Back to school

Britain, Autumn 2013. The worst of the crisis is (we hope) over. But money is tight. Real incomes are falling. Energy prices are rising. People may be able to borrow money, but many of the routes available are relatively new: tuition fee loans, shared ownership mortgages, payday loans...

Some will be making the “right choices” when it comes to their finances. Others will be making decisions they may regret further down the line. A greater number are likely to simply feel like they are muddling through.

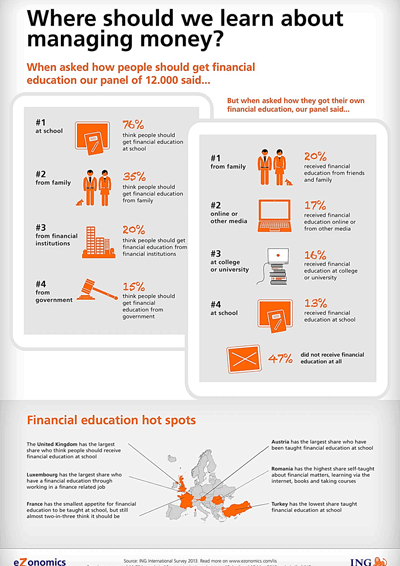

New research conducted by Ipsos for banking group ING finds one in two Europeans admitting to never having received any financial education. The knowledge we have picked up is most likely to be from friends/family, or what we have seen in the media, social or otherwise.

Which brings us to the next generation. Is enough being done to equip tomorrow’s adults with the skills they will need to navigate their personal finances? Will the Britain of tomorrow fit the following description:

“A society in which all children and young people have the skills,knowledge and confidence to manage their money well, now and in the future”

This is the vision of the Personal Finance Education Group, a charity devoted to providing education resources to support teaching children and young people about money. And they certainly seem to be filling a gap. In 2010, an Ofsted report pointed out that school provision for financial capability learning was weaker than for enterprise or for careers. It pointed to a lack of coherence as to what good looks like, a shortage of skills among teaching staff, and a lack of continuity between what children learned at primary and secondary levels. This report from the House of Commons Library provides more details.

Whatever today’s adults were taught, it does not appear to have been particularly memorable. Just 12% of Britons recall receiving financial education at school. But that’s not to say they don’t think it’s important: a whopping 88% say that financial education should be provided at school – the highest in Europe.

And the Government agrees. September saw the announcement that financial capability teaching, already in place in Scotland, Wales and Northern Ireland, would be extended to England. It will feature in citizenship education, but also in mainstream maths lessons.

This does indeed appear to be a topic where government policy and public opinion are at one with each other. Not something we see every day!