Consumers remain anxious

Insights into the New America brought to you by Clifford Young and Bernard Mendez

The labor market is relatively healthy. Inflation remains relatively low. Consumer spending also hasn’t declined significantly, even as some signals suggest a broader slowdown may be on the horizon. Even amid continued buzz that looming tariffs could lead to a recession, the economy remains intact.

But that hasn’t helped Americans feel more confident about the economy.

Ipsos polling finds that consumer confidence declined for the third consecutive month in May, reaching levels last seen following the wave of inflation occurring under former President Joe Biden. How are Americans feeling about the economy? And is there a light at the end of the tunnel?

Below are five charts on where consumer sentiment stands, what economic issues they are most concerned about, and what might lie ahead in the future.

- Consumer confidence dip. Recent data shows that consumer confidence has declined for the third consecutive month, even as reported job loss and inflation haven’t risen significantly. Is anticipatory friction the culprit?

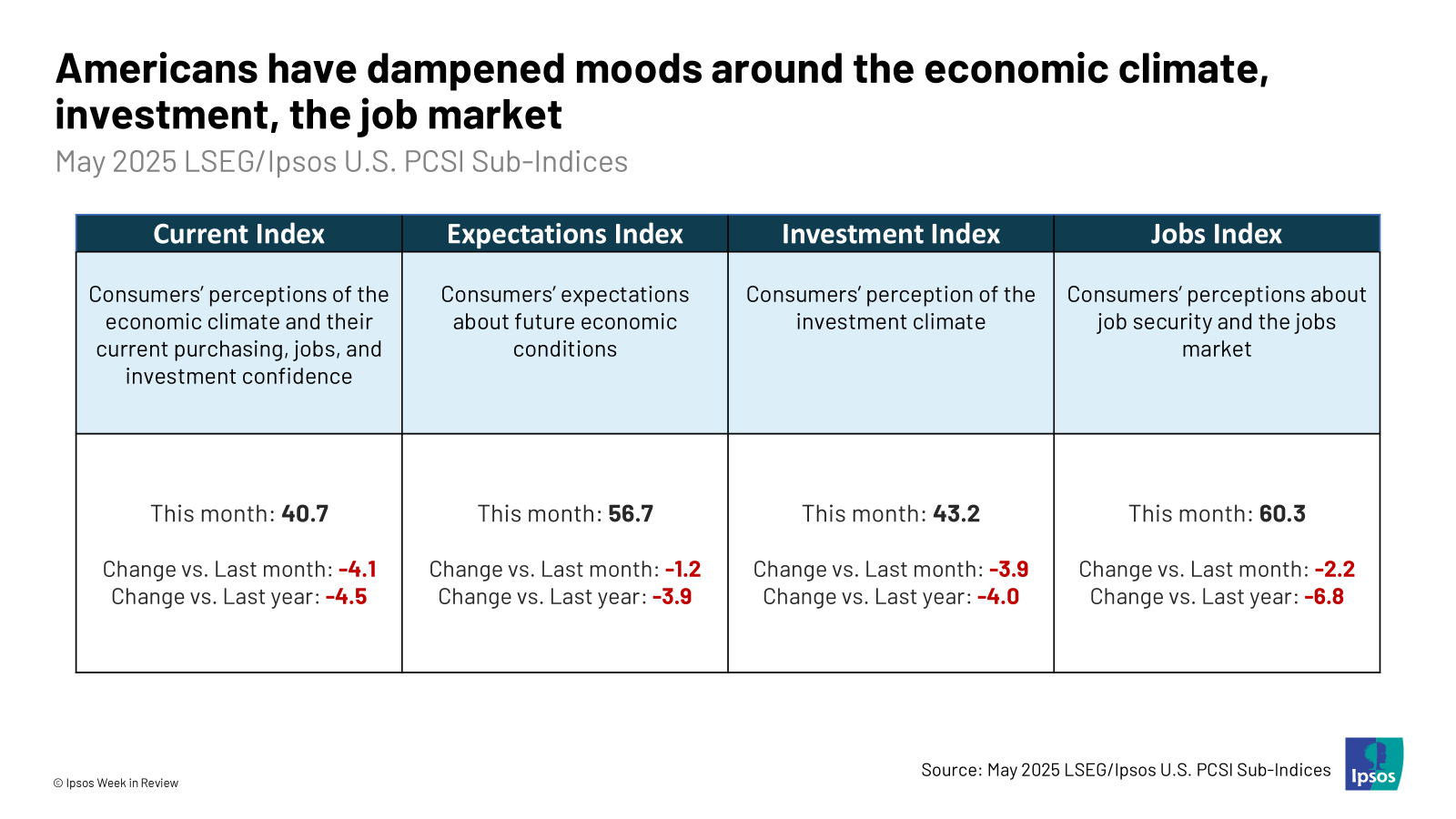

- Dampened mood across the board. All four sub-indices of consumer confidence are muted. It’s not just prices – perceptions of the economic climate, investment, job security, and the ability to find jobs are all down.

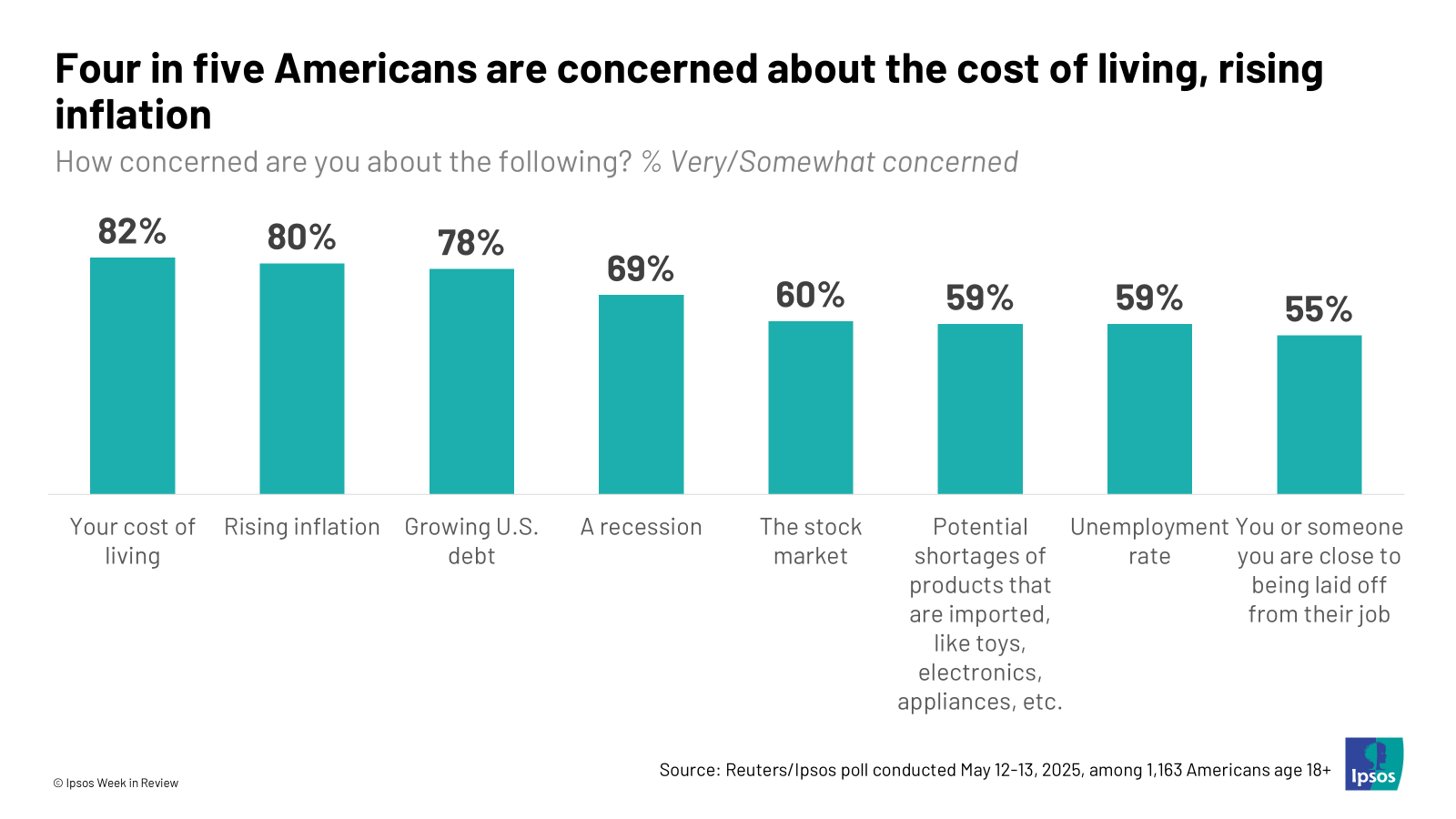

- Concern over inflation persists. Americans remain highly concerned with inflation and the cost of living. Fewer, but still majorities, are concerned about a potential recession or the stock market. But what is clear: economic anxieties are widespread.

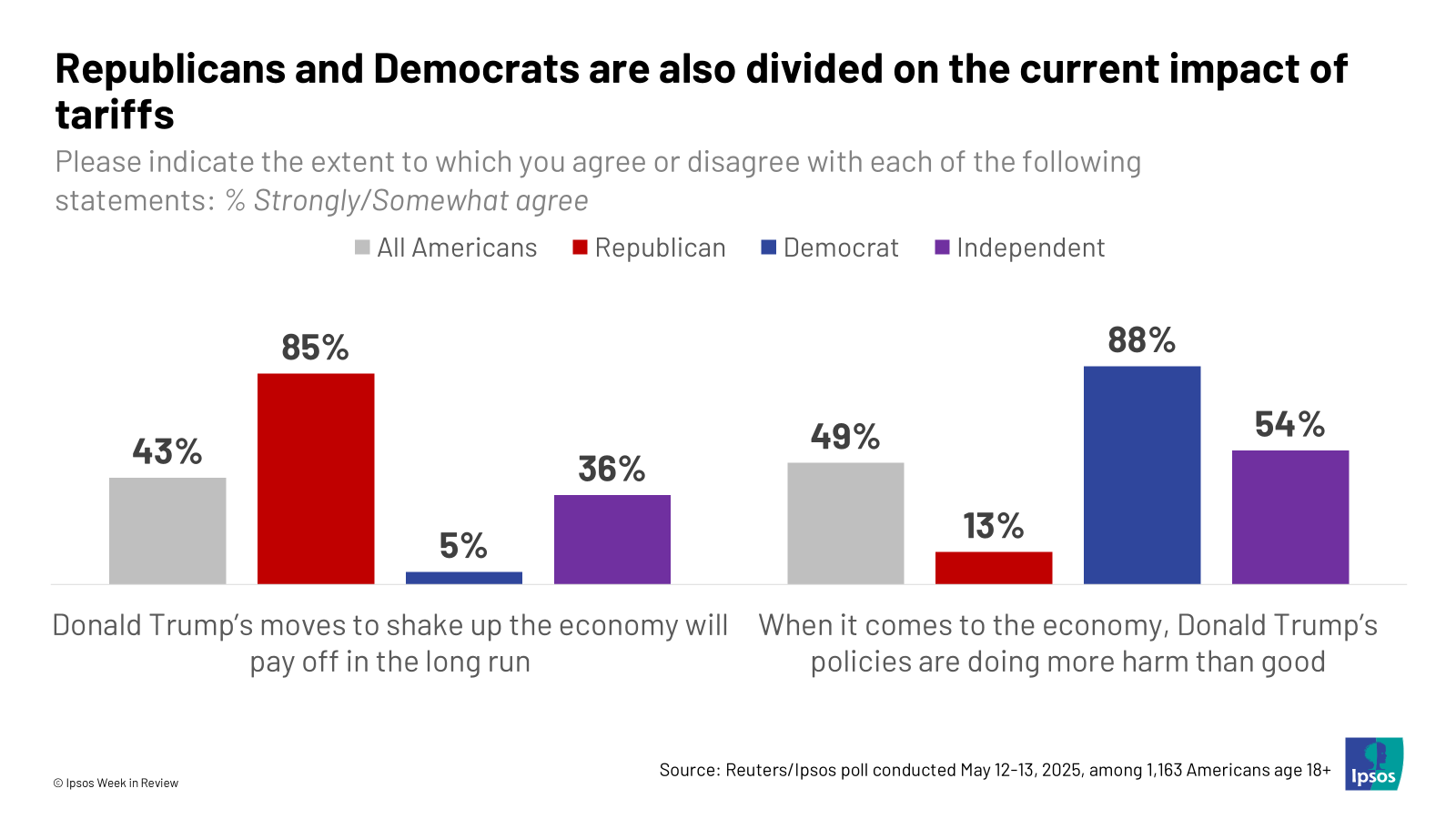

- Tariffs divide. Americans are divided current and future impact of tariffs. To some, President Donald Trump’s policies aren’t and won’t help the economy. To others, Trump’s policies aren’t doing more harm than good and will pay off in the long run. Two Americas; one red, one blue.

- The bleeding stops. Over the past few weeks, Trump has seen some positive momentum in his approval ratings, suggesting some of the friction has waned. Will consumer sentiment be next?

Two weeks ago, we wrote about anticipatory friction and broad uncertainty as potential drivers of a decline in Trump’s approval rating.

This anticipatory friction also appears to be a driver in Americans’ dampened sentiment around the economy given the otherwise solid macroeconomic indicators. That said, Trump’s approval rating has eked up in recent days, suggesting that the impacts of anticipatory friction might be declining.

If this holds, will this translate into a more optimistic consumer? We will have to see. Trade deals could eliminate some of Americans’ uncertainty around the economy, while more mixed signals could bring back the friction. Watch this space.