, the open banking service needs the process of development for gaining market recognition and popularization. During the period, as for different customers, banks shall have different strategies to solve the difficulties of different client groups and encourage the individuals to accept the service, so as to promote the development of open banking service in China.