Are You Confident Your Line Extension Will Pay Out?

Failure of a line extension to add to the bottom line is its ticket to the innovation graveyard.

While there are many examples of successful line extensions -Dannon174 Activia,174 Olay174 Regenerist, and Bayer174 Low Dose, to name a few - many line extensions do not result in incrementality. Incrementality is the extent to which a new line extension adds volume to the category, the company or the brand, taking into account cannibalization, competition and other market factors.

Marketers may have different reasons for introducing line extensions. They may have a truly winning idea, or they may need something new to advertise and promote to the consumer or some thing fresh to share with the retailer to protect their shelf space. Whatever the reason, many line extensions will not achieve enough incrementality to make a difference - either because of low volume or high cannibalization. It has been shown that, on average, close-in line extensions generate only 1% of category sales (McKinsey Quarterly, 2006). Moreover, many close-in line extensions cannibalize heavily from their parent brands - with the situation worsening in the second year when marketing support for the line extension declines.

How can marketers forecast how much incremental volume their line extension concepts will generate - not only at the parent brand level, which is the traditional scope of incremental forecasts, but also at the category and brand portfolio levels? Moreover, how can marketers optimize their product line ups should their line extensions be introduced?

The answers lie in an integrated approach to incrementality that leverages proven innovation, forecasting and line optimization techniques. Equally important, incrementality forecasts must consider the competitive context to ensure accuracy, and explore category growth opportunities and consumer usage occasions so marketers can uncover new ways to grow their businesses.

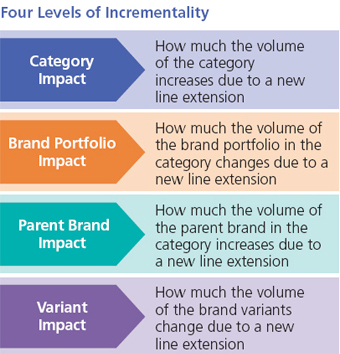

Four Levels of Incrementality - from a Marketing Perspective

Traditionally, marketers introduced line extensions with the objective of increasing parent brand revenue. However, marketers may now have additional objectives for their line extensions. They may seek to grow the category, or they may need to optimize variants within the brand. As brand architectures become more complex, the effect of the line extension on the company's other brands in the category becomes a concern as well.

Given the business issue at hand, it may be appropriate to forecast the impact of the line extension on the category, the company's brand portfolio in the category, the parent brand and its variants.

Category Impact

Being the leader in a category can be a double edged sword: while marketers enjoy most of the revenue the category has to offer, there's not much opportunity to steal share. For example, this may be the case in the ketchup category, where Heinz174 is the dominant player. The goal of a line extension may be to grow the category - by bringing in new category buyers or increasing consumption among current category buyers (often by creating new usage occasions, which can be difficult to discern).

Brand Portfolio Impact

Some companies market several products within a category under different brand names. For example, Nestle offers several brands in the mineral water category, including Perrier,174 San Pellegrino174 and Vittel.174 In these situations, an understanding of the extent to which the new line extension will help or hurt the brand portfolio within the category is needed. The goal of the incrementality forecast is to measure how much the combined volume of the brand portfolio would increase after the introduction of a new line extension - knowing that cannibalization will most probably be an issue.

Parent Brand Impact

Forecasting brand incrementality is necessary when a marketer wants to understand the impact of a line extension introduction on the volume of the parent brand within a category. For example, a brand manager may be considering extending his beverage brand with a new flavor introduction, which is a close-in line extension and therefore presents high potential for cannibalization.

Variant Impact

Marketers may be interested in a line extension's impact on specific variants in a line, especially if they have a few star players who generate the most profits. A forecast of each variant would be needed to ensure the new line extension will not cannibalize the stars. In addition to the forecast, the marketer would be looking for ways to optimize the line: should some of the existing variants be removed in light of the line extension introduction?

Measuring Incrementality

Many companies make efforts to measure incrementality. Some companies may simply do a source of volume analysis using a replacement question - without obtaining volume estimates or even calibrating the data to actual market share. Others may conduct a line optimization analysis - without determining the volume impact on each variant. In this case, the marketer will be able to see which variants are cannibalized more than others on a relative basis but not on an absolute basis.

In order to measure incrementality, we use a four step approach that can be used at the concept and concept /product phases. Our approach integrates forecasting and optimization, and can be used at the category, brand portfolio, parent brand and variant levels.

1. Forecast Year 1 Volume for the Line Extension Concept

The first step to measuring incrementality is to determine the maximum Year 1 volume potential of the line extension concept - in the context of the current marketplace. Using our Designor174 NextGen Modular Forecasting system, we forecast Year 1 volume using:

- Key survey measures (Relevance, Expensiveness and Differentiation -what we refer to as our RED measures and which we use throughout the innovation process)

- A simple marketing plan (assumed or provided by client)

- The market structure (the extent to which the market is dominated by a few leading brands vs. fragmented into many brands)

- Competitive context (we compare consumer ratings of their Most Often Purchased Product ("M.O.P.P.") to their ratings of the line extension concept, thereby enabling evaluation in a true competitive context)

The market structure and competitive context are critical components because a brand does not exist in isolation - the market structure and competition will always pose an opportunity or a threat.

2. Project Volume Trends for the Parent Brand or Brand Portfolio

Our next step is to project how volume for the parent brand or the brand portfolio would change given any changes in their spending or distribution. For example, will the parent brand or other brands in the portfolio give up spending or facings to the new line extension? It is also important to consider ongoing trends which may impact the volume of the company's brands in the category.

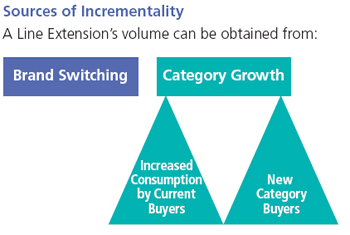

3. Measure Source of Volume

When launching a line extension, volume can be sourced from other brands in the category (ideally from competitive brands, but often from the parent brand) or from category growth, another ideal situation.

Source of volume (SOV) can be derived from asking consumers directly what products would be replaced with the line extension or asking them to make trade-offs - with results being calibrated to the market in either case. To determine category growth, we take a non-traditional approach that incorporates several perspectives. First, we measure interest in the concept among both category buyers and category non-buyers. Second, we look to see if there are differences in the occasions for which consumers buy the category vs. the occasions for which they would buy the concept. Third, we analyze those consumers who say they are interested in the concept but say they would not substitute the product for anything else in this category, as this may indicate category growth.

4. Drill Down to the Variant Level

At Ipsos, we can drill down beneath the brand level to measure the impact on the brand variants. Our recommended approach is to combine the SOV analysis above with a line optimization approach, such as Ipsos' Line Evolution tool. By integrating Line Evolution, we not only determine how much volume the line extension will generate but also how much volume existing variants will lose due to the introduction. This information can be used by the marketer to determine the optimum lineup for the brand. Moreover, our line optimization tool fully analyzes consumer usage occasions to uncover hidden potential to extend the line's appeal.

The Result

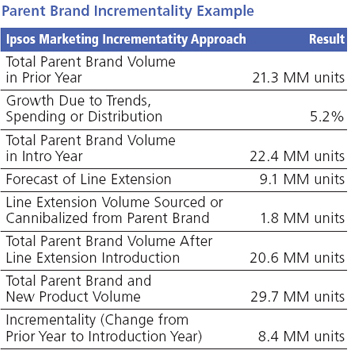

The forecast, parent brand projections, SOV analysis, and line optimization are combined to determine incremental volume at multiple levels. The result is a Year 1 forecast that reveals the impact a line extension will have from different business perspectives.

For example, a marketer looking to extend his candy line with a new miniature size would need to predict the impact of the line extension on the parent brand. As illustrated in Figure 3, we would forecast the expected volume of the new size and then determine the incremental volume to the parent brand taking into account growth in the parent brand due to trends, spending and distribution as well as decline in the parent brand due to cannibalization. A similar forecast could be conducted if the company offered other candy brands in miniature sizes and they were likely to be affected.

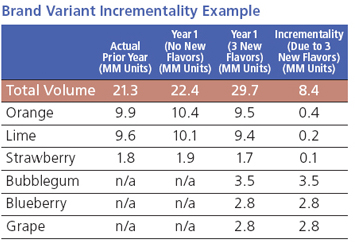

Now suppose the marketer is considering introducing several new flavors in his candy line. He will need to look at the impact on the brand's variants in order to decide which of the new flavors and existing flavors should be included in the line up. As illustrated in Figure 4, the current line up consists of three flavors and achieves sales of 21.3 MM units. If no new flavors are introduced, the marketer can expect to achieve sales of 22.4 units the following year due to expected brand growth. However, if he introduces three new flavors (Bubblegum, Blueberry and Grape), 29.7 MM units would be sold, thereby yielding incremental volume for the line of 8.4 MM units.

By determining the effect of the new flavor introductions on the volume of each variant in the line, the marketer can decide which flavors are worth keeping and which should be replaced with a new flavor.

In this case, the marketer would consider removing the existing Strawberry flavor since it generates the least volume.

Finally, let's consider the case where the marketer developed a line extension intended to create new usage occasions for candy - let's say a candy that could be used as an ingredient for baking. Here, a category growth forecast would be conducted. This type of growth is often the most difficult to measure. Therefore, our analysis would take into account new usage occasions among existing category buyers and new category buyers.

Additional category issues can also be addressed with our incrementality technique. For instance, the marketer may want to extend his chocolate brand with a new chocolate mint. Here, the forecast would take into account volume sourcing from both the chocolate category and the mint category.

Line Extending with More Confidence

Line extension forecasts have traditionally included only the parent brand and have not branched out to capture category growth or the effect of the line extension on the company's brand portfolio in the category or variants within the parent brand. Moreover, competitive context is often lacking and usage occasions are not adequately addressed.

Our comprehensive approach to line extension incrementality leverages two of our most unique and powerful tools: Designor NextGen Modular Forecasting, which takes into consideration the impact of competition, and Line Evolution, which includes a complete usage occasion analysis to determine category growth potential. These tools provide marketers with more accurate forecasts that can address a wider variety of business issues - from the micro-level of variants within a brand to the macro-level of category growth.

![[WEBINAR] The Super Bowl’s Best Ads of 2025](/sites/default/files/styles/related_more_insights/public/ct/event/2025-01/linkedin_1.png?itok=p3tp7r3V)

![[WEBINAR] What the Future: Creativity](/sites/default/files/styles/related_more_insights/public/ct/event/2024-06/feature.png?itok=FLH-EDOM)