Two-thirds of Captains of Industry believe the economy will get worse over the next 12 months

- 9 in 10 agree the impact of COVID-19 is one of the most important issues facing Britain today

- Two-thirds (66%) agree that the Government’s policies will improve the state of the British economy

- Two-thirds say the way the Government handles Britain’s transition out of the EU is important to their business

- A third see no opportunities for their company in relation to Brexit

Economy & Business Challenges

In the latest Captains of Industry survey by Ipsos, 66% of Britain’s business elite say they believe the country’s economy will get worse over the next 12 months. Only 30% expect it to improve while 4% say it will stay the same.

In the survey, which spoke to over 100 Captains of Industry, widely acknowledged as the authoritative source of opinion on Britain’s business elite, almost 9 in 10 (86%) of these Captains see the impact of COVID-19 as one of the most important issues facing Britain today. While around half see Brexit, and economic uncertainty as the single most important issue (52% and 49% respectively).

While general expectations appear to be negative, Captains are more enthusiastic when it comes to their own companies. Over 60% believe business for their company will improve or stay the same (42% and 21% respectively) while a third (35%) say it will get worse over the next 12 months.

When it comes to these companies, their Captains are more concerned with economic uncertainty (59%) than they are with the impact of coronavirus (49%). A quarter see maintaining and retaining staff as one of the most important problems facing their company and only 16% see Brexit uncertainty as a significant obstacle.

Two-thirds (66%) agree that the Government’s policies will improve the state of the British economy, including 14% who strongly agree, while only 1 in 5 (21%) disagree.

Looking to future action, more than 4 in 5 (82%) Captains want the Government to focus investment on regions such as the North of England in order to grow those areas and reduce regional inequalities, with only 8% disagreeing. Meanwhile, only 18% agree that the Government should focus investment on London and its surrounding area, 62% disagree. Over half (54%) believe the Government’s industrial strategy will encourage economic growth in this country.

Impact of COVID-19

Almost all Captains say coronavirus poses a moderate to very high threat to the UK economy (98%), including 56% who say it poses a very high threat. Nine in ten (91%) believe it poses a threat to the world.

Four in ten (82%) are concerned about the risk posed to their business and their workforce, while 83% are worried about the effect on their supply chain. Seventy-eight per cent say COVID-19 poses a moderate to very high threat to their costs while 37% say the same about their exports. While half (54%) say there is only low to very low threat of coronavirus affecting their R&D.

Forty-four per cent of those asked said they have used or plan to use the coronavirus job retention scheme while 38% say they have/ plan to defer their VAT payment. One in five (18%) have provided/ plan to provide statutory sick pay for those advised to self-isolate and 4% have/ plan to use the Coronavirus Large Business Interruption Loan Scheme. A quarter (24%) are not planning to use any government support activities during the pandemic.

Almost 6 in 10 Captains (58%) say the government have handled the coronavirus well so far, with 42% believing that they have handled it badly, including 13% who say very badly.

Impact of Brexit

Two-thirds of Captains (66%) agree that how well the government handles the Brexit transition period is important to their business, including 40% who strongly agree. Only 31% disagree.

Free movement of goods/ frictionless trading/ access to custom union is considered the most important thing for the UK to obtain in negotiations with the EU, half (47%) of Captains see this is important. A further 2 in 5 (40%) want to see freedom of movement/ access to skilled labour/ clarity on EU national employees.

Over a third (35%) of Captains see no opportunities for their company in relation to Brexit. However, some see opportunities in the new markets beyond the EU (14%), increased inward investment (7%) and an opened access to skilled workers from outside of the EU (7%), among others.

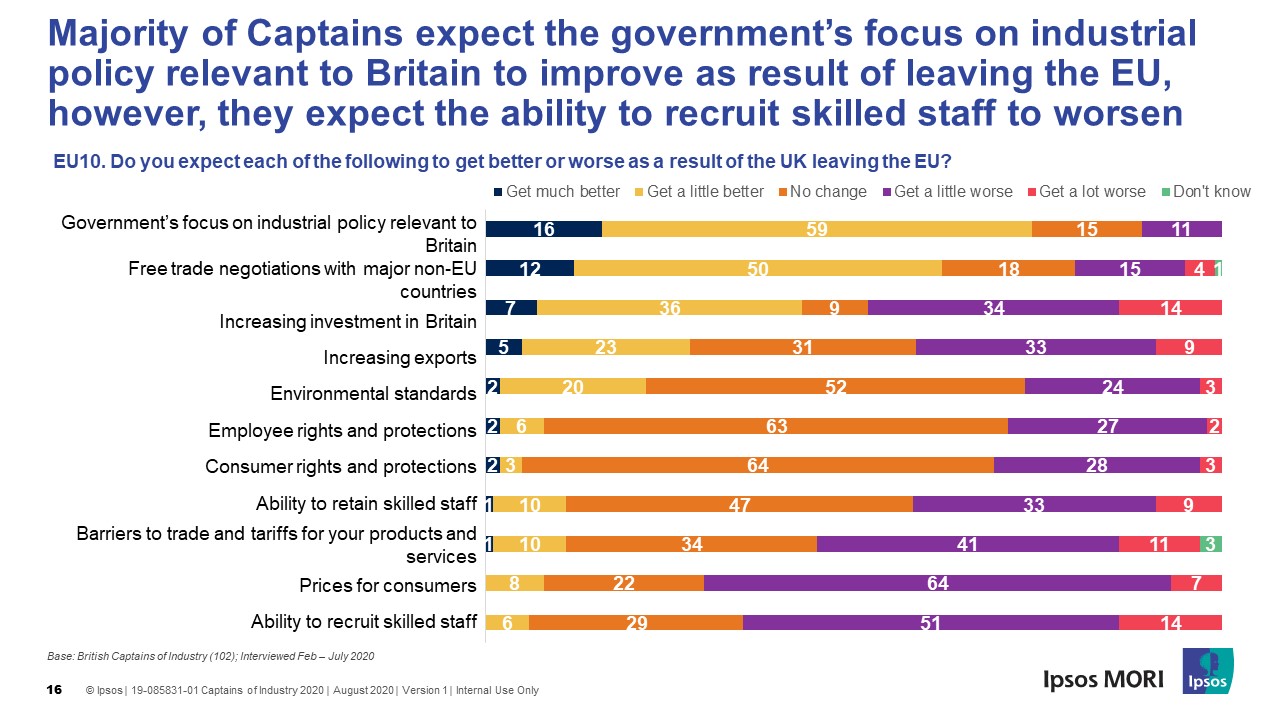

Half of the Captains of Industry surveyed (51%) expect that barriers to trade and tariffs for their products and services will get worse as a result of leaving the UK, while 11% expect them to get better and a third (34%) say they will stay the same. Two-thirds expect the ability to recruit skilled staff to get harder (65%) while 42% expect the ability to retain skilled staff to get worse.

Three in five (62%) expect to see free trade negotiations with major non-EU countries get better, however opinion is split as to whether there will be increasing investment in Britain, 43% believe it will get better while 48% expect it to get worse.

Only a quarter of Captains (24%) are optimistic that the UK will be able to quickly sign beneficial trade deals with major powers, while two-thirds (67%) feel pessimistic, including a quarter (25%) who feel very pessimistic. Similarly, 68% do not think that such deals will compensate for any loss of trade with the EU for the UK as a whole, 30% believe they will help.

When looking to the outcome of the Brexit transition period, half (52%) of the Captains of Industry expect a UK-EU trade deal to come into place, covering some but not all sectors. A further 35% expect to see the transition period extended while 12% believe the UK will exit the transition period without a trade deal.

Kelly Beaver - Managing Director of Public Affairs, Ipsos said:

The insight into the hopes and concerns of British businesses on the economy is incredibly important to understanding where businesses believe the economy is headed. The immediate concerns of COVID-19 are dominating but it’s clear that there continue to be longer term concerns about Brexit and its impact on the economy and business. But the significant uptick in belief amongst business leaders that the Government’s economic policy will improve the state of the economy in the long term will be greeted with relief by Rishi Sunak.

Technical Note

Ipsos conducted 102 interviews with participants from the top 500 companies by turnover and the top 100 by capital employed in the UK. Participants were Chairmen, Chief Executive Officers, Managing Directors/Chief Operating Officers, Financial Directors or other executive board directors. Interviews were primarily carried out by telephone/video conferencing due to COVID-19 (9 were conducted face to face before lockdown). Fieldwork took place between February – July 2020.