Many insured Americans feel insurance falls short of providing affordable access

Washington DC, July 20, 2023— The latest Patient Experience Survey (PES) finds that insured Americans believe health insurance is not living up to providing affordable and accessible health care. Relatedly, many insured Americans worry that insurance may not cover a medicine their doctor prescribes, and some report difficulty accessing medication because of insurance barriers. Moreover, out-of-pocket health care costs, like deductibles and copays, are a significant concern for these people. Strong majorities of insured Americans agree on many solutions to address these cost-related concerns, with near consensus on policies related to regulating hospitals, insurers, and pharmacy benefit managers (PBMs).

Explore some of the main findings here:

1. Experience and concern with insurance barriers

2. Out-of-pocket costs are a concern for many

3. Strong majorities of insured Americans agree on many solutions

1. Experience and concern with insurance barriers

Many insured Americans feel health insurance is falling short of providing affordable access to health care, with some experiencing insurance-related delays to their medication.

- Nearly all insured Americans (93%) think insurance should provide affordable access to health care. Though only a third (34%) think it currently does so for everyone.

- About four in 10 insured Americans taking prescription medication (38%) report that, in the past year, they or a family member had trouble accessing their medication because of various insurance barriers.

- Specifically, three in ten (29%) insured Americans taking prescription medication note that, in the past year, they or their family members faced at least one utilization management practice, like waiting for their insurance to authorize a medicine their doctor prescribes.

- Notably, nearly all insured Americans (93%) agree doctors – not insurers – should determine whether a prescription medicine is clinically appropriate.

2. Out-of-pocket costs are a concern for many

For many insured Americans, out-of-pocket health care costs—like deductibles and coinsurance—are serious concerns; out-of-pocket health care costs are a concern for more insured Americans than many common everyday expenses.

- Insured Americans say they are more worried about their ability to afford their health care out-of-pocket costs (57%) than they are about expenses like the costs of healthy food (45%) or transportation (40%).

- A plurality (39%) of insured Americans who find affording their health care out-of-pocket costs difficult point to their deductible being too high as the main reason for this cost burden.

- One in five insured Americans (19%) says their out-of-pocket costs are more than they could afford if they had a major unexpected medical event or were newly diagnosed with a chronic illness. Rural Americans (38%), caregivers (28%), Hispanic Americans (27%), LGBTQ+ Americans (26%), Black Americans (23%), and women (22%) with insurance are all more likely to report being unable to afford an unexpected major medical event or chronic illness diagnosis.

- Medical debt is not just hypothetical—17% of insured Americans report having medical debt. These debts are primarily driven by hospital bills (59%), doctor bills (57%), and diagnostic tests (42%).

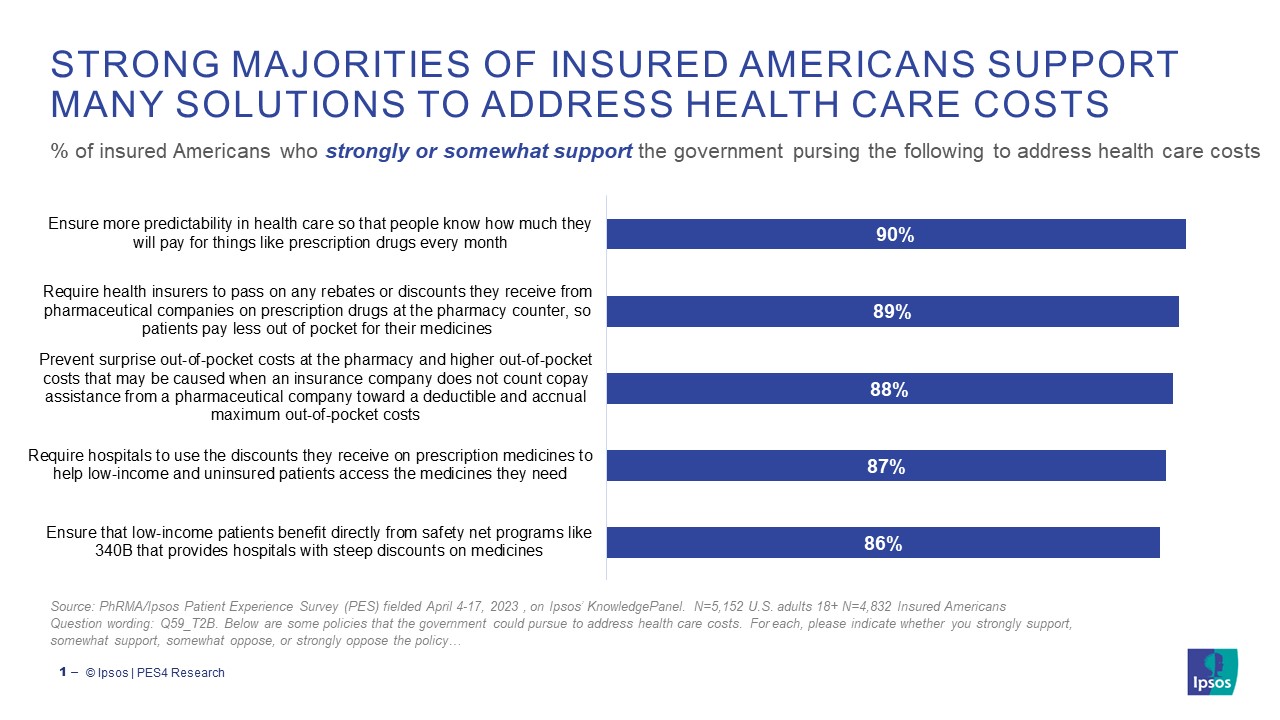

3. Strong majorities of insured Americans agree on many solutions

Given these worries and experiences, insured Americans decisively support policy solutions that address out-of-pocket costs and insurance barriers to medication.

- Nearly all insured Americans (90%) support ensuring more predictability in health care, so that people know how much they will pay for things like prescription drugs every month.

- Similarly, 89% of insured Americans support government policies aimed at requiring health insurers to pass on any rebates or discounts they receive from pharmaceutical companies on prescription drugs at the pharmacy counter, so patients pay less out of pocket for their medicines.

- Most insured Americans (88%) support the government pursuing policies that prevent surprise out-of-pocket costs at the pharmacy and higher out-of-pocket costs that may be caused when an insurance company does not count copay assistance from a pharmaceutical company toward a deductible and annual maximum out-of-pocket cost.

- A decisive majority of insured Americans (87%) also supports the government requiring hospitals to use the discounts they receive on prescription medicines to help low-income and uninsured patients access the medicines they need.

- A similar share (86%) of insured Americans back the government ensuring that low-income patients benefit directly from safety net programs like 340B that provides hospitals with steep discounts on medicines.

To explore these findings more, please download the slides.

About the Study

The Patient Experience Survey (PES) is a robust and reliable data source on patient perceptions and behaviors around access to health care and prescription medicines. A literature review was conducted around existing and relevant academic surveys, which helped to inform the questionnaire design. The questionnaire was tested and refined through a series of cognitive pre-tests and in-depth interviews to ensure measurement validity and reliability.

The survey was conducted April 4th – April 17th, 2023 by Ipsos using the probability-based KnowledgePanel®. The survey is based on a nationally representative probability sample of 5,152 adults aged 18 or older. The sample included 3,443 insured respondents who reported taking prescription medicines and 4,823 respondents who reported being insured.

The survey was conducted using KnowledgePanel, the largest and most well-established online probability-based panel that is representative of the adult US population. The recruitment process employs a scientifically developed address-based sampling methodology using the latest Delivery Sequence File of the USPS – a database with full coverage of all delivery points in the US. Households invited to join the panel are randomly selected from all available households in the U.S. Persons in the sampled households are invited to join and participate in the panel. As a result of the recruitment and sampling methodologies, samples from KnowledgePanel cover all households regardless of their phone or internet status and findings can be reported with a margin of sampling error and projected to the general population.

The study was conducted in both English and Spanish. The data were weighted to adjust for gender by age, race/ethnicity, Census region by metropolitan status, education, household income, race/ethnicity by gender, race/ethnicity by age, race/ethnicity by education, and English language proficiency. The demographic benchmarks came from the 2022 March Supplement of the Current Population Survey (CPS) from the US Census Bureau, with the exception of the benchmarks for English language proficiency which were obtained from the 2021 American Community Survey (ACS) from the US Census Bureau. The weighting categories were as follows:

- Gender (Male, Female) by Age (18–29, 30–44, 45–59, and 60+)

- Race/Hispanic Ethnicity (White Non-Hispanic, Black Non-Hispanic, Other Non-Hispanic, Hispanic, 2+ Races Non-Hispanic)

- Census Region (Northeast, Midwest, South, West) by Metropolitan Status (Metro, Non-Metro)

- Education (Less than High School, High School, Some College, Bachelor or higher)

- Household Income (Under $25,000, $25,000-$49,999, $50,000-$74,999, $75,000-$99,999, $100,000-$149,999, $150,000+)

- Race/Hispanic Ethnicity (White and Other Non-Hispanic, Black Non-Hispanic, Hispanic) by Gender (Male, Female)

- Race/Hispanic (White and Other Non-Hispanic, Black Non-Hispanic, Hispanic) by Age (18–44, 45+)

- Race/Hispanic (White and Other Non-Hispanic, Black Non-Hispanic, Hispanic) by Education (Less than Bachelor, Bachelor or higher)

- Language Proficiency (English Proficient, Bilingual, Spanish Proficient, non-Hispanic)

The margin of sampling error is plus or minus 1.46 percentage points at the 95% confidence level, for results based on the entire sample of adults.

For more information on this news release, please contact:

Christopher Moessner

Senior Vice President, US

Public Affairs

+1 571-358-5411

[email protected]

About Ipsos

Ipsos is one of the largest market research and polling companies globally, operating in 90 markets and employing over 18,000 people.

Our passionately curious research professionals, analysts and scientists have built unique multi-specialist capabilities that provide true understanding and powerful insights into the actions, opinions and motivations of citizens, consumers, patients, customers or employees. Our 75 solutions are based on primary data from our surveys, social media monitoring, and qualitative or observational techniques.

Our tagline "Game Changers" sums up our ambition to help our 5,000 customers move confidently through a rapidly changing world.

Founded in France in 1975, Ipsos has been listed on the Euronext Paris since July 1, 1999. The company is part of the SBF 120 and Mid-60 indices and is eligible for the Deferred Settlement Service (SRD).ISIN code FR0000073298, Reuters ISOS.PA, Bloomberg IPS:FP www.ipsos.com