Consumer sentiment lowers -1.6 percentage points in May 2025, on poor outlook for jobs and economy with Trump admin’s trade laws, job cuts and macro factors like global economic slowdown, wars: LSEG-Ipsos PCSI India

Consumer sentiment has lowered -1.6 percentage points on poor outlook for jobs and economy with Trump admin’s trade laws, job cuts and other macro factors, like global economic slowdown, wars etc. The silver lining is the sentiment for personal finances (for day to day running of households) and investments (savings, spending on big ticket items and investments for the future) is showing a rebound in May 2025 on the back of new tax regime coming into effect and leading to enhanced incomes for taxpayers and the salaried class and moderate salary hikes by India Inc.

The good news is that despite tough macro conditions, India is ranked 3rd in the pecking order on the national index score.

The sub-indices show a mixed bag. The PCSI Economic Expectations (“Expectations”) Sub-Index shows a decline of -4.2 percentage points in May 2025; consumer sentiment for the PCSI Employment Confidence (“Jobs”) sub-index has dipped -2.6 percentage points. Interestingly, the consumer sentiment for Current Personal Financial Conditions sub index (Current Conditions) is up, +0.1 percentage points, and the PCSI Investment Climate (“Investment”) sub-index shows an improvement of +0.4 percentage points, over last month.

Amit Adarkar, Ipsos India CEO said, "India has shown a great deal of resilience in the face of tough macro factors: Tough talking by the Trump administration on job cuts and triggering the trade tariff wars. Global economic slowdown and its impact on the local economy. India was also in the midst of a skirmish with Operation Sindoor, though the war lasted a week, it impacted the stock markets with early volatility but later stabilized. Notably, consumer sentiment is seen to pick up for personal finances and investments, indicating salary hikes and increments doled out by India Inc. Further, the new tax regime triggering enhanced savings and disposable incomes for discretionary spends. It is a strange paradox of sorts, with enhanced salaries for some and job cuts and trimming of the workforce widely seen across some large corporations. The monsoon could bring cheer with a bumper crop and boost the economy. Further, we see lowering of food inflation."

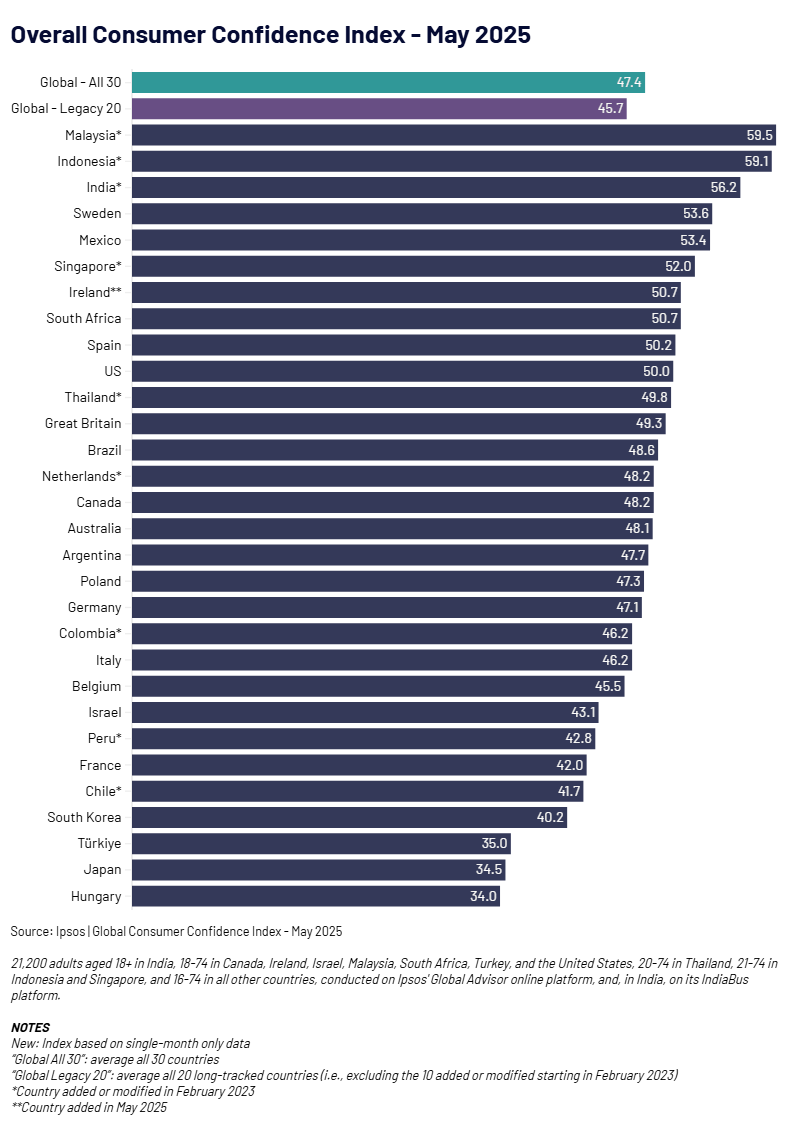

Consumer sentiment in 30 countries

Among the 30 countries, Malaysia (59.5) holds the highest National Index score. No country this month has a National Index score of 60 or higher.

Nine other countries now show a National Index at or above the 50-point mark: Indonesia (59.1), India (56.2), Sweden (53.6), Mexico (53.4), Singapore (52.0), Ireland (50.7), South Africa (50.7), Spain (50.2), and U.S. (50.0).

In contrast, just three countries show a National Index below the 40-point mark: Türkiye (35.0), Japan (34.5), and Hungary (34.0).

Compared to 12 months ago, fifteen countries show a significant drop in consumer sentiment. In contrast, just six countries show a significant increase from May 2024, most of all in Malaysia (+12.3).

The Global Consumer Confidence Index is the average of all surveyed countries’ Overall or “National” indices. This month’s installment is based on a monthly survey of more than 21,000 adults under the age of 75 from 30 countries conducted on Ipsos’ Global Advisor online platform. This survey was fielded between April 25 and May 9, 2025.

Notably, Ipsos has modified the scope of the Global Consumer Confidence Index. From this month on, it now spans 30 countries with the addition of Ireland.

About the Study

These findings are based on data from a monthly 30-country survey conducted by Ipsos on its Global Advisor online survey platform and, in India, on its IndiaBus platform. They are first reported each month by LSEG as the Primary Consumer Sentiment Index (PCSI).

The results are based on interviews with over 21,700 adults aged 18+ in India, 18-74 in Canada, Ireland, Israel, Malaysia, South Africa, Turkey, and the United States, 20-74 in Thailand, 21-74 in Indonesia and Singapore, and 16-74 in all other countries.

The monthly sample consists of 1,000+ individuals each in Australia, Brazil, Canada, France, Germany, Great Britain, Italy, Japan, Spain, and the U.S., and 500+ individuals in each of Argentina, Belgium, Chile, Colombia, Hungary, Indonesia, Ireland, Israel, Malaysia, Mexico, the Netherlands, Peru, Poland, Singapore, South Africa, South Korea, Sweden, Thailand, and Turkey. The sample in India consists of approximately 2,200 individuals of whom 1,800 were interviewed face-to-face and 400 were interviewed online.

Samples in Argentina, Australia, Belgium, Canada, France, Germany, Great Britain, Hungary, Italy, Japan, the Netherlands, Poland, South Korea, Spain, Sweden, and the U.S. can be considered representative of their general adult populations under the age of 75. Samples in Brazil, Chile, Colombia, Indonesia, Israel, Ireland, Malaysia, Mexico, Peru, Singapore, South Africa, Thailand, and Turkey are more urban, more educated, and/or more affluent than the general population. The survey results for these countries should be viewed as reflecting the views of the more “connected” segment of their populations. India’s sample represents a large subset of its urban population — social economic classes A/B/C in metros and tier 1-3 town classes across all four zones.

The data is weighted so that the composition of the sample in each country best reflects the demographic profile of the adult population according to the most recent census data.