Canadian Home-Buying Intentions on the Rise

Finding the Right Property is the Biggest Challenge for Prospective Homebuyers when Purchasing a Home

Among first-time homeowners and prospective homebuyers, four in ten (36%) say choosing the right property is the most challenging part of making the decision to buy a home. Other challenges include deciding how much house they can afford (22%); getting a preapproved mortgage (8%); home inspection (6%); closing costs of a home (6%); choosing a realtor (5%);selecting a mortgage term (5%); choosing a mortgage provider (4%); making an offer on a house (4%); choosing a lawyer (2%) and government programs (2%).

To make sure the home they purchased was the right one, first time homeowners looked at an average of 13 homes before they bought their current home. One in three (34%) looked at more than 10 houses while two in three (66%) looked at 10 or fewer houses.

Canadians put a lot of effort into finding the right property, probably because nine in ten (87%) say they feel buying a house or condominium is a good investment, and while young Canadians between the ages of 18 and 24 (76%) are the least likely to agree, still three quarters think owning a home is a good investment. Most likely to agree are 45-54 year olds (89%) followed by 35-44 year olds (87%) and 25-34 year olds (84%).

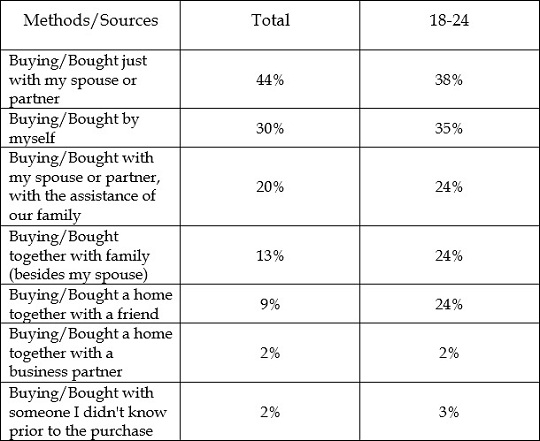

Methods and Sources to Fund Home Purchase

Among first-time homeowners and prospective first-time homebuyers, excluding those who purchased a piece of land or bought from a real estate sale, most either bought with a spouse or partner (44%), bought by themselves (30%) or bought with their spouse or partner with the assistance of their family (20%). Younger prospective homebuyers and first-time homeowners are most likely to buy with a family member, excluding spouse, (24%) or with a friend (24%). In the table below are all the methods and sources used or expected to be used in home purchases.

These are some of the findings of an Ipsos poll conducted between January 28 and February 4, 2016, 2016, on behalf of RBC. For this survey, a sample of 2,000 Canadians from Ipsos' online panel was interviewed online. Weighting was then employed to balance demographics to ensure that the sample's composition reflects that of the adult population according to Census data and to provide results intended to approximate the sample universe. The precision of Ipsos online polls is measured using a credibility interval. In this case, the poll is accurate to within +/ - 2.5 percentage points, 19 times out of 20, had all Canadian adults been polled. The credibility interval will be wider among subsets of the population. All sample surveys and polls may be subject to other sources of error, including, but not limited to coverage error, and measurement error.

For more information on this news release, please contact:

Sean Simpson

Vice President

Ipsos Public Affairs

416.324.2002

[email protected]

About Ipsos in Canada

Ipsos is Canada's market intelligence leader, the country's leading provider of public opinion research, and research partner for loyalty and forecasting and modelling insights. With operations in eight cities, Ipsos employs more than 600 research professionals and support staff in Canada. The company has the biggest network of telephone call centres in the country, as well as the largest pre-recruited household and online panels. Ipsos' marketing research and public affairs practices offer the premier suite of research vehicles in Canada, all of which provide clients with actionable and relevant information. Staffed with seasoned research consultants with extensive industry-specific backgrounds, Ipsos offers syndicated information or custom solutions across key sectors of the Canadian economy, including consumer packaged goods, financial services, automotive, retail, and technology & telecommunications. Ipsos is an Ipsos company, a leading global survey-based market research group.

To learn more, please visit ipsos.ca.

About Ipsos

Ipsos is an independent market research company controlled and managed by research professionals. Founded in France in 1975, Ipsos has grown into a worldwide research group with a strong presence in all key markets. Ipsos ranks third in the global research industry.

With offices in 86 countries, Ipsos delivers insightful expertise across six research specializations: advertising, customer loyalty, marketing, media, public affairs research, and survey management.

Ipsos researchers assess market potential and interpret market trends. They develop and build brands. They help clients build long-term relationships with their customers. They test advertising and study audience responses to various media and they measure public opinion around the globe.

Ipsos has been listed on the Paris Stock Exchange since 1999 and generated global revenues of e1,669.5 ($2,218.4 million) in 2014.

Visit ipsos.com to learn more about Ipsos' offerings and capabilities.

More insights about Consumer Goods

![[WEBINAR] KEYS: Global Trends - The Uneasy Decade](/sites/default/files/styles/related_more_insights/public/ct/event/2025-09/thumbnail-templates_0.png?itok=Qh37M2xL)

![[WEBINAR] Canadian EV Adoption Trends in 2025](/sites/default/files/styles/related_more_insights/public/ct/event/2025-01/thumb.png?itok=RSGzZvMm)

![[WEBINAR] Sustainable Packaging: A Potential Avenue of Distinction](/sites/default/files/styles/related_more_insights/public/ct/event/2023-09/SustainablePackaging_WebR_feature%20copy.jpg?itok=X0DpNf_C)