Consumer sentiment weakens amid Trump’s tariff trade laws and job cuts’ uncertainty: LSEG-Ipsos PCSI India April 2025

Consumer sentiment has weakened in April to 57.8 percentage points (pp) from 60.2 pp in March 2025, a -2.4-pp dip, amid Trump’s tough trade laws, feared job cuts, inflation and financial crunch, according to the new report of the LSEG-Ipsos Primary Consumer Sentiment Index 2025, India report for April 2025.

Consumers are grappling with a tough macro environment and we are seeing its impact across the 4 sub indices. The PCSI Economic Expectations (“Expectations”) Sub-Index has shown a minor dip 0f -0.5 percentage points, likewise, the PCSI Employment Confidence (“Jobs”) sub-index decreased -3.9 percentage points. The Current Personal Financial Conditions sub index (Current Conditions) is down -5.1 percentage points, and the PCSI Investment Climate (“Investment”) sub-index has shown a downward slide of -3.8 percentage points.

Amit Adarkar, CEO, Ipsos India is baffled with how the consumer sentiment has shown a complete volte-face from last month: "We live in extremely uncertain times and global decisions are wreaking havoc within local economies. US President, Mr. Donald Trump’s tough trade laws and upward revision of tariffs have thrown the stock market into a tizzy. And while he has paused it for 3 months, the jolt has been predominantly felt around cost of essential commodities, fear of job cuts and financial stress and the impending impact. We anticipate tougher days ahead, unless there is some consensus reached."

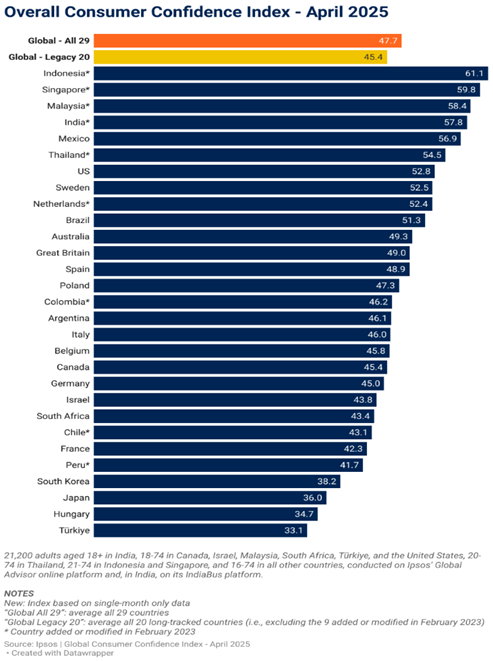

Among 29 economies measured, five countries show significant gains in consumer sentiment, while seven countries show a notable decline. All four sub-indices are down significantly this month.

Based only on the “legacy 20 countries” tracked since March 2010, the Index would read at 45.4, down 0.8 point since March.

Sentiment is mixed in the Asia-Pacific. Australia (-3.1 points) shows the largest decline among all countries, and India (-2.4 points) is also down significantly. However, sentiment is up in Singapore (+2.6 points), Indonesia (+2.6 points), and Thailand (+2.2 points).

Consumer confidence is also mixed in Latin America. Peru (-2.4 points) and Argentina (-2.1 points) show significant declines this month. In contrast, Chile (+2.4 points) and Brazil (+2.2 points) are both up significantly.

Lastly, sentiment in the U.S. has trended downward in recent months. Since reaching its highest point in more than three years in December, U.S. consumer confidence has declined nearly five points.

The Global Consumer Confidence Index is the average of all surveyed countries’ Overall or “National” indices. This month’s instalment is based on a monthly survey of more than 21,000 adults under the age of 75 from 29 countries conducted on Ipsos’ Global Advisor online platform. This survey was fielded between March 21 and April 4, 2025.

Consumer sentiment in 29 countries

Among the 29 countries, Indonesia (61.1) holds the highest National Index score. It is the only country with a National Index score of 60 or higher.

Nine other countries now show a National Index at or above the 50-point mark: Singapore (59.8), Malaysia (58.4), India (57.8), Mexico (56.9), Thailand (54.5), the U.S. (52.8), Sweden (52.5), the Netherlands (52.4), and Brazil (51.3).

In contrast, four countries show a National Index below the 40-point mark: South Korea (38.2), Japan (36.0), Hungary (34.7), and Türkiye (33.1).

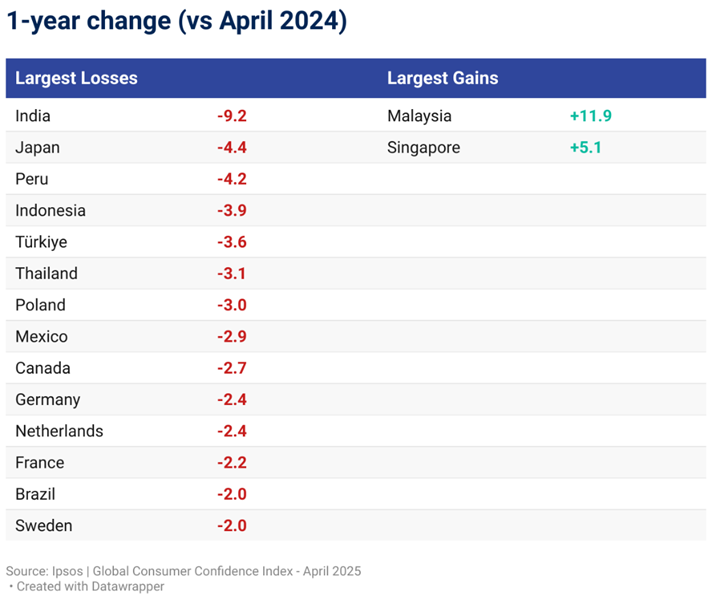

Compared to 12 months ago, fourteen countries show a significant drop in consumer sentiment. In contrast, only Malaysia and Singapore show a significant increase from April 2024.

About the Study

These findings are based on data from a monthly 29-country survey conducted by Ipsos on its Global Advisor online survey platform and, in India, on its IndiaBus platform. They are first reported each month by LSEG as the Primary Consumer Sentiment Index (PCSI).

The results are based on interviews with over 21,200 adults aged 18+ in India, 18-74 in Canada, Israel, Malaysia, South Africa, Türkiye, and the United States, 20-74 in Thailand, 21-74 in Indonesia and Singapore, and 16-74 in all other countries.

The monthly sample consists of 1,000+ individuals each in Australia, Brazil, Canada, France, Germany, Great Britain, Italy, Japan, Spain, and the U.S., and 500+ individuals in each of Argentina, Belgium, Chile, Colombia, Hungary, Indonesia, Israel, Malaysia, Mexico, the Netherlands, Peru, Poland, Singapore, South Africa, South Korea, Sweden, Thailand, and Türkiye. The sample in India consists of approximately 2,200 individuals of whom 1,800 were interviewed face-to-face and 400 were interviewed online.

Samples in Argentina, Australia, Belgium, Canada, France, Germany, Great Britain, Hungary, Italy, Japan, the Netherlands, Poland, South Korea, Spain, Sweden, and the U.S. can be considered representative of their general adult populations under the age of 75. Samples in Brazil, Chile, Colombia, Indonesia, Israel, Malaysia, Mexico, Peru, Singapore, South Africa, Thailand, and Türkiye are more urban, more educated, and/or more affluent than the general population. The survey results for these countries should be viewed as reflecting the views of the more “connected” segment of their populations. India’s sample represents a large subset of its urban population — social economic classes A/B/C in metros and tier 1-3 town classes across all four zones.

The data is weighted so that the composition of the sample in each country best reflects the demographic profile of the adult population according to the most recent census data.

The global indices and averages reported here reflect the average result for all the countries and markets in which the survey was conducted. They have not been adjusted to the population size of each country or market and are not intended to suggest “total” results.

Sample surveys and polls may be subject to other sources of error, including, but not limited to coverage error and measurement error. The precision of Ipsos online surveys is calculated using a Bayesian credibility interval with a survey of N=1,000 being accurate to +/- 3.5 percentage points and a survey of N=500 being accurate to +/- 5.0 percentage points.

The LSEG/Ipsos Primary Consumer Sentiment Index (PCSI), ongoing since 2010, is a monthly survey of consumer attitudes on the current and future state of their local economy, personal financial situation, savings, and confidence to make major investments. The PCSI metrics reported each month for each of the countries surveyed consist of a “Primary Index” based on all 10 questions below and of several “sub-indices” each based on a subset of these 10 questions.

The publication of these findings abides by local rules and regulations.