Hong Kong New Normal Tracking Study - More stability and less pessimism but still not the end of the tunnel

![]()

Same concerns but more pronounced

Covid-19 remains the top concern for Hong Kong residents, nearly one in four (23%) claiming it is the main challenge facing the SAR today, based on the latest poll from our New Normal tracker#. A separate global study conducted by Ipsos shows that Hong Kong and Japan are the only two places where covid-19 is still a main concern1.

Unsurprisingly, a similar proportion (21%) think inflation is the second main challenge for the Territory, with health being the third (19%). The proportion of people who are concerned about the rising cost of living and health increased since our previous poll in September last year, when these two issues were mentioned by 16% and 13% of our survey respondents, respectively.

Less pessimism amid a stable situation

The above said, perceptions of the Territory’s economic situation have improved in the past three months. While two-thirds (67%) of Hong Kong residents still think the SAR’s economy is in poor shape, this is an improvement on what we saw in September, when 78% of residents held such negative view.

This lower degree of pessimism is likely to be induced by stability in people’s incomes. The proportion of Hong Kong residents who have seen their incomes decline in the past three months has remained almost unchanged since September: just over one-third (36%) of the Territory’s residents have seen their incomes decline in the past three months, a proportion that rises to nearly half (47%) among those on household incomes of less than HK$30,000 per month.

Importantly and consistent also with earlier data, more than half (57%) of Hong Kong residents have enjoyed stable incomes. This is particularly the case among people at the higher end of the household income scale (HK$60,000+/ month), where 66% have seen their incomes stable over time.

This is creating a two-tier society, though, where income differentials may lead to polarization. The global Ipsos study mentioned earlier shows that the vast majority of people in Hong Kong (85%) believe that having large differences in income and wealth is bad for society overall1.

Shifting spend to health and hygiene

Most people in the Territory have continued the steps taken earlier in the year to weather the financial impact of covid-19 and inflation. Such steps involve changes in shopping habits for nearly nine in 10 residents and alterations to lifestyle habits for eight in 10 – all similar proportions to what was seen back in September (see figures 1 and 2 below).

Consumers have also spent less on some non-essential categories in the past three months. For example, 38% claim to have spent less on spirits and wine, 30% on beer, 24% on confectionery and snacks, and 23% on ready-to-drink coffee/ milk tea. The percentages for spirts and wine, beer and ready-to-drink coffee/ milk tea are higher than they were in September, meaning more consumers are reducing their spend on those categories.

Given the ongoing but more pronounced concerns over covid-19 and health noted above, some of these savings are being redirected to health- and hygiene-related categories, which have seen an increase in spending. Nearly one in three (32%) Hong Kong residents have been spending more on fresh food/ fresh produce, and 30% have spent more on health supplements as well as household disinfectants and cleaning products.

Evolving shopping behaviours

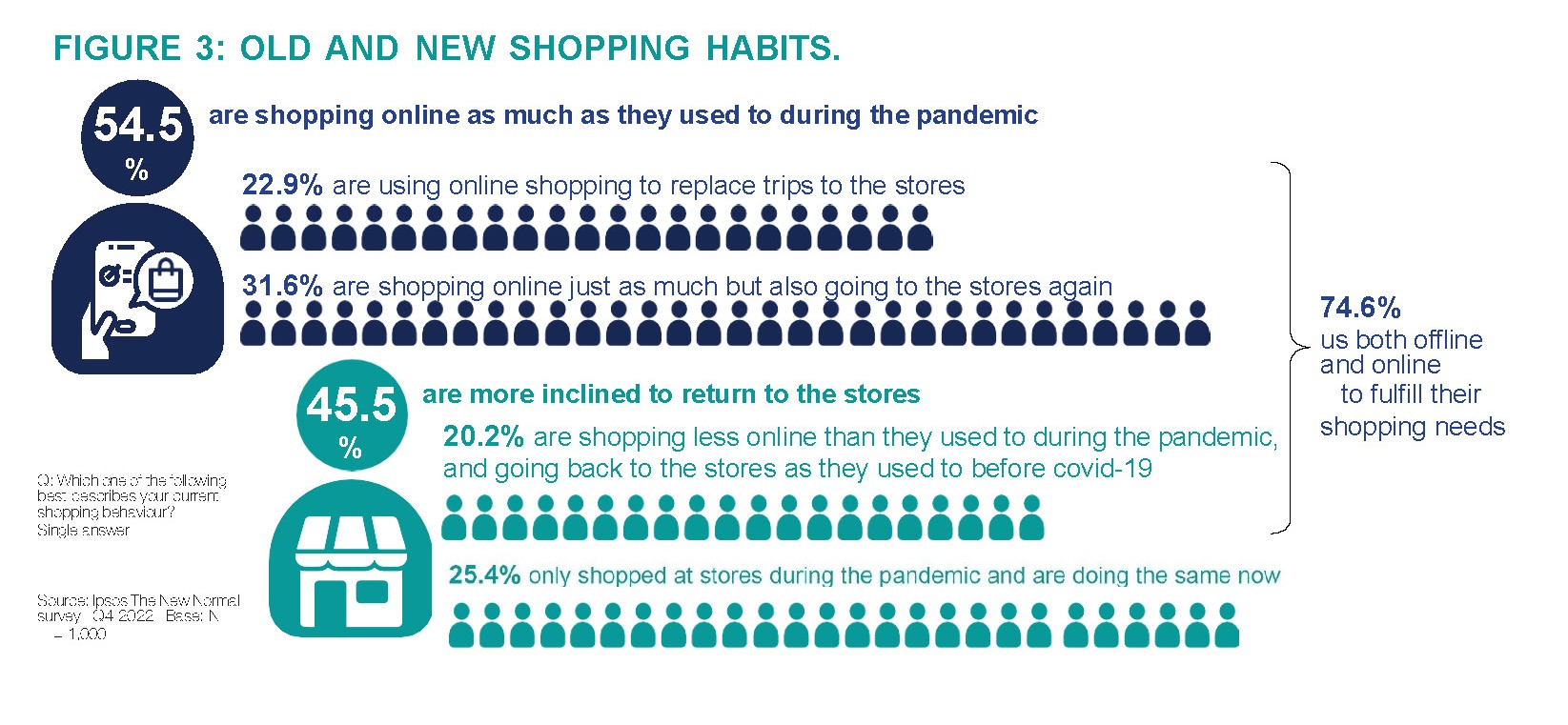

There has been much debate on whether consumers would return to their pre-covid-19 shopping habits or would stick to the behaviours developed during the pandemic. Our data suggest both things are happening: Just over half (54.5%) of Hong Kong residents claim to be shopping online as much as they did during the peak of the pandemic, the remaining (45.5%) visiting the stores more now even though nearly half of them still shop online (see figure 3).

Importantly, three in four consumers (74.6%) in the SAR rely on both offline and online channels to fulfill their shopping needs.

Moving forward

While the relaxation of covid restrictions will help restore some normality and Hong Kong residents are less pessimistic, the Territory will continue facing headwinds in 2023. A majority of our survey respondents (70%) expect inflation to go up over the course of the year, which the Economist expects to reach 2.5%2 (up from 1.9% in 2022). As a result, four in 10 (41%) residents expect their disposable income and standard of living to decline over the course of the next 12 months.

Against this backdrop, businesses and brands need to do a number of things if they are to grow:

- The rising cost of living is making people more conscious of their diminishing purchasing power. Brands need to demonstrate clear and compelling value-for-money propositions.

- The current situation is probably widening the wealth gap between consumers on high and low incomes. Brands need to ensure their product/ service portfolios and price points cover all bases, so as to be able to address the needs of different consumer segments.

- In hard times some categories are seen as unnecessary. However, people still need to treat themselves, particularly during challenging times. Brands can still encourage consumers to spend on such categories by positioning them as affordable treats.

- Old and new shopping behaviours are converging, a large proportion of consumers relying on both offline and online to satisfy their shopping needs. Brands need to ensure their products/ services are available where consumers want to find them, and all touchpoints work together to deliver a seamless shopping experience.

- Last but not least, brands and businesses need to be empathetic: at times when people feel vulnerable, brands need to show understanding, and reflect it in their offers and how they connect with consumers.

#IPSOS HONG KONG NEW NORMAL TRACKER

This tracking programme monitors changes in consumer sentiment and behaviour in response to the covid-19 pandemic. Data were collected monthly between April 2020 and June 2021, and quarterly thereafter. Additional markets/ questions available upon request.