Side-by-side Social Intelligence

According to Ipsos’ Tech Tracker, Q2 2016, using social media is the second most popular activity, after using email, on smartphones in Great Britain.

The first thing many of us do in the morning when we wake up is reach for our phone or tablet to check Facebook or Instagram to see what our friends have been up to; check Twitter for the news; contact friends and family via WhatsApp; and then maybe take a look at Snapchat. We can connect with people all over the world and access a wealth of information on any topic imaginable, all without having to get out of bed.

And influencers on social media can have a huge impact on how people behave and think, helping to provide brands with powerful engagement through a new kind of audience understanding (Ipsos, Social Influencers study 2016).

A rich source of insight for understanding people

This proliferation of social media activity yields a huge amount of rich, unprompted and unstructured data, generated in real time.

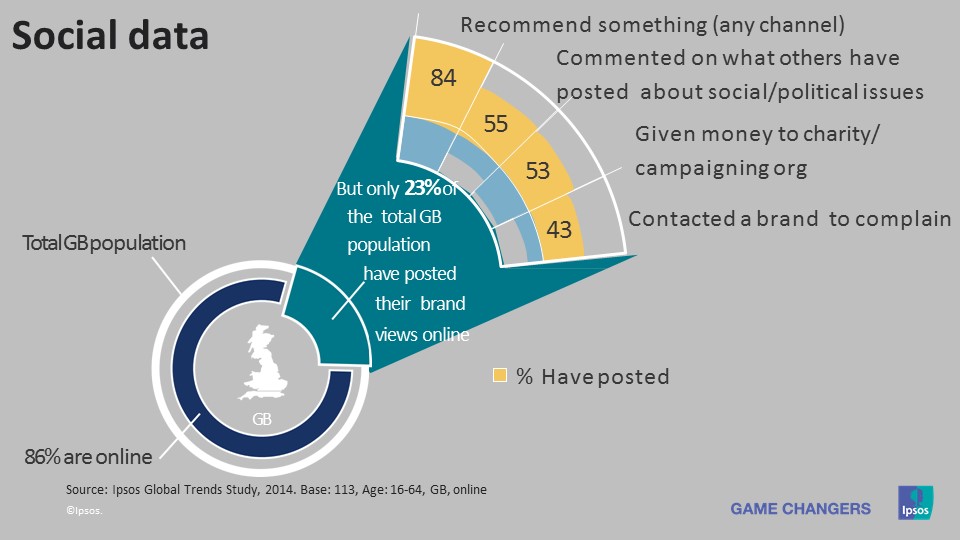

19% of people in Great Britain said one of their main reasons for social networking in the last month was to give their opinion (Ipsos, Global Trends 2014). And some of these opinions are about brands.

This data, along with other online brand interactions and behaviours can be of great value to marketers. However, it becomes of even greater value when layered with multiple data sources. By combining traditional survey data with observation, ‘passively captured’ behaviours, geo-demographics, transactional data, and of course data generated from social platforms, we can uncover much deeper insights.

When focusing on social data, the key is to go beyond merely ‘listening’ to what is being said and move to really understanding. It is vital to analyse conversations using both qualitative and quantitative techniques to gain a deep understanding of how consumers discuss, think and feel about the topic of study.

By taking this rich but skewed data (more on that later), combining it with other data sources and, most importantly, adding context to the interpretation, we turn what is essentially social listening into social intelligence.

Social data – don’t take it all at face value

So what do we mean by ‘rich but skewed’?

Any form of data has inherent biases that vary according to how it is derived. At Ipsos we always adhere to the best working practices to ensure our survey data is from a representative audience, offers robust sample sizes and is free from as many biases as possible.

Social data is no different – it must be handled with care to ensure it is useful and representative of our target audience.

Context is key to ensuring that the information derived through social intelligence is not viewed in isolation, and to ensure the insights are valid. For example, is what is being observed typical of the category or driven by broader trends or behaviours? Understanding the context is vital to ensure the correct conclusions are drawn.

The social self

Social media offers individuals a platform to have a voice. Organic social data (that which has not been prompted or sponsored by a brand) creates an abundance of unprompted ‘natural’ reactions and therefore a potential wealth of insights. However, we have to recognise that everything that is on social media is there for a reason.

Social media, by its very nature, gives an individual a public means of expression and this is often considered (or rapidly re-considered in some cases!) when interacting with anyone or anything. Online, people can create a version of themselves, and all of their activity – the pages they like on Facebook, the comments they tweet, or the pictures they post to Instagram, all help to build this, often highly curated, online persona or avatar. People tend to create the best possible version of themselves. Therefore, there can often be a variation between their online projected self and what they are actually doing and thinking in real life.

Dark social:

There are limitations as to what social data can be accessed and analysed. The mainstream social media monitoring systems are only able to scrape from a limited, and broadly open, number of sources.

Some platforms, such as Facebook, sell their data at a premium, while others, such as Snapchat, have data that cannot be reported on at all.

With 64% of young people aged 11-16 in England and Wales saying they access Snapchat on a daily basis or more via a tablet/smartphone/PC or laptop (Ipsos, Young People Omnibus Study 2016), ‘dark social’ is becoming increasingly important.

The term ‘Dark Social’ originated from Alexis Madrigal, tech editor at Atlantic.com, to refer to social interactions that come from sources outside of those that can be captured via social media monitoring tools.

Dark Social sources that are not trackable:

- Some native mobile apps – Facebook, Instagram, etc

- Messaging apps – WhatsApp, Snapchat, Hangouts, Facebook Messenger, etc

- Secure browsing – clicking from HTTPS to HTTP

With these sources excluded, social monitoring systems can only capture a partial picture of all social interactions (Radium One Study, 2014). With only a small portion of the total social behaviour that occurs included in analysis, it is impossible to paint a total ‘social picture’.

Context is key

This all means that social intelligence is not necessarily representative of the entire social media picture for a brand, and it most definitely is not representative of society’s opinion of a brand. Hence why it is so important to add context to ensure that the correct conclusions can be drawn. By context, we mean looking at the external influences that could be impacting social opinions, alongside benchmarking relevant metrics against competitors, in order to ascertain if the trend seen for a particular brand is typical of the category. All of this helps to add essential perspective to the raw data.

Using sophisticated algorithms, it is possible to add structure to the unstructured social data set. This adds efficiency and accuracy beyond that which is capable by manual coding. It also means we can look at bigger quantities of data to add increased robustness to our data sets.

But it’s not all about the technology. Qualitative analysis is also critical to understand the underlying motivations behind the quantified responses. Who is doing your social media analysis is almost as important as what that analysis looks like. You need real skill and expertise to identify those nuggets of insight on how brands are being perceived, how social influencers are adding ROI and how to quickly turn a ‘PR disaster’ into a ‘PR gold mine’.

Using social data intelligently

Social intelligence has a broad range of applications for brand building and customer experience. As long as there are publically available conversations online about a topic of interest, it is possible to listen in and mine the data for insights. Integrated social intelligence can work to enhance and compliment other research techniques.

We believe that social intelligence makes surveys more actionable. By getting to the ‘whys’ and explaining movements in brand measures or by uncovering trends and areas that drive the brand and category relationships that the survey is not fully covering. It also helps to shed light on customer experiences.

Whilst surveys make social intelligence more useful. Viewing social data through the lens of a tracking study helps fill in the gaps, illuminating and enhancing the story of the brand/service that we are observing.

Brand tracking:

Social media data should be used to enhance tracking surveys to ensure they are reflective of changing consumer behaviour. People’s lives are multifaceted, so let’s ensure our tracking solutions are multi-dimensional too. Adding structure to social data opens up a large opportunity for continuous learning in an efficient and effective manner.

Customer experience:

Social intelligence is increasingly important to really understand the ‘Voice of the Customer’. Social intelligence provides an opportunity for brands and services to gain incremental insight on how effective new approaches, initiatives or products are impacting customer satisfaction, in real time.

Can social data be used as a prediction?

We can all see the allure here. Can we find out if we have a problem and what is causing it (or why we are doing well and what we need to do to re-inforce that) before it becomes too late to do anything about it? And if social and search data is available in real time, then could that be the source?

Well the answer to those questions is ‘sometimes’.

We have conducted multiple investigations looking into the patterns and seeking to predict behaviours. The correlations are not present in all sectors, but do have some examples where it works, primarily when we have been looking to predict the right measure using the right topic of discussion.

So what does this mean for brands?

- Social media analysis needs to be far more than just assessing volume and sentiment. Adding structure to the unstructured social conversations allows you to quantify and robustly integrate with other data sources.

- Context is key. Never look at your brand/service in isolation. Understand not only what has been said, but how, when and where. And do not just take the social mentions in isolation, contextualise them with other data sources too.

- Social intelligence can enhance your other research and insight projects. Do not view it as a separate standalone source of insight, but instead a complementary enhancement to other studies you run.

The Ipsos point of view for social intelligence can be summarised as:

- The world has changed, and people’s lives are increasingly social.

- Therefore research needs to be able to truly capture this changing behaviour.

- Social intelligence offers a rich but skewed view point.

- Context is key for interpreting social data.

- Social intelligence should be used to inform all projects.*

- Social intelligence enhances rather than replaces traditional research.

- The future of insights lays in layering social, survey and search data.

* Exceptions would be where no conversations about the brand or topic have been generated.