Hong Kong New Normal Tracking Study - Rising Prices and Inflation Dent Hong Kong Consumers’ Confidence

![]()

The latest data from our New Normal tracker shows that one in three Hong Kong residents (33%) are earning less now than they did three months ago. While this is consistent with the levels reported back in June, this proportion goes up to 40% among those on household incomes of less than HK$30,000 a month. Among this unfortunate group, nearly half (47%) saw their incomes reduced by up to 10% as a result of the pandemic, with a further 28% reporting reductions between 11% and 20%.

Placing this in a broader context, more than three quarters (78%) of Hong Kong residents think the territory’s economy is in poor shape. This view is held particularly strongly by those who saw their incomes decline in the past three months, nearly 9 in 10 (86%) of whom believing the economic situation in Hong Kong is somewhat/ very bad. It is therefore not surprising that rising prices and inflation are now one of the main concerns for people living in the special administrative region, second only to COVID-19. Consequently, people are worried about their personal finances and nearly seven in 10 (68%) feel they need to cut back on spending; a similar proportion (70%) expect to have less money to spend on end-of-year holiday gifts and celebrations this year.

Indeed, the cost of living and concerns over the economy are forcing people to make difficult decisions to be able to manage their finances. For example, more than one in four residents (27%) are delaying or cancelling purchases of big-ticket items, a proportion that rises to 35% among people earning less now than they used to. Besides postponing or altogether avoiding making big financial outlays, some Hong Kong residents are also using their investments to make ends meet: Nearly one in four people (23%) have sold or plan to sell their investments to keep as much cash as possible. This course of last resort is more prominent among people whose income has declined, 31% of whom have cashed or are planning to cash in their investments. Similarly, nearly two in 10 people (18%) are using their savings to pay bills, a proportion that goes up to one in three (33%) among those who have seen their incomes decline as a result of the pandemic.

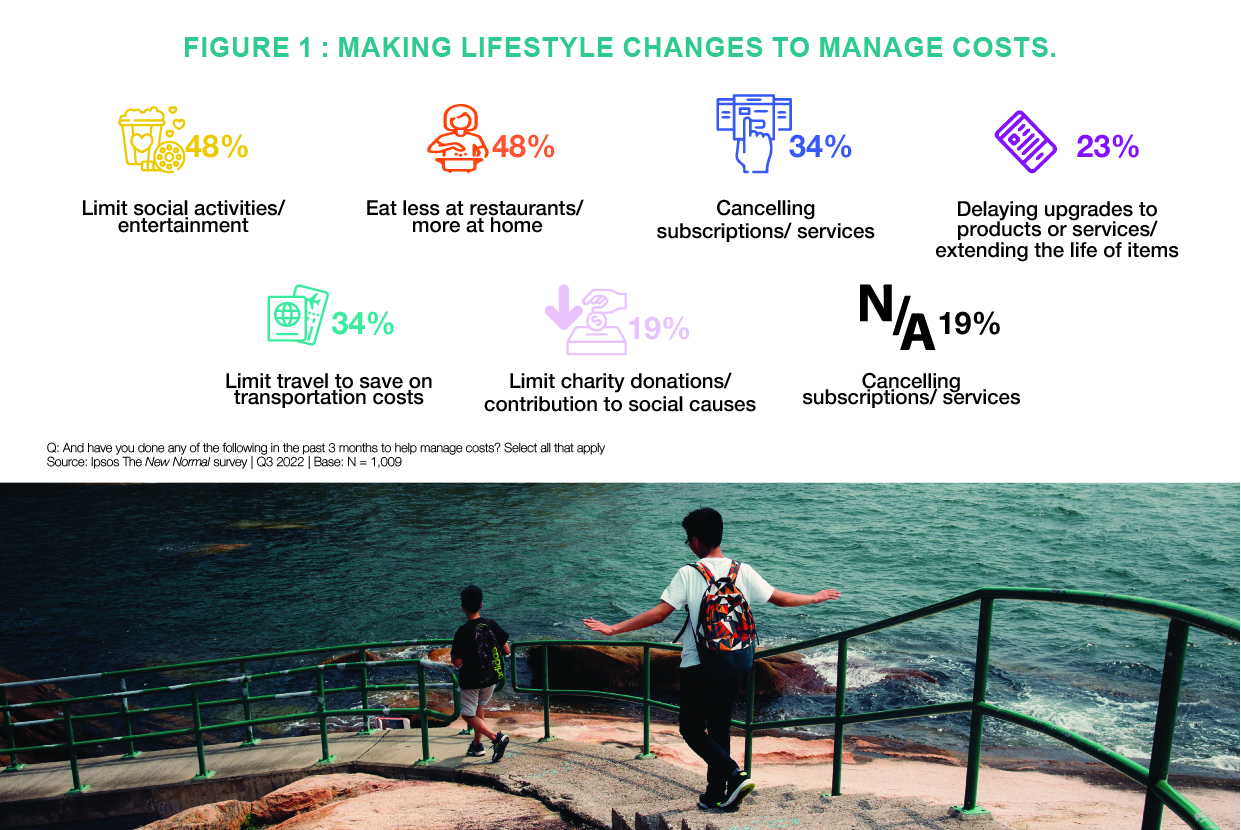

On a more day-to-day basis, the majority (81%) of Hong Kong residents are also making lifestyle changes to reduce their spending, such as limiting social activities and entertainment or cutting down on eating out and having more meals at home (see Figure 1). Again, these measures are more prominent among those whose incomes have dropped in the recent past.

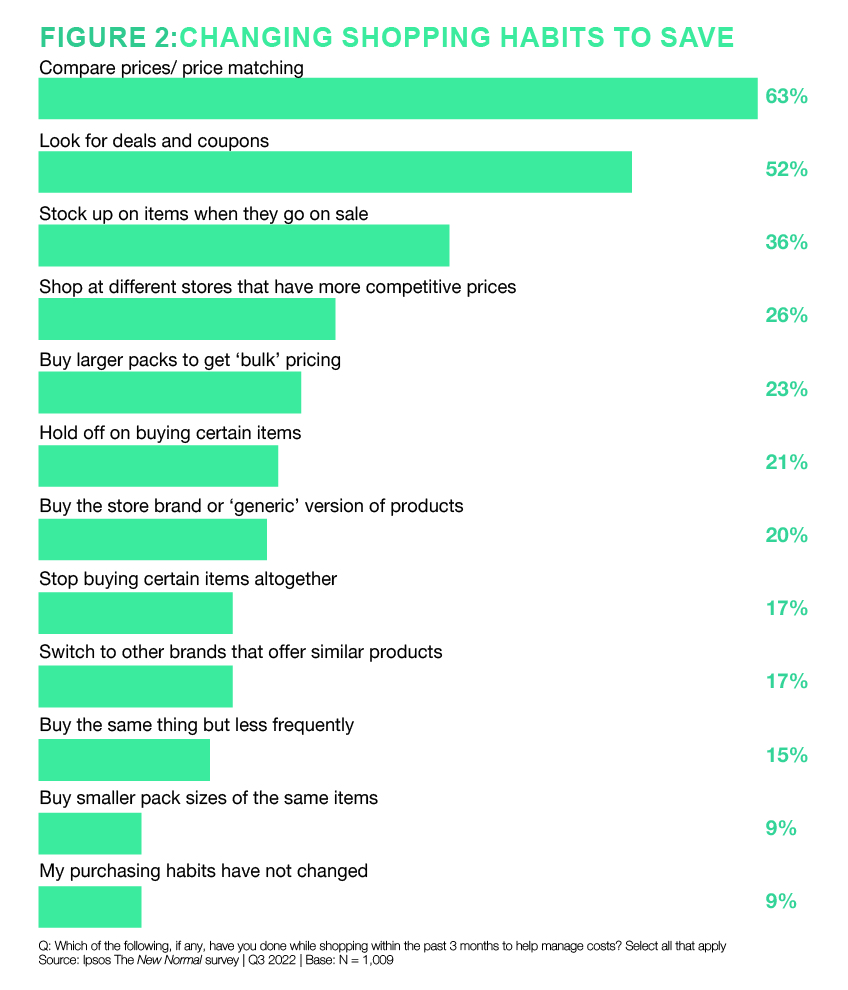

This thrifty mindset is also leading to more considered and cautious daily purchase decisions, the vast majority (91%) of Hong Kong consumers admitting to having changed their shopping habits: prices are being compared, deals and coupons are welcomed, and large packages are bought to benefit from ‘bulk’ pricing (see Figure 2).

Unfortunately, there is a perception that the situation is unlikely to change in the immediate future: more than half of Hong Kong residents (52%) do not expect the economic outlook for the territory to improve until Q.2 next year at the earliest, a further 27% simply do not know when they will see light at the end of the tunnel.

Hong Kong consumers’ confidence is clearly low and this has two immediate im-plications for brands. The first is the need to show empathy: at times when people feel vulnerable, brands need to show understanding and reflect it in their offers. This leads to the second implication: the need to demonstrate value for money. This is not just about price promotions but about brands framing and positioning their of¬fers in a way that is relevant to the target consumers in the current context. In fact, there is an opportunity for premium pricing in categories that provide consumers with small pleasures in challenging times.

#IPSOS HONG KONG NEW NORMAL TRACKER

This tracking programme monitors changes in consumer sentiment and behaviour in response to the COVID-19 pandemic. Data were collected between 25 August 2022 and 5 September 2022. Additional markets/ questions available upon request.