Could a summer of extreme weather affect EV acceptance?

KEY Findings:

- Concerns are increasing about our environment.

- Overall EV acceptance has not improved year over year.

- Key Sustainability segments are more interested in electric vehicles.

- Additional EV education will help improve EV acceptance.

Summer 2023 has sparked renewed attention from many Americans when it comes to extreme weather. July 2023 was hotter than any other month in the global temperature record, and in states like Florida, 100-degree ocean temperatures were recorded, killing off coral, microorganisms and fish. In August, wildfires in Maui, as well as British Columbia and the Northern Territories in Canada, drew more attention to the much-debated role of climate change.

These extreme weather events affect companies in every industry, including the auto sector, which faces new pressure from the federal government on emissions. The Environmental Protection Agency in April announced new strict emissions limits that it said the auto industry could meet if 67% of new-vehicle sales are electric by 2032.

As governments promote electric vehicles as a method of fighting climate change, consumer interest in EVs remains a complex issue. Here is what Ipsos research shows.

We need clean energy, but are consumers willing to shift?

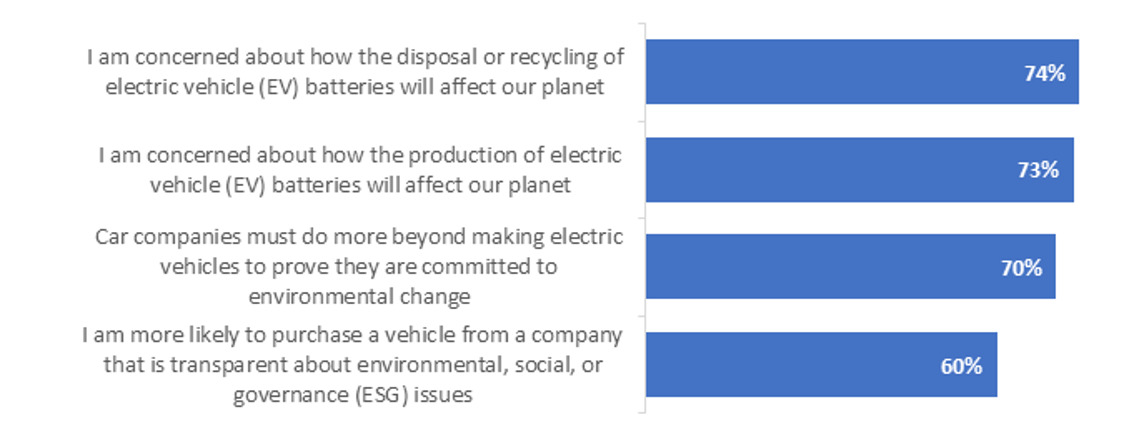

Electric vehicles may be the future for many consumers, but for all their promise of a cleaner future, Ipsos finds that consumers have concerns about the production of EV batteries and the batteries’ environmental impact. The mining of raw materials for battery production often involves disrupting natural habitats, and there is also the issue of disposal at the end of the batteries’ lifespan..

Source Ipsos polling, n=1,000 18+ year olds

Companies in the electric vehicle sphere should persist in developing more sustainable and high-performing batteries. Companies also need to communicate and educate consumers on how the development of these batteries is positively impacting society through their mining and recycling of the materials.

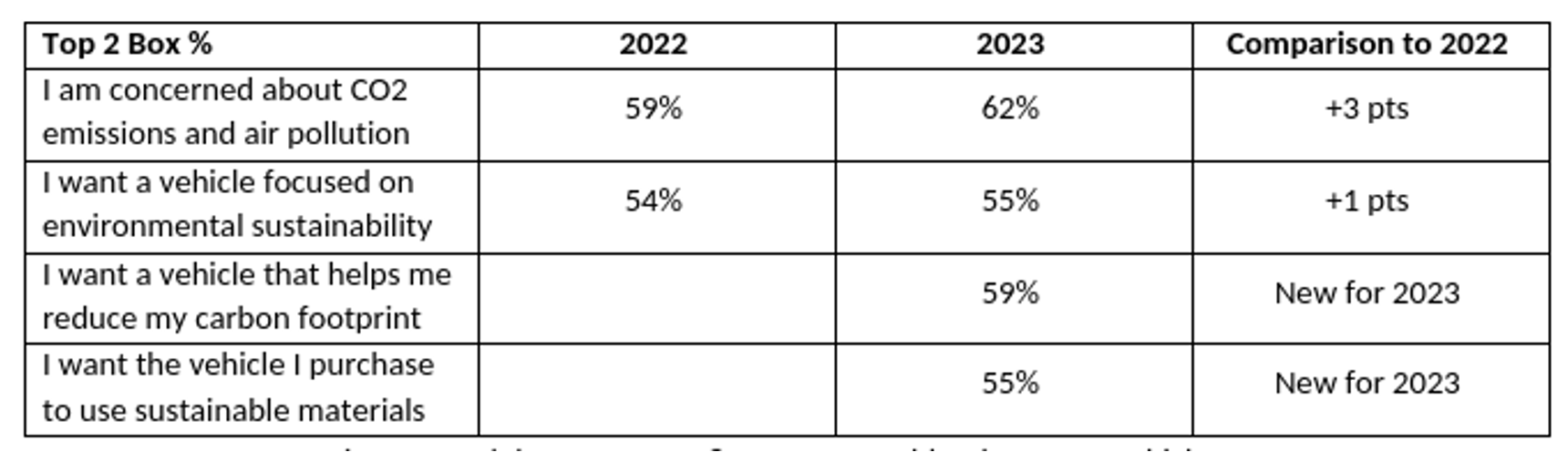

Reducing carbon footprints.

Ipsos’ 2023 Navigator trending shows that consumers agree sustainability and CO2 emissions are growing concerns, with increases compared to 2022 and the majority of consumers indicating interest in environmental sustainability.

Source 2023 Ipsos Navigator Module 2 n=2,000 18- to 74-year-olds who own a vehicle

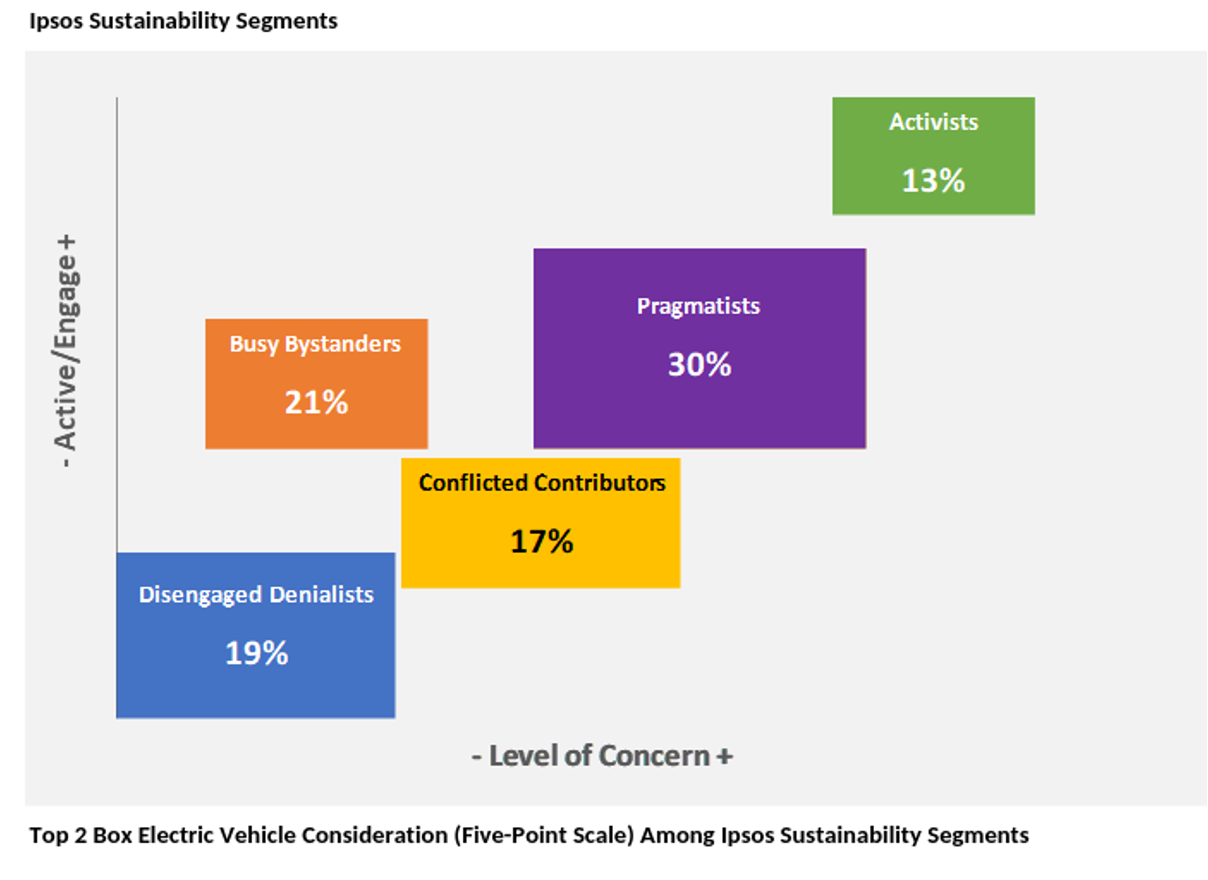

But are consumers motivated to shift their behavior? Ipsos observed the following mix of our Ipsos Sustainability segments among vehicle owners, with about a third of consumers considering themselves “Pragmatists” and just roughly one in 10 considered “Activists.”

Ipsos Sustainability Segments

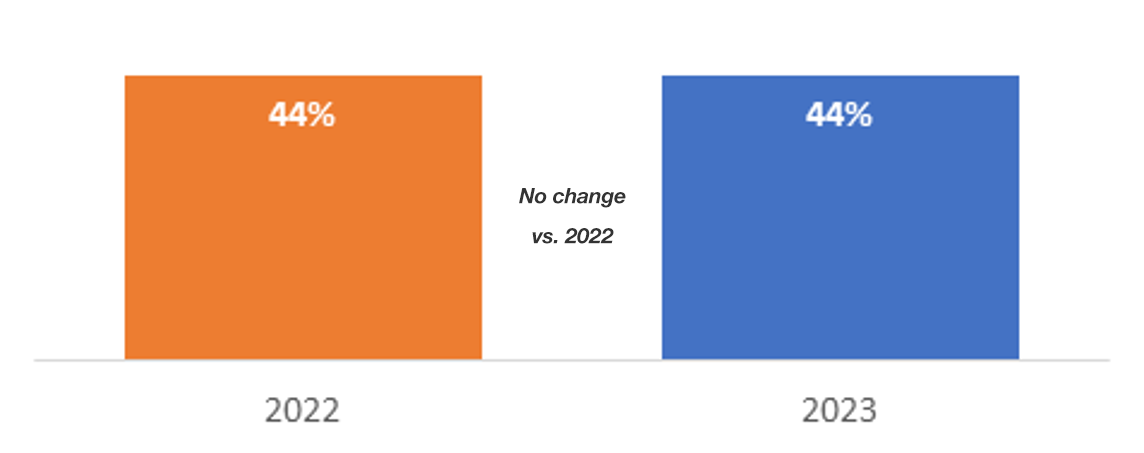

Top 2 Box Electric Vehicle Consideration (5 pt scale) total by year

Year-over-year interest in EV consideration remains flat from summer 2022 compared to 2023. More education is needed for consumers to be aware of the impacts of electric vehicles, their batteries and how consumers can help by making more sustainable choices.

Source: 2023 Ipsos Navigator Module 2 n=2,000 18- to 74-year-olds who own a vehicle

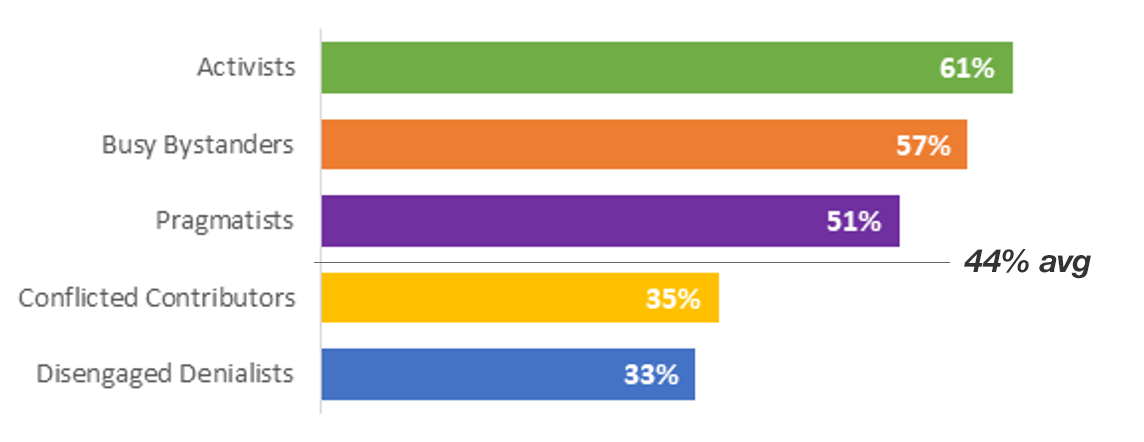

While overall EV acceptance and consideration remain flat year over year, Ipsos has revealed that the more engaged and aware Ipsos Sustainability segments are, the more interested they would be in considering an EV. Additional education and information will be helpful to further expand EV acceptance.

Top 2 Box Electric Vehicle Consideration (Five-Point Scale) Among Ipsos Sustainability Segments

Source 2023 Ipsos Navigator Module 2 n=2,000 18- to 74-year-olds who own a vehicle

What’s Next

Global warming is real, with consequences ranging from record global temperatures to the extinction of species. A significant part of the blame lies in companies’ energy production, choices provided to consumers and consumers’ consumption patterns. Companies, especially in the auto industry, need to continue asking themselves tough questions:

- Do companies carry on business as usual, and leave a fractured planet riddled with storms and droughts?

- Or do they take the road less travelled and embrace an energy revolution with new offerings and education requirements which – though not without its hurdles – promises a cleaner, greener future?

Here at Ipsos, we guide your business decisions to measure the interest and impact of different choices you are considering. Consumers are changing their attitudes toward the environment and are willing to take chances but need further education and choices. We currently monitor key trends in the automotive industry within our Ipsos Navigator which includes Electrification, Driving Technology plus Shared Mobility. Information on our offering is listed below.

Plus, we have access to additional information regarding what really motivates consumer choice by our Ipsos AMD team and with our AutoMOTIVES offering. We have just launched it and are focusing on Driving Technology initially and will cover Electrification in the future, click below for more information.

![[WEBINAR] Global Voices of Experience 2026](/sites/default/files/styles/list_item_image/public/ct/event/2026-02/thumbnail-global-voices-experience.jpg?itok=NN6W-9Ft)

![[WEBINAR] Increasing Efficiencies in Service Delivery in the Public Sector](/sites/default/files/styles/list_item_image/public/ct/event/2025-01/feature_4.png?itok=0fa4kfCx)