Despite Interest Rate Decline, 82% Of Canadians Who Don’t Own a Home Say Buying One Remains Unaffordable

A majority of Canadians say that even with a decline in interest rates, owning a home remains out of reach.

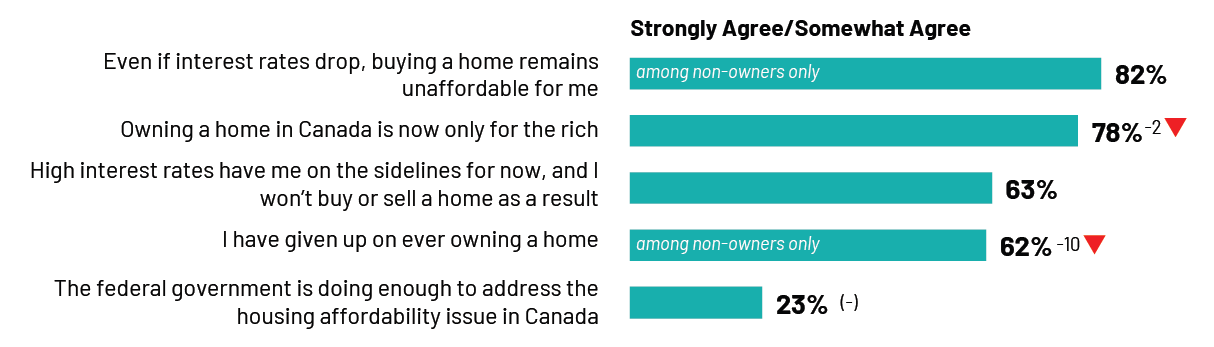

Canadians maintain their pessimistic outlook on housing market affordability: a strong majority (78%) agree that owning a home in Canada is now only for the rich, and just over six in ten (63%) say they will stay on the sidelines of the market due to high interest rates, shelving their dreams of ownership or climbing the property ladder. Just one-quarter (23%) agree the federal government is doing enough to address housing affordability in Canada.

Although interest rates have started to decline, eight in ten Canadians who don’t own a home say that even if interest rates drop, buying a home remains unaffordable for them. Six in ten who don’t own a home say they have given up on ever owning one, although the feeling has subsided (-10 pts) somewhat since April.

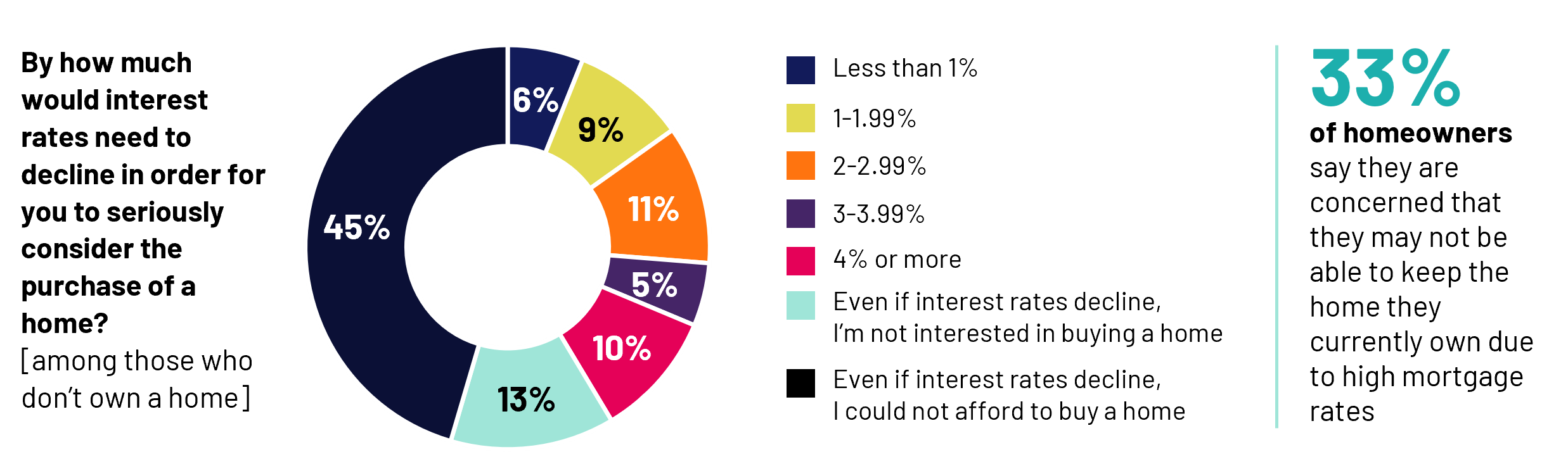

Among those who do not own a home, 6% say interest rates would need to decline by less than 1% for them to consider buying a home; 25% say rates would have to decline by between 1% and 3.99%; and 10% say they would have to decline by 4% or more. However, a majority (45%) say that even if rates declined, they still could not afford a home.

Among those who currently own a home, one-third (33%) are concerned that they may not be able to keep the home they currently own due to high mortgage rates. Nearly seven in ten (67%) of those with a mortgage say that if they were to renew or get a new mortgage in 2024, they would choose a fixed mortgage (vs. 30% who would choose variable and 4% who would choose another type of mortgage).

These are some of the findings of an Ipsos poll conducted between June 7 and 10, 2024, on behalf of Global News. For this survey, a sample of 1,001 Canadians aged 18+ was interviewed online. Quotas and weighting were employed to ensure that the sample’s composition reflects that of the Canadian population according to census parameters. The precision of Ipsos online polls is measured using a credibility interval. In this case, the poll is accurate to within ± 3.8 percentage points, 19 times out of 20, had all Canadians aged 18+ been polled. The credibility interval will be wider among subsets of the population. All sample surveys and polls may be subject to other sources of error, including, but not limited to coverage error, and measurement error.

For more information on this news release, please contact:

Sean Simpson

Senior Vice President, Ipsos Public Affairs

+1 416 324 2002

[email protected]

Ipsos is the world’s third largest market research company, present in 90 markets and employing more than 18,000 people.

Our passionately curious research professionals, analysts and scientists have built unique multi- specialist capabilities that provide true understanding and powerful insights into the actions, opinions and motivations of citizens, consumers, patients, customers or employees. We serve more than 5000 clients across the world with 75 business solutions.

Founded in France in 1975, Ipsos is listed on the Euronext Paris since July 1st, 1999. The company is part of the SBF 120 and the Mid-60 index and is eligible for the Deferred Settlement Service (SRD).

ISIN code FR0000073298, Reuters ISOS.PA, Bloomberg IPS:FP

http://www.ipsos.com/

![[WEBINAR] TOAST 2025 The Sip Spectrum: The Multifaceted World of Modern Drinking](/sites/default/files/styles/related_more_insights/public/ct/event/2025-08/thumb.jpg?itok=L18Y1o3A)

![[WEBINAR] Ipsos Global Trends 2025: Canadian Edition](/sites/default/files/styles/related_more_insights/public/ct/event/2025-08/thumbnail-templates_5.png?itok=hLtbMkre)