Ipsos Financial Wellbeing Tracker shows decline in worry about household finances – though stark societal divides remain

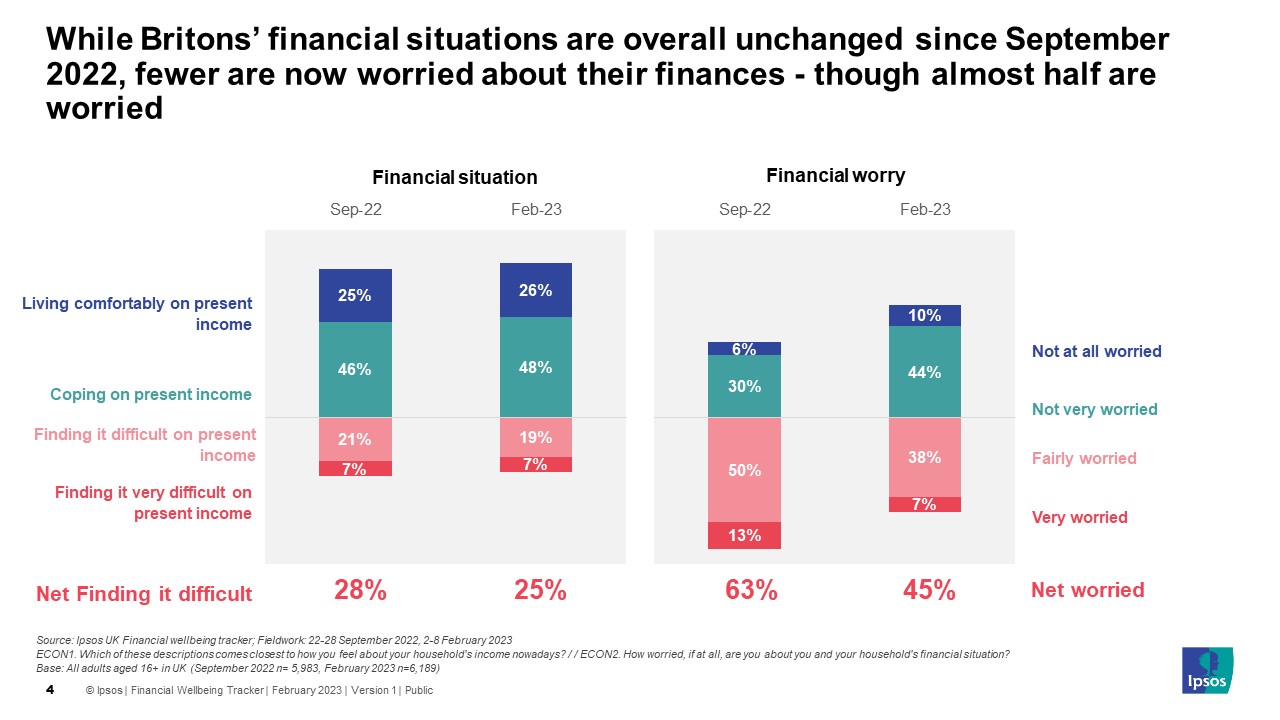

The latest Ipsos Financial Wellbeing Tracker reveals a significant decline in the number of UK adults who are worried about their household’s financial situation. The research, conducted in February, shows that while still almost half (45%) are worried, this is down from 63% in September 2022, with the proportion not very worried increasing to just over half (54%) from 36%.

In contrast, assessments of whether people are coping or finding it difficult on their household’s income nowadays are largely stable. One in four (25%) are finding it difficult or very difficult at present (down three percentage points from September), with 48% coping on their present income (compared with 46% in September) and 26% living comfortably (25% in September).

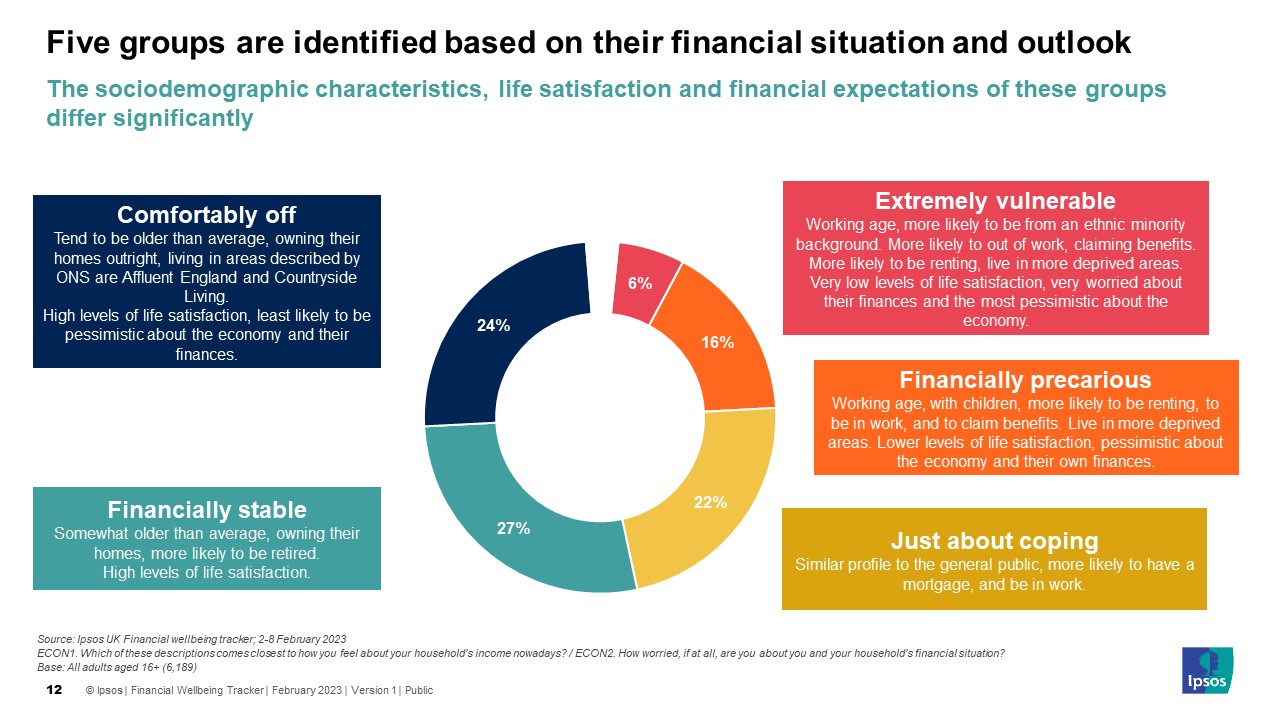

The changes in financial worry mean there has been a shift in the five financial groupings identified in the previous wave, with significant increases compared with September in the proportion who are financially stable (27% vs 17% in September) and a significant decline in the proportion who are just about coping (22% vs 32% in September). Slightly fewer Britons are in vulnerable groups too with those who are financially precarious dropping four points to 16%, while one in four (24%) remain in the comfortably off segment.

However, despite these changes, a small but consistent share (6%) continue to be extremely vulnerable, finding it very difficult to manage on their incomes and being very worried about their financial situation.

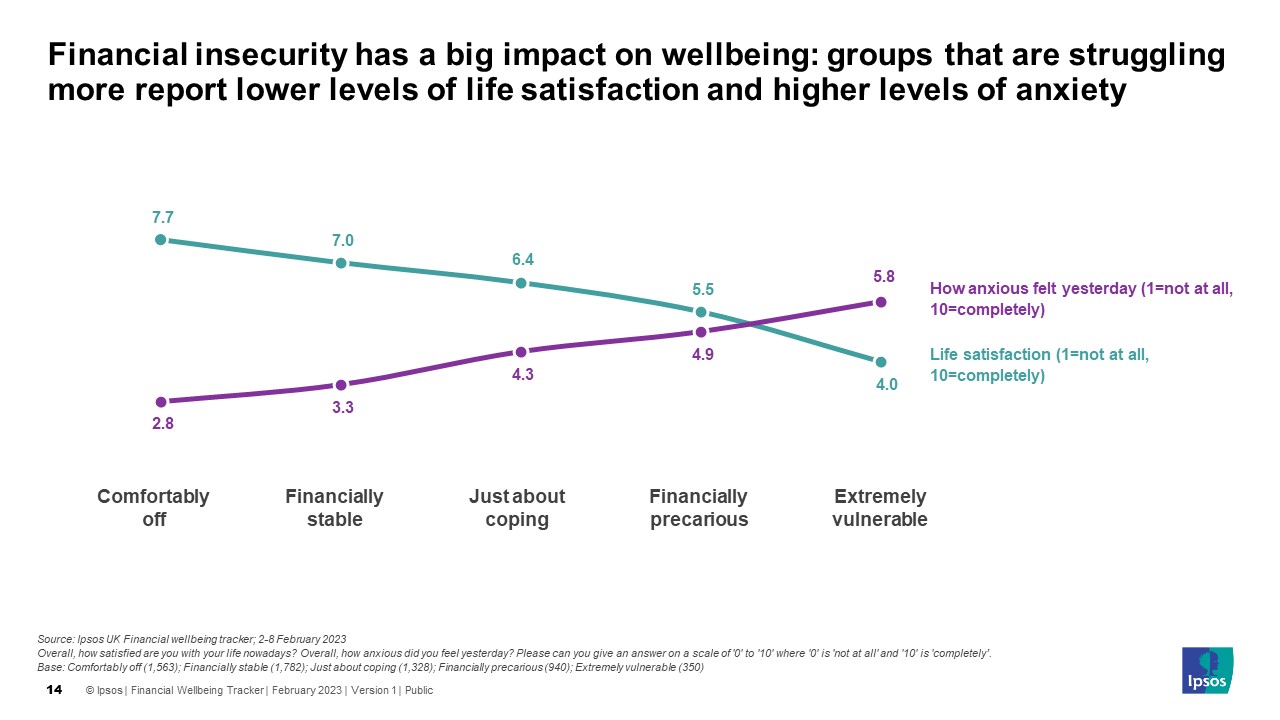

Furthermore, when looking at the sociodemographic characteristics and life satisfaction of these groups, stark differences remain. Life satisfaction falls, and levels of anxiety rise, among the groups who are more financially insecure.

These include notable differences according to generation , with a majority of the Pre-War and Baby Boomer generation either comfortably off or financially stable. In comparison, younger generations are more likely to find themselves in more financially vulnerable groups – and also to report lower life satisfaction and higher levels of anxiety.

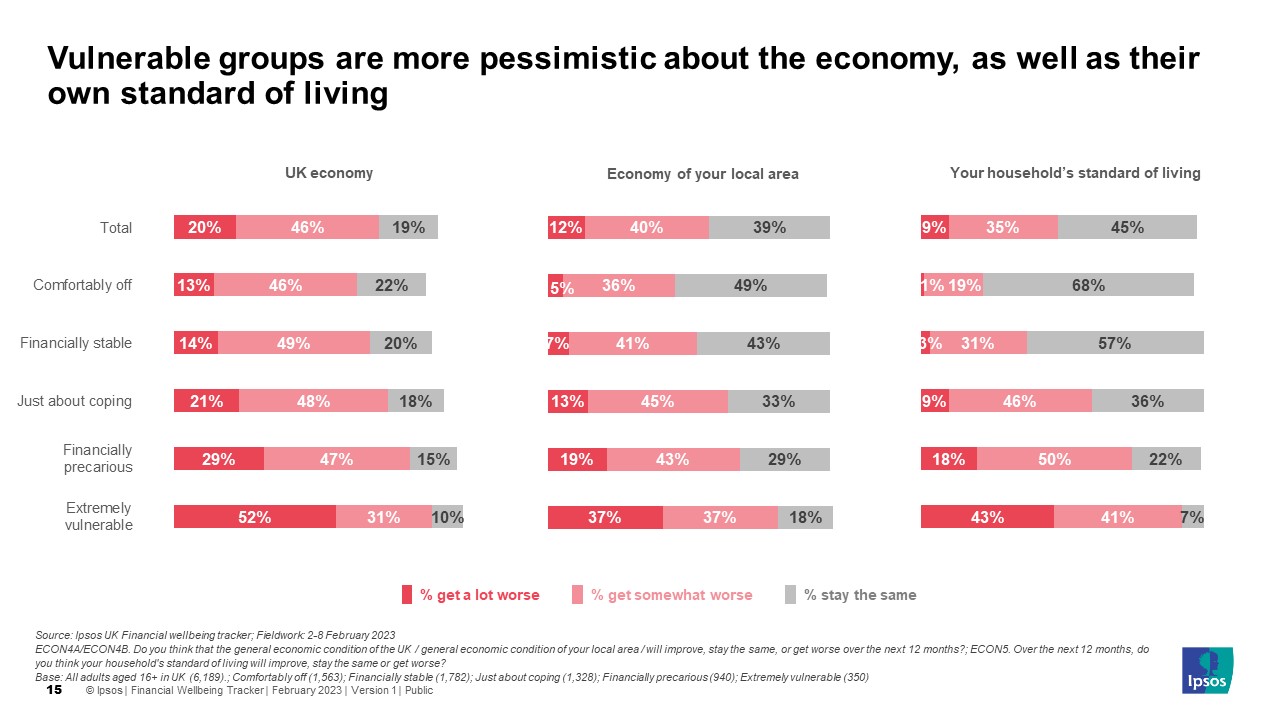

Economic expectations

The research also asked about whether people thought the UK economy, the economy of their local area and their household’s standard of living will improve over the next 12 months. Pessimism is now much lower compared to September, though majorities still expect things to get worse for the UK economy and that of their local area, and very few are optimistic for improvements.

Two-thirds (66%) now think the UK economy will get worse, compared to 86% in September. Just over half (52%) think the economy of their local area will get worse, down from 75%. Meanwhile, 44% now expect their household’s standard of living to get worse, down from 59%. The proportion thinking their standard of living will get worse is now equal to those who believe it will stay the same (45%).

However, despite these shifts reducing pessimism, for all three measures, there is still very little expectation that things will improve. Instead, more expect that the situation will remain about the same.

Trinh Tu, Managing Director of Ipsos Public Affairs in the UK, said:

Our Ipsos Financial Wellbeing Tracker shows that there has been a significant drop in the level of concern about personal finances amongst the public since our research during the Liz Truss administration in September 2022, however worry does remain high. This suggests that the Government may have managed to stabilise public concern following this period of upheaval, but there remains some way to go in order to restore public faith that the economy will improve. In particular there is still a core group of the working population who may be coping now but who are still worried about the future, while the most financially vulnerable are also having to deal with lower levels of wellbeing and higher anxiety.

Technical Note

Ipsos interviewed online a representative UK sample of 6,189 adults aged 16+ from 2-8 February 2023. This data has been collected by the Ipsos UK KnowledgePanel, an online random probability panel which provides gold standard insights into the UK population, by providing bigger sample sizes via the most rigorous research methods. Data are weighted by age, gender, region, Index of Multiple Deprivation quintile, education, ethnicity and number of adults in the household in order to reflect the profile of the UK population. All polls are subject to a range of potential sources of error.