Sports gambling growth driven by small group of highly engaged sports fans

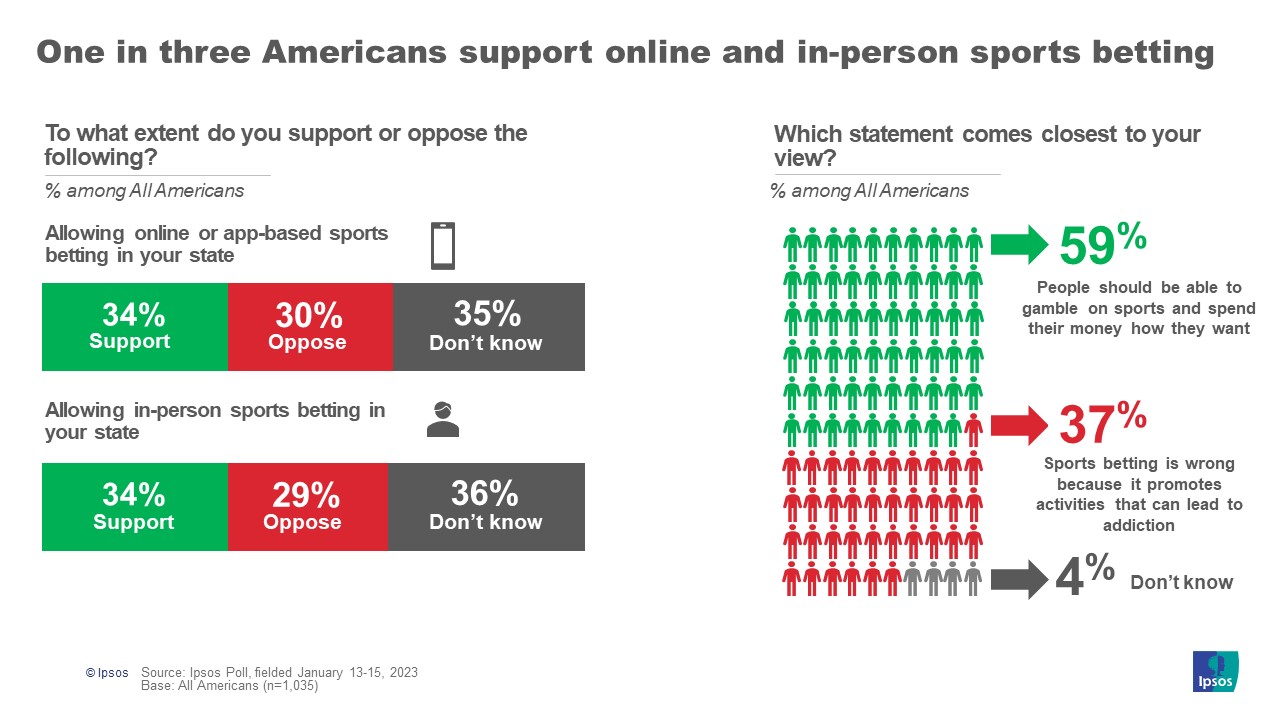

Washington, D.C., February 1, 2023 – In the past few years, legal sports betting has exploded as an industry in certain states. Now, a new Ipsos poll finds that the industry’s growth is on the back of a very small group of Americans. Fewer than one in ten report placing official bets in the past year. This group is very engaged with the sporting world and also significantly more likely than the American public to favor legalizing sports betting. In fact, only a third of Americans are in favor of allowing online and in-person sports betting in their state. While support is mixed, with another third unsure how they feel about the issue, a majority do believe that people should be able to gamble on sports and spend their money how they want.

Detailed Findings

1. Fewer than one in ten Americans have placed an official bet on a sporting event.

- Just 8% of Americans have placed an official bet on a live sporting event online. Even fewer have bet on a live event in-person (4%) or on an esports event in either fashion (3%). Sports bettors are more likely to be male, younger, and wealthier.

- The most popular league to bet on among sports bettors is the NFL (59%). Other popular leagues and sports to bet on include the NBA (34%), NCAA football (30%), NCAA basketball (26%), MLB (26%), and horse racing (25%).

- A strong majority of sports bettors can be described as infrequent bettors that only bet once a month or less (73%). Just one in five bet 2-3 times a month or more, and only 5% bet multiple times per week.

- While one in three Americans feel that sports betting is a way to get people more engaged with sports, more than twice as many sports bettors (69%) feel the same.

- Among the vast majority of Americans that do not bet on sports, the most cited reason is that it is a waste of money (52%), followed by not knowing enough about sports to bet on them (31%).

2. One in three Americans support legalizing sports betting both online and in-person in their state. Public opinion is evenly split between those who support legalizing betting, those who oppose, and those who are unsure.

- Men, sports fans, and official sports bettors are more likely to support legalized sports betting. They follow a similar profile to bettors themselves, who are more likely to be male and younger.

- A similar percentage of Americans agree that sports betting is a way to get people more engaged in sports (33%).

- While support for legalized sports betting is tepid, nearly three in five Americans (59%) say people should be able to gamble on sports and spend their money how they want. In contrast, 37% say sports betting is wrong and promotes activities that can lead to addiction.

3. Americans are split on how sports betting impacts the integrity of the game. However, this does not register as main issue for most Americans.

- Similar to overall support for legalizing gambling, sentiments on whether or not betting affects the integrity of the game are mixed. Thirty-seven percent of Americans agree that sports betting lessens the integrity of the game. Thirty percent disagree with this sentiment, and 32% don’t know.

- Americans ages 55+ are much more likely than their younger counterparts to agree that sports betting lessens integrity (47% agree vs. 29% of 18-34 year olds and 31% of 35-54 year olds).

- While some concern exists, just 11% of Americans see sports betting leading to fixed matches as a main issue currently facing the sports world. Only 4% believe the decision to allow sports betting is a main issue.

4. While a majority of Americans support requiring sports franchises to be more transparent about player injuries, they do not believe it should come at the expense of players’ medical privacy.

- Nearly three in five Americans (59%) and two in three sports bettors (67%) support requiring sports franchises to disclose more information about player injuries.

- Self-ascribed sports fans are more likely than non-sports fans to show support (63% vs. 50%, respectively).

- Despite broad support for more transparency, 70% of Americans believe players’ medical privacy should always be protected, even if it results in less transparency for sports bettors. Just one in four (26%) say sports bettors deserve more transparency from sports leagues about player injuries and health.

- Of note, a majority of sports bettors (64%) agree that player’s medical privacy should always be protected.

About the Study

This poll was conducted January 13-15, 2023, by Ipsos using the probability-based KnowledgePanel®. This poll is based on a nationally representative probability sample of 1,035 general population adults age 18 or older. The sample includes 81 official sports bettors. Since the official sports bettors have a low base size (N<100), interpret results with caution.

The margin of sampling error is plus or minus 3.2 percentage points for at the 95% confidence level, for results based on the entire sample of adults. The margin of sampling error takes into account the design effect, which was 1.12 for all respondents. For official sports bettors, the margin of sampling error is plus or minus 11.7 points at the 95% confidence level, and the design effect was 1.16. The margin of sampling error is higher and varies for results based on other sub-samples. In our reporting of the findings, percentage points are rounded off to the nearest whole number. As a result, percentages in a given table column may total slightly higher or lower than 100%. In questions that permit multiple responses, columns may total substantially more than 100%, depending on the number of different responses offered by each respondent.

The survey was conducted using KnowledgePanel, the largest and most well-established online probability-based panel that is representative of the adult US population. Our recruitment process employs a scientifically developed addressed-based sampling methodology using the latest Delivery Sequence File of the USPS – a database with full coverage of all delivery points in the US. Households invited to join the panel are randomly selected from all available households in the U.S. Persons in the sampled households are invited to join and participate in the panel. Those selected who do not already have internet access are provided a tablet and internet connection at no cost to the panel member. Those who join the panel and who are selected to participate in a survey are sent a unique password-protected log-in used to complete surveys online. As a result of our recruitment and sampling methodologies, samples from KnowledgePanel cover all households regardless of their phone or internet status and findings can be reported with a margin of sampling error and projected to the general population.

The study was conducted in English. The data were weighted to adjust for gender by age, race/ethnicity, education, Census region, metropolitan status, and household income. The demographic benchmarks came from the 2022 March Supplement of the Current Population Survey (CPS). The weighting categories were as follows:

- Gender (Male, Female) by Age (18–29, 30–44, 45-59 and 60+)

- Race/Hispanic Ethnicity (White Non-Hispanic, Black Non-Hispanic, Other, Non-Hispanic, Hispanic, 2+ Races, Non-Hispanic)

- Education (Less than High School, High School, Some College, Bachelor or higher)

- Census Region (Northeast, Midwest, South, West)

- Metropolitan Status (Metro, non-Metro)

- Household Income (Under $25,000, $25,000-$49,999, $50,000-$74,999, $75,000-$99,999, $100,000-$149,999, $150,000+)

About Ipsos

Ipsos is one of the largest market research and polling companies globally, operating in 90 markets and employing over 18,000 people.

Our passionately curious research professionals, analysts and scientists have built unique multi-specialist capabilities that provide true understanding and powerful insights into the actions, opinions and motivations of citizens, consumers, patients, customers or employees. We serve more than 5000 clients across the world with 75 business solutions.

Founded in France in 1975, Ipsos is listed on the Euronext Paris since July 1st, 1999. The company is part of the SBF 120 and the Mid-60 index and is eligible for the Deferred Settlement Service (SRD).

ISIN code FR0000073298, Reuters ISOS.PA, Bloomberg IPS:FP www.ipsos.com