Energy - the quest for a licence to operate

A secure supply of affordable and sustainable energy is fundamental to human activity, and underpins economic growth. It can also help to explain differences between countries in development and wealth. But the global energy industry cannot always count on public opinion simply handing it a licence to operate. The public are all too aware of the downsides of many types of energy generation, and the possibility they will affect public welfare and the environment. Fuelled by media and NGO pressure to meet the challenge of climate change, the public may see the energy industry as an obstacle to controlling climate change, possibly even as the force behind climate change denial. The realities of emerging energy technology point towards a growing need for public support because the new technologies, like fracking, carbon capture and storage and large scale renewables, often imply disruption, environmental damage and risk to human health.

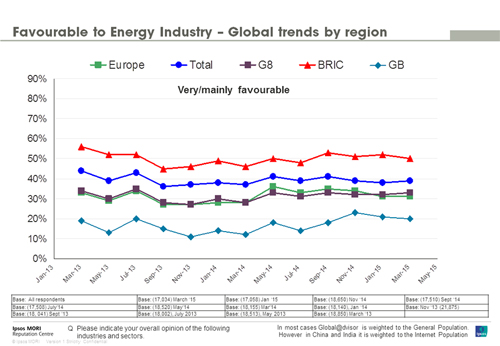

The Ipsos global industry reputation tracking data, covering 23 countries, sees the energy industry viewed positively, on balance, across the world, with 33% favourable, 28% unfavourable and the remainder neutral. While, overall, the reputation of the energy industry has held up fairly well 2013-15, the trends show a marginal weakening in industry favourability across the world since January 2013. This is notwithstanding the wide gap between views among the G8 countries and those of the much more favourable BRICs:

Projecting into the longer term, however, this slow erosion of public support could eventually translate into a growing challenge for the global energy industry. Unpopular new energy sources that give rise to public concern – fracking is the best example - require high levels of trust from the public to be operationally successful and keep costs down. The public needs to believe that the industry has their best interests in mind; if they perceive a simple drive for profit at the expense of public safety and environmental protection opposition will grow and the task of increasing energy supply will become more difficult. Attempting to progress such developments against the headwind of public opposition or, at worst, direct action, can reduce financial returns, and therefore the economic viability of energy investment. It is a vital interest of the energy industry that it maintains stable public support over the long term.

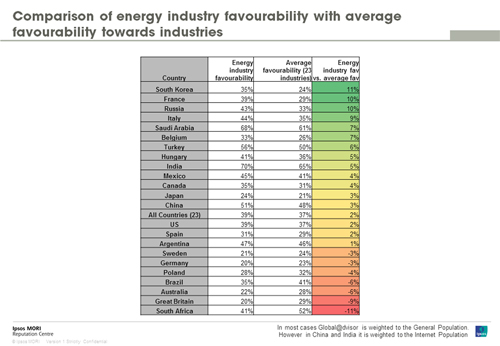

Energy remains one of the more favourably regarded industries – its global favourability is two points above the average favourability for the 23 industries measured. However, it can be misleading to compare the standing of the industry directly between countries since in some countries all industries may receive higher or lower ratings than elsewhere, purely as a result of cultural norms. The table below shows a comparison of favourability towards the energy industry with average industry favourability in each country. This can be helpful since it reduces the impact of cultural norms that can distort international surveys of this kind.

Q. Please indicate your overall opinion of the following industries and sectors (very favourable, mainly favourable, neither favourable nor unfavourable, mainly unfavourable, very unfavourable) – Pharmaceuticals Base: General public – Argentina (500), Australia (999), Belgium (501), Brazil (1001), Canada (999), China (1004), France (1000), Germany (1000), Great Britain (1002), Hungary (503), India (501), Italy (1003), Japan (1005), Mexico (501), Poland (500), Russia (501), Saudi Arabia (501), South Africa (501), South Korea (505), Spain (1001), Sweden (500), Turkey (500), US (1006). Fieldwork 23 Feb-6 March 2015. Industries included in country average: Airline, automotive, banking, beer, chemical, confectionery, consumer packaged food, credit card, energy, fast food, insurance, investment, media, mining and metals, oil and gas, personal computers, pharmaceuticals, restaurant, retail, soft drinks, telecommunications, tobacco, wine and spirits.

Typical of this effect is the position of India, where very high absolute scores are commonly recorded for all kinds of industries and companies – Indian respondents are reluctant to be critical. In the case of the energy industry, favourability is highest in India (70%) but when compared against the Indian average for all industries it falls to a modest 5% above average, placing energy in India only joint 8th among the full list of 23 countries.

In fact, on this measure, it is in South Korea, France and Russia that the energy industry is relatively most favourably regarded. By contrast, the potential problem countries for the industry are identified as South Africa, Great Britain, Australia and Brazil. South Africa’s recent power cuts and Brazil’s energy crisis are well documented, and illustrate the pivotal importance of security of supply as a hygiene factor for the energy industry’s reputation: if it does not supply energy at all its reputation collapses. Similarly, Australia is facing a gas supply squeeze and this, together with a recent collapse in renewables investment, has undermined confidence in the energy industry.

Great Britain is a melting pot of energy-related concerns, starting with perceptions of oligopoly pricing and a lack of trust in electricity and gas suppliers, to the nimby opposition that has undermined onshore wind energy, controversy over new subsidies for nuclear energy and the public protest that has faced the first exploratory fracking. This litany of public disapproval looks set to be joined by alarm over recent predictions that the margins of safety around Britain’s security of electricity supply are soon to fall to their lowest level ever due to lack of generating capacity.

In many countries the story is similar: governments and energy companies are failing to work successfully together to plan national energy futures, while global market trends are constantly presenting new obstacles, such as the current depression in oil prices.

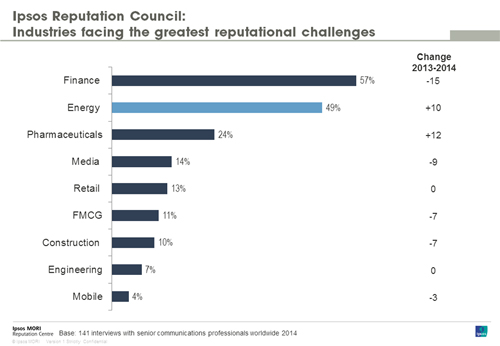

Communications professionals agree that the energy industry has a growing reputational problem. In the annual consultation with the Ipsos Reputation Council, 141 senior communicators from across the world placed the energy industry second only to financial services as the industry with the greatest reputation challenges – up 10 points on 2013’s figures, only pharmaceuticals shows a steeper rise in concern.

Behind these figures are some strong views among corporate communicators; energy is a sector on which many have an opinion:

Energy continues to face challenges because it is so fundamental to economic progress

- Reputation Council member

The energy sector has a bit more of a challenge on its hands (than financial services) because people view it with more suspicion and are more directly impacted by the bill coming through the door, whereas the bill to pay the bankers is hidden in the taxes

- Reputation Council member

Potentially energy will run into more difficulties, with more and more discussion about energy transformation and nuclear power, a lot of things were done wrongly in the past so probably the energy sector hasn't seen the lowest point of the curve yet

- Reputation Council member

The most detailed (and critical) comments on energy from the Reputation Council relate specifically to the situation in Great Britain, where the Competition and Markets Authority is in the process of reporting back from its investigation of the British energy market:

The energy industry is not managing its reputation particularly well, people don't understand all of the work they do and therefore they are just being nailed for charging high prices

- Reputation Council member

Energy is in for a tough couple of years, it needs to explain itself, I don't know where it is at the moment on this whole competition commission piece, between generation and retail sides of it, but you can see a political desire to break up energy into generation and retail

- Reputation Council member

The basic issue in Britain, which is perhaps a salutary lesson for other countries, is that the industry has failed to communicate in a way that builds trust, and without trust it cannot build public support or its licence to operate. While the principal pressure falls on the energy companies themselves, the British Government and the regulator also have an important role:

As long as the model behind it isn't communicated better, as long as this issue of public private funding of some of the infrastructure projects in particular in energy in the UK isn't made clear, there is going to be the fundamental mistrust from the public towards energy because the reality is going to be very unfortunately that energy prices are going to rise quite significantly, because of the cost of energy and the massive investment needed in clean energy. I believe that government or regulators will have to explain that much better as it is getting to be a massive issue of confidence for the energy sector

- Reputation Council member

Robert Knight is a Research Director at Ipsos.