Canada Is Top Preferred Oil Supplier for G7 Nations

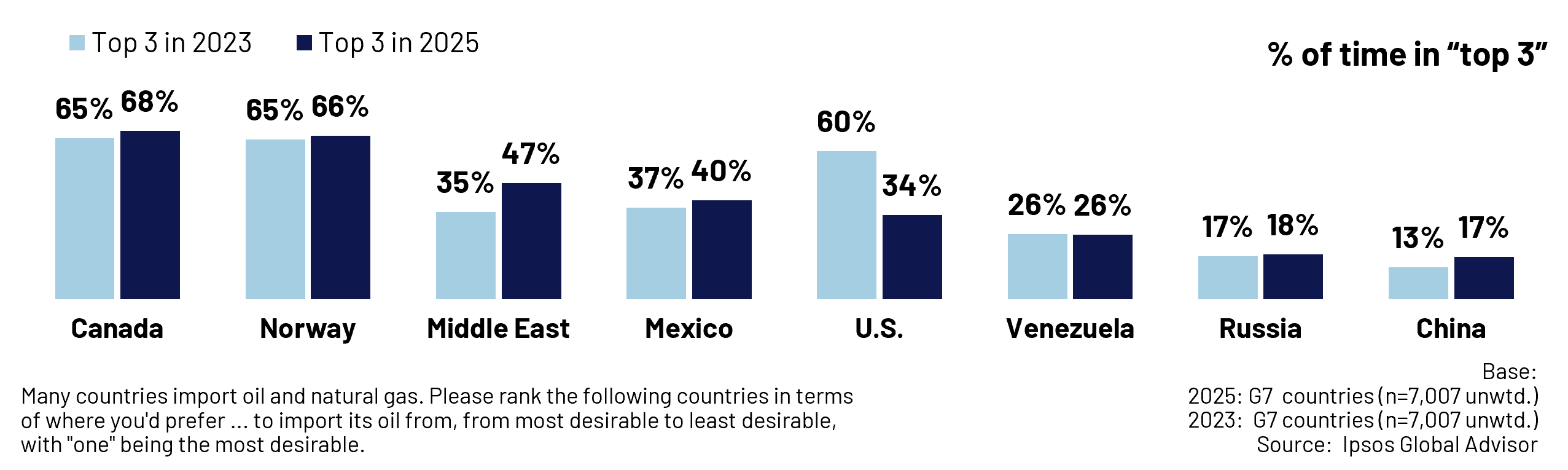

According to a recent global poll conducted by Ipsos, Canada has emerged as the top preferred oil supplier among G7 allies. Asked to rank eight possible suppliers, respondents in G7 countries ranked Canada in the top three 68% of the time, the most often of the eight possible suppliers. As Canada prepares to host world leaders at the G7 summit in Alberta, Canada has an opportunity to showcase its industry.

What we did

Ipsos repeated a question from its 2023 Context Energy study, asking respondents in 18 G20 countries to rank their preferred suppliers of imported oil from eight possible suppliers. For more details on the methodology, please see the "About This Study" section at the end of this document.

Among G7 countries, Canada edged out Norway through a slight increase from 65% to 68% of respondents placing it in the top 3 (shown above), and an increase 19% to 21% ranking it as the #1 supplier. The U.S. also declined as a top ranked supplier among G7 countries, as 26% fewer respondents put it in the top 3 (From 60% to 34%), and 11% less ranking it #1 (from 22% to 11%).

The Middle East significantly increased its standing among G7 countries, with 12% more respondents in these countries putting it in the top 3. Mexico, on the other hand, while more preferred within North America, but fewer preferred among G7 countries, now trailing the Middle East, Norway, and Canada. The U.S. has dropped as a preferred supplier in the G7 and now ranks 5th.

Amidst geopolitical instability, Canada continues to stand out as a reliable and democratic source of oil characterized by robust environmental safeguards among G7 allies. This presents a significant opportunity for Canadian producers to contribute to the global supply as Canada hosts world leaders from the G7. By differentiating itself from the U.S. and others, Canada can leverage its unique position to build support for its hydrocarbon exports, solidifying its role in the evolving global energy marketplace.

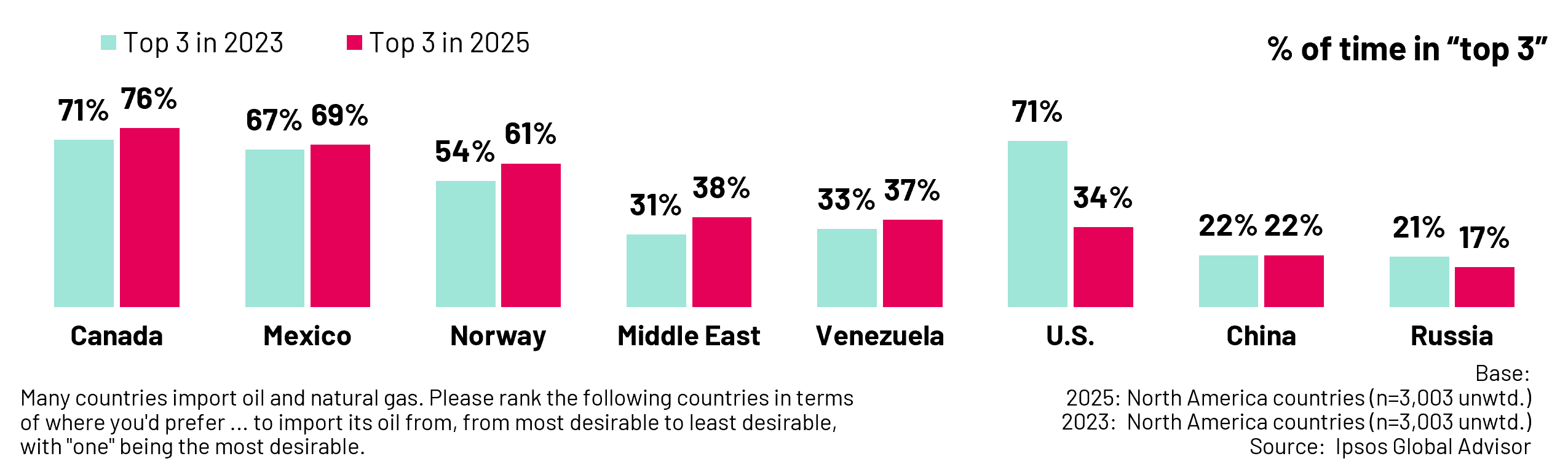

Canada also improved its position as the preferred supplier within North America, rising from 71% to 76% in the top 3 (shown above) and significantly from 37% to 49% as the #1 choice. Canada’s strong regional ties, established infrastructure, and perceived stability may have contributed to this increase, and Canada may be seen as the obvious alternative to the U.S. by Mexico. Indeed, the U.S. saw a decrease in the number of times it was selected in the top 3, from 71% to 34% in North America. The U.S. is now the #1 choice for only 17% of North Americans, down from 44% in 2023. Norway was also more often selected in the top 3, rising from 54% to 61% in North America.

As the U.S. experiences a drop in its global reputation, citizens of G20 nations are increasingly preferring other sources of oil to meet their import needs.

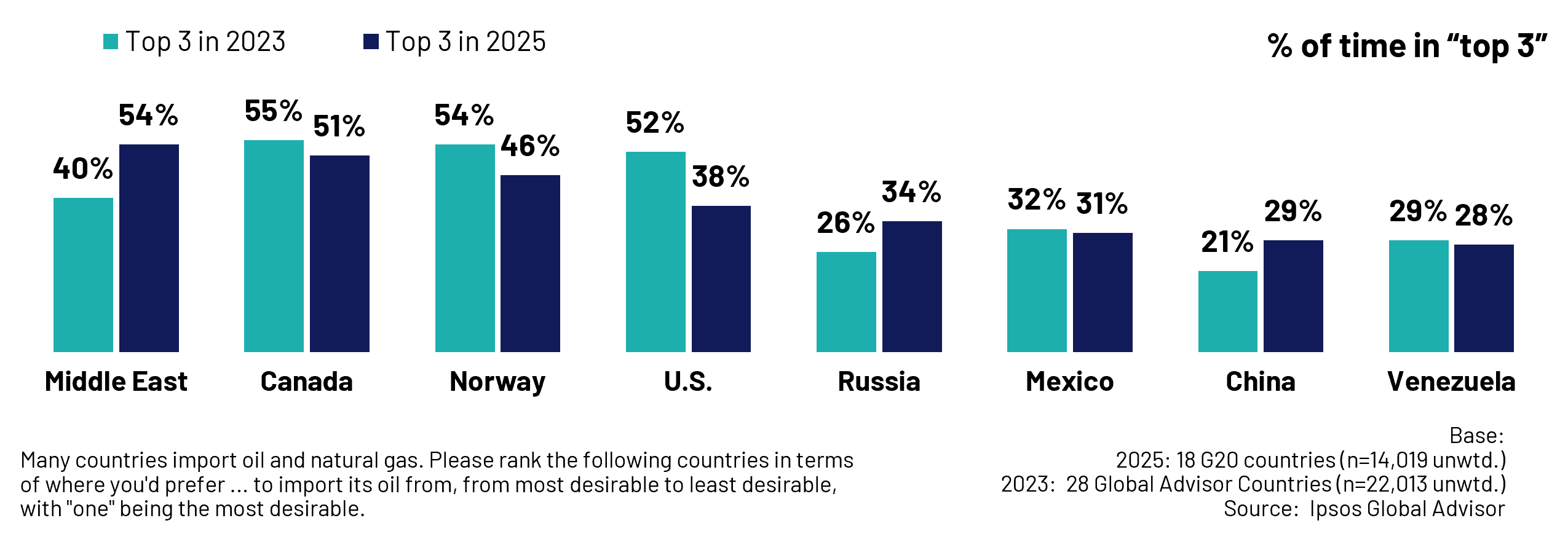

The Middle East has significantly increased its ranking, both as a top 3 supplier (from 40% to 54%) and as the #1 choice (from 20% to 31%).

This increase in preference is likely due to its strategic importance in global energy supply, increasing involvement in global politics and initiatives such as the India–Middle East–Europe Economic Corridor (IMEEC) and the expansion of BRICS group of eleven countries.

Meanwhile, Canada remains a top preferred supplier of oil across the G20 and now ranks second in terms of how often it appears in the top 3. (shown above).

Canada’s enduring appeal possibly stems from its stable political situation, reliable supply, environmental measures and established trade relationships. Canada has opportunities to tell its responsible development story to countries seeking environmentally regulated, democratic oil as the world turns away from viewing the United States as a preferred supplier.

These are the results of an 18-country survey conducted by Ipsos on its Global Advisor online platform on behalf of the Pathways Alliance between Friday, April 25, and Friday, May 9, 2025. For this survey, Ipsos interviewed a total of 14,019 adults aged 18-75 in G20 countries, excluding Russia.

The data are weighted so that the composition of each country’s sample best reflects the demographic profile of the adult population according to the most recent census data. “The Global Country Average” reflects the average result for all the countries and markets in which the survey was conducted. The precision of Ipsos online polls is calculated using a credibility interval with a poll where N=1,000 being accurate to +/- 3.5 percentage points and of where N=500 being accurate to +/- 5.0 percentage points.

For more information on this news release, please contact:

Gregory Jack

Senior Vice President, Public Affairs (Canada)

[email protected]

Ipsos is one of the largest market research and polling companies globally, operating in 90 markets and employing nearly 20,000 people.

Our passionately curious research professionals, analysts and scientists have built unique multi-specialist capabilities that provide true understanding and powerful insights into the actions, opinions and motivations of citizens, consumers, patients, customers or employees. Our 75 business solutions are based on primary data from our surveys, social media monitoring, and qualitative or observational techniques.

“Game Changers” – our tagline – summarizes our ambition to help our 5,000 clients navigate with confidence our rapidly changing world.

Founded in France in 1975, Ipsos has been listed on the Euronext Paris since July 1, 1999. The company is part of the SBF 120, Mid-60 indices, STOXX Europe 600 and is eligible for the Deferred Settlement Service (SRD).

http://www.ipsos.com/